Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 6 hours

More news

The global trend towards eating healthier food has seen tree nut production worldwide increase year-on-year for the last decade, a period which showed a 24% increase compared to the previous decade. The greatest nut consumption is in the high-income countries, with the United States (US) and Europe being the biggest consumers.

"An estimated 4,2 million tonnes of nuts are produced globally," says Dr Mmatlou Kalaba, director at the Bureau for Food and Agricultural Policy’s (BFAP) commodity markets and foresight division.

"Almonds make up the greatest volume of tree nuts produced, accounting for about a third of global production. The fastest global tree nut growth, however, is macadamia production. Walnuts, cashews and pecans have also experienced strong average increases, showing growth of 44, 32 and 18%, respectively. Brazil nut production declined significantly, mostly due to unfavourable environmental conditions," he explains.

Pecans have shown good growth in South Africa and there is a strong demand for young trees. Pecan production had increased from 5 000 tons in 2010 to 10,500 tonnes in 2015. The development of pecan orchards has been mainly around the Vaalharts irrigation scheme in the Northern Cape, but there are also growers in parts of Limpopo, Cradock in the Eastern Cape, and Citrusdal in the Western Cape.

However, macadamia nuts take the lead as one of South Africa’s fastest-growing industries. “We are now the largest producer of macadamia nuts in the world, after recently pulling ahead of Australia by a small margin,” says Dr Kalaba.

Gilberto Biacuana, Land Bank economist and research analyst, confirms that macadamia nut production in South Africa has experienced exponential growth in the last few years, influenced mainly by robust international demand.

Figure 1 shows macadamia nut (nut in shell) production between 2006 and 2017, indicating the sustained upward growth. Production increased at a compound annual growth rate (CAGR) of 8,1% from 16,007 tonnes in 2006 to 44,610 tonnes in 2017.

"This trend has been influenced by the expansion in area under macadamia trees to support the increasing global demand of macadamia nuts,” Biacuana says. Data from the International Nut and Dried Fruit Council (INC) revealed that South Africa was the leading global producer of macadamia nuts in 2018, accounting for 29% of world production. Other major global producers included Australia at 25%, Kenya at 13%, China at 10%, and the US at 7%.

According to Biacuana, new plantings increased from 1 250ha in 2013 to 5,000ha in 2017. There are nearly 700 farmers involved in macadamia nut production in Levubu and Tzaneen in Limpopo, from Hazyview to Barberton in Mpumalanga, and in the coastal areas of KwaZulu-Natal. He also says Macadamias South Africa (SAMAC) estimates that the industry employs approximately 12,500 people.

Macadamia nut exports have maintained an upward trend from 2012 to 2018, with a dip in 2016, which was probably a reflection of loss due to drought.

Exports increased at a CAGR of 17,6% between 2012 and 2018. Biacuana says a closer look at the data shows that South Africa’s exports of macadamia nuts are predominantly nuts in shell (unprocessed). “In 2018, in-shell macadamia nut exports accounted for 70,8% of total macadamia nut exports. This probably reflects the underdeveloped processing sector of the macadamia nut value chain.”

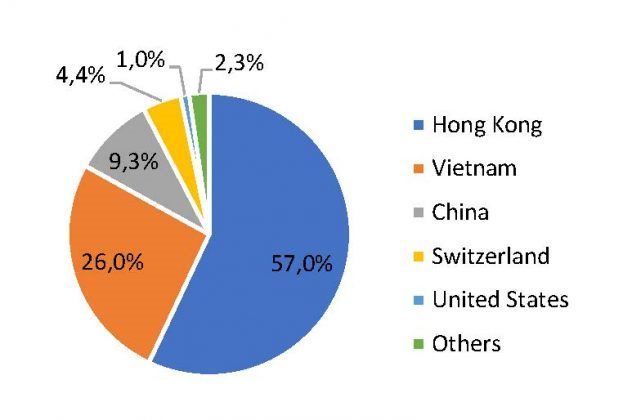

Figure 2 illustrates the major destinations for South Africa’s macadamia nuts in shell exports from 2014 to 2018, with Hong Kong at 57%, Vietnam at 26%, China at 9,3%, Switzerland at 4,4%, and the US at 1%.

During the same period, the major export destinations for South Africa’s shelled macadamia exports were the US at 43,1%, the Netherlands at 9,8%, Hong Kong at 8,5%, Germany at 6%, and Spain at 4,8% (Figure 3).

Biacuana notes that competition looms for macadamia producers, despite the export success of macadamias in recent years. “The major competitive risk to the South African macadamia industry in the future is the increased planting of macadamia orchards in China.”

Table 1 contains the major global producers of macadamias (nuts in shell) and their respective areas under production in 2015. “The biggest producers in terms of the total area under production in 2015 included, among others, China at 42,6%, South Africa at 12,8%, Australia at 11,5%, and Kenya at 11,5%.”

As illustrated in Figure 4, China will potentially increase its production from 12 000 tons in 2017 to 50,000 tonnes in 2020, an increase of 317%. Therefore, most of the projected growth in global production will come from China. "The increase in China’s production and the subsequent decrease in its imports will likely put global prices under pressure in the medium to long term," says Biacuana.

Figure 4 shows that production from other major producers is projected to remain relatively stable between 2018 and 2020.

The macadamia industry has grown significantly in the last few years, driven by the increased global demand for nuts. With the rise of the middle class in developing countries, this trend is likely to remain in place for the foreseeable future.

Biacuana warns that increased production in China could lead to import substitution, which may affect the demand for South African macadamias and apply downward pressure to global macadamia nut prices. “It is unclear when such an increase in supply is likely to happen. Nonetheless, such a likelihood remains a risk to the global macadamia nut market in the near future. Hopefully, the South African macadamia nut industry will adapt and seek new markets,” he says.

AgriOrbit is a product of Centurion-based agricultural magazine publisher Plaas Media. Plaas Media is an independent agricultural media house. It is the only South African agricultural media house to offer a true 360-degree media offering to role-players in agriculture. Its entire portfolio is based on sound content of a scientific and semi-scientific nature.

Go to: http://agriorbit.com/