February shows rebound in passenger traffic growth

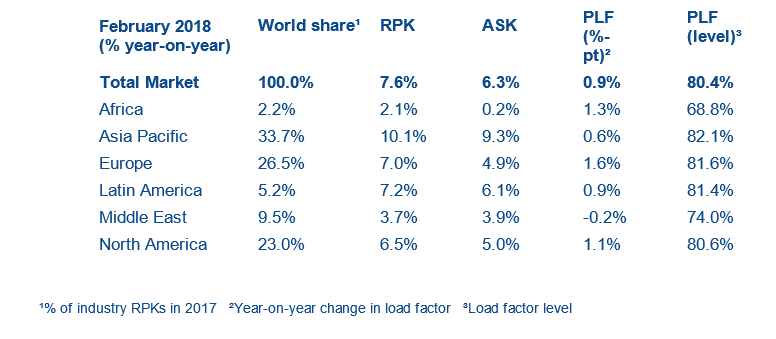

Total revenue passenger kilometres (RPKs) for the month rose by 7.6%, compared to February 2017, which was up from 4.6% year-over-year growth in January. The monthly capacity (available seat kilometres or ASKs) increased by 6.3%, and the load factor rose by 0.9 percentage points to 80.4%, surpassing the previous record for the month of 79.5%, which was set in February 2017.

"As expected, we saw a return to stronger demand growth in February, after the temporary slowdown in January. This is supported by a robust economic backdrop and solid business confidence. However, increases in fuel prices – and labour costs in some countries – will likely temper the amount of traffic stimulation from lower airfares this year," said Alexandre de Juniac, IATA’s director general and CEO.

International passenger markets

In February, international passenger demand rose by 7.2% compared to February 2017, which was up from the 4.2% increase recorded in January. Led by airlines in Latin America, all regions recorded better year-on-year growth compared to January’s results. The total capacity climbed by 5.9%, and the load factor rose by 1.0 percentage points to 79.3%.

• European carriers saw February demand increase by 6.8% compared to a year ago; a modest acceleration compared to a 6.0% increase in January. Passenger volumes are trending upwards at a double-digit annualised rate alongside supportive economic conditions in the region. Capacity rose by 5.0% and the load factor increased by 1.4 percentage points to 82.2%, the highest among regions.

• Asia-Pacific airlines’ February traffic rose by 9.1% compared to the year-ago period. The demand is supported by healthy regional economic growth and expansion in the number of routes on offer. Capacity increased by 8.4% and the load factor climbed by 0.6 percentage point to 80.5%.

• Middle East carriers recorded a 3.4% demand increase in February compared to the year-ago. Capacity rose by 3.9% and the load factor slipped by 0.3 percentage points to 74.1%. Carriers in the region faced significant headwinds over the past year including the temporary ban on large portable electronic devices, as well as the proposed travel bans to the US from some countries in the region.

• North American airlines’ traffic climbed by 7.2% in February, supported by the relatively vigorous US economic backdrop, while the weaker dollar appears to be offsetting some of the negative impacts on inbound travel. Capacity rose by 4.6% and the load factor was up by 1.9 percentage points to 78.0%.

• Latin American airlines posted the fastest year-on-year growth for a second consecutive month as February traffic jumped up by 9.8% compared to February 2017, which is up from 8.1% growth in January. The demand continues to recover from the impacts of the severe 2017 hurricane season. Capacity increased by 8.9%, and the load factor rose by 0.6 percentage points to 81.5%.

• African airlines experienced a 6.3% rise in traffic for the month compared to the year-ago period. The growth occurred amid an improving regional economic backdrop. Business confidence in Nigeria has risen sharply over the past 15 months, while a reduction in political uncertainty in South Africa has contributed to an improvement in business confidence for the first time in more than a year. Capacity rose by 3.3%, and the load factor climbed by 1.9 percentage points to 67.8%.

Domestic passenger markets

Domestic travel demand rose by 8.2% in February compared to February 2017, which is up from 4.9% year-over-year growth in January; with all markets reporting increases, led by India and China. Domestic capacity climbed by 7.0% and the load factor increased by 0.9 percentage points to 82.3%.

• India’s domestic traffic rose by 22.9%, the 42nd consecutive month of double-digit year-on-year demand growth, and the load factor exceeded 90% for the first time on record. Passenger demand continues to be stimulated by network growth that translates into time savings for air travellers.

• Australian domestic traffic rose by 3.9% compared to the year-ago period, which was a 17-month high.

The bottom line

"All around the globe, we see the same positive picture of growth in demand for aviation connectivity. Aviation is the business of freedom, enabling people to lead better lives. Aviation has helped to lift millions from poverty, but for aviation to deliver even greater benefits in future; adequate, affordable infrastructure is a must.

"A case in point is the Latin American region, where aviation already supports jobs for 5 million people and $170bn in GDP. The potential for aviation to do far more exists, but without concerted action by governments to address capacity shortfalls, the region could face an infrastructure crisis in the future. Within the region, Mexico City is the most critical of the bottlenecks. The current airport was designed for 32 million passengers annually but serves 47 million. The solution is a new airport which is already under construction, but its future has been politicised in the current presidential election. The vital need for the new airport needs to be understood by all," said de Juniac.