The pacemaker implanted into a healthy Durban man last year might not have been for the patient's wellbeing. Instead, it's likely to have been part of an elaborate plot, involving cardiologists and surgeons, to swindle insurance companies.

The operation in October last year is one of several being investigated by a host of organisations, including the police's commercial crimes unit.

Potentially risky surgery

The patient was willing to have the surgery because of the promise of financial gain. He is suspected of being part of a bizarre scam that uses poor people who provide false information to rip off insurance companies for millions.

The patients allegedly apply for massive insurance cover. Months later they undergo potentially risky surgery, then claim millions on their disability and illness cover.

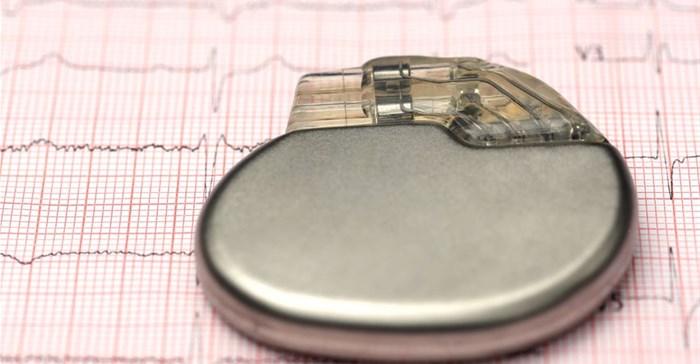

The pacemakers are embedded in the chest or abdomen on a permanent or temporary basis - but are not activated, because otherwise they would interfere with a healthy heart. These electronic devices are meant to control abnormal heart rhythms.

The Sunday Times reveals that:

- The Hawks, the police's Durban commercial crimes unit, the ombudsman for longterm insurance and the South African Insurance Crime Bureau are investigating allegations that pacemakers are being used in the fraud;

- At least two pacemaker insertions have been rejected by insurance companies and are being investigated by the ombud's office. The value of the two claims is R30,5m;

- Discovery Health and Old Mutual have been directly affected and other insurance companies are on high alert; and

- An audit is under way at Discovery Health to review all pacemaker-linked policies dating back two years. It has already cancelled several "suspicious"policies.

Two R30,5m claims

Insurance ombudsman, Judge Ron McLaren said that suspicious behaviour had been reported to his office. The two R30,5m claims for illness and disability cover are being investigated.

Ironically, it was the alleged fraudsters who complained to McLaren's office and triggered the investigation. This happened when their claims were rejected - after an operation - for discrepancies related to income and previous claims history. It was after the medical insurance companies listed their reasons for the rejections that the scheme was uncovered.

Claiming for unnecessary, risky surgery

"The elaborate fraudulent scheme involves the unnecessary implantation of a pacemaker device into somebody who has significant insurance for a claim event," McLaren's office said this week.

"In a genuine case, a pacemaker provides an electric impulse to the muscles of the heart to ensure that the heart beats regularly. The implantation of a pacemaker for a person who has no need, therefore, is questionable to say the least."

It said that the insurer which reported the scam said it was financed by "persons who find indigent participants to apply for insurance cover".

The new "member" borrows money - at allegedly exorbitant interest rates - from the scamsters, to be able to pay the substantial premiums for a few months, the office said.

"It is yet unknown what happens to the proceeds of a successful claim."

Cover taken out under false pretenses

According to McLaren, the method was that a person would take out cover - in one case for R13,75m - allegedly under false pretenses.

Individuals massively inflated their monthly earnings and deliberately left out information, including whether they previously had insurance.

The first case being investigated started in December 2014 and the second in March last year. Both are subject to criminal investigation.

In the latter case, the surgery took place on October 22 2015. A claim was submitted but rejected by the insurance company, and the complainant contacted the ombudsman.

"During its investigations, the insurer established that the complainant's average income for 2014 was less than R6,000 [a month], which was in stark contrast to the more than R600,000 per year declared at application stage," McLaren said.

He also discovered that other required information had been left out of the application, and found in favour of the insurance company pending the completion of the police investigation.

Hawks spokesman, Captain Simphiwe Mhlongo, said: "The case is still under investigation and no arrests have been made."

Discovery and Old Mutual investigating suspicious policies

Glenn Hickling, head of legal services at Discovery, said: "We have initiated an audit of all the policies written since the beginning of last year that we deem to be suspicious and which fit the modus operandi used. Of those policies, we have terminated several of them and continue to monitor the remainder closely."

Hickling said alarm bells went off when claims were lodged soon after a policy was taken out or soon after substantial changes were made, and where the medical evidence did not support the insertion of a pacemaker.

Old Mutual's Ursula van der Westhuizen said the scam had hit the company.

"Old Mutual is aware of the alleged pacemaker scam and we, together with other insurers, have reported the matter to the SAPS. We are giving our full support to assist them with their investigation,” she said.

Medical practitioners would be involved

A health professional said the scam would involve a number of people, including cardiologists and surgeons.

"This sort of scam would require a diagnosis from a cardiologist, a willing surgeon who would perform such an operation, as well as a technician who would be responsible for handling the pacemaker. All these health professionals are complicit in such a scheme."

The Health Professions Council of South Africa did not respond to questions about complaints against members allegedly involved in the scam.