Contrary to what may be expected, the impact of SA's tumultuous start to 2018 has not greatly negatively affected the country's economic growth to date.

Lightstone has amalgamated findings from some of the major institutions, as well as analysis from their own datasets and does not expect any significant variations in the key economic indicators for 2018 when compared to 2017.

Paul-Roux de Kock, analytics director at Lightstone, says that forecasts show that GDP is expected to grow by between 0.7% and 1.5%. Interest rates are expected to change by -0.5 and one percentage point and consumer price inflation should remain stable at between 4% and 5.5% towards the end of 2018.

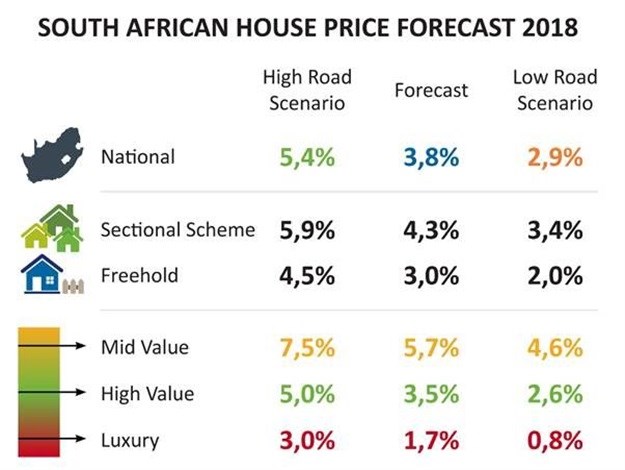

National forecast

At the end of 2017, national house price inflation stabilised at roughly 4% and, according to De Kock, experts are not expecting noteworthy deviations during 2018. This range is also indicative of what can be expected for house prices in 2018. In layman’s terms, if the economy does not fluctuate, neither will the house prices.

Forecasts by values band

As is the dynamic nature of inflation, it is warranted that a variation in the South African house price inflation forecasts for the mid, high and luxury values bands is expected. The same fluctuation can be expected for freehold properties.

“Looking back at the last 18 months, we have observed that price inflation of the mid-value properties has tended to be about 2% above national inflation,” says De Kock. “High value properties are 0.5% below national inflation and luxury properties sit at about 2% below national inflation.”

De Kock includes that the negative link between house prices and house price inflation will persist until the end of 2018 with the following forecasts:

1. Mid value between 4.6% and 7.5%

2. High Value between 2.6 and 5%

3. Luxury 0.8% and 3%

Higher growth in the lower market segments have not always been the norm, with the luxury segment experiencing disproportionately higher growth from 2009 to 2016. One potential reason for the recent decline in the luxury segment inflation is due to owners scaling down, and this, combined with more buyers from the informal housing market entering the lower end affordable market, would drive the increase in the lower and mid value segments.

Forecast for freehold and sectional title properties

Differences in the house price inflation of sectional scheme and freehold properties are less pronounced, with the difference between the two segments conventionally being around 1% up or downward. Similar to the luxury segment, freehold properties have traditionally grown faster than sectional schemes.

De Kock explains the reversal of this trend: “In recent months this has changed and sectional scheme properties has experienced some growth and this is probably due to this segment’s affordability and added benefits like security and maintenance.” De Kock says that the trend will persist into 2018 and that freehold and sectional scheme property prices won’t deviate too far. Sectional scheme property prices will continue to grow faster than freehold properties.

The house price growth for these two segments are expected to grow at:

1. Sectional scheme properties between 3.4% and 5.9%

2. Freehold properties between 2% and 4.5%

The expected house price growth for the different classes of properties along with national inflation can be seen in the figure below:

In 2017 the market was very much skewed towards a buyers’ market; this will start stabilising in 2018 with investors feeling more positive about South Africa. However, we might not see the full effect of a potential economic turnaround play positively into property price growth until the noise around land expropriation without compensation dissipates. Luxury property inflation will continue to decrease; however, the deviation will be more subtle and sectional title property will enjoy more growth as the popularity in this segment will endure into 2019.