Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

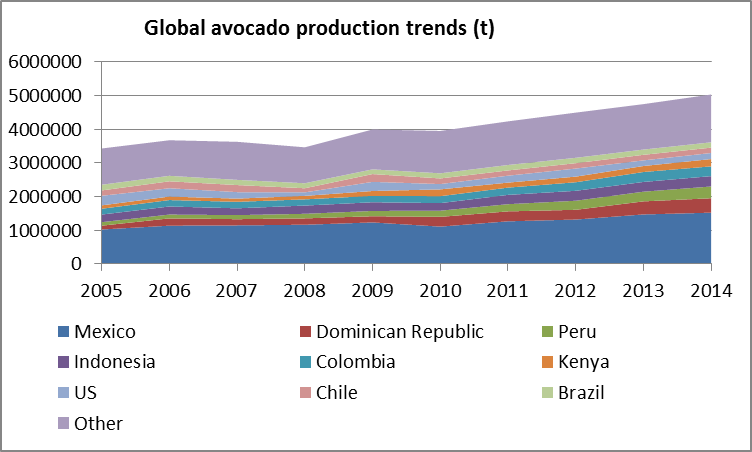

Strong demand has kept avocado prices at attractive levels for the past decade, which continues to bode well for additional investment into this sector. As a result of drought conditions in some of the major avocado-producing and exporting countries in 2016, global prices have significantly increased, as production has declined. The American Restaurant Association, which analyses data from the United States Department of Agriculture, reported that the wholesale price of avocado in the United States (US) increased 125% between January and September 2017, from $37.25 (about R527.48) for a standard box of 48 avocados to $83,75 (R1,185.95).

Mexico, which is currently the world’s biggest producer of the fruit and exports primarily to the US, Europe, Asia and Canada recorded a substantial harvest in 2016. However, production declined by an estimated 20% in 2017 as a result of unfavourable weather conditions. Poor weather also led to a production decline in Peru in 2017, resulting in limited production and insufficient supply.

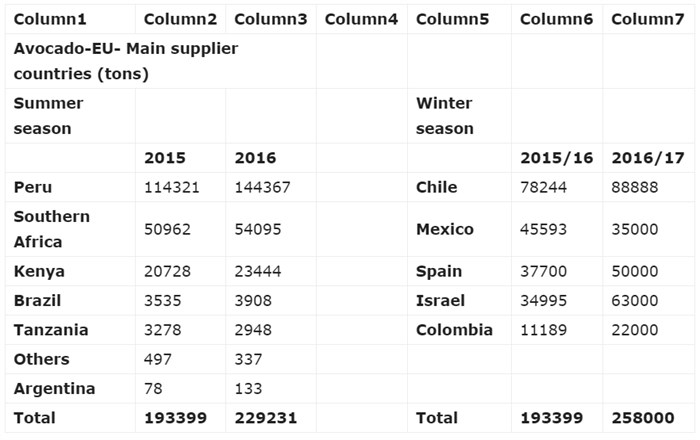

This presents South African producers with a temporary opportunity to gain more widespread access to the European market. Meanwhile, avocado production has recovered in Chile, after almost a decade of drought. Chile ceases avocado exports during April, opening up a potential marketing window for South African producers.

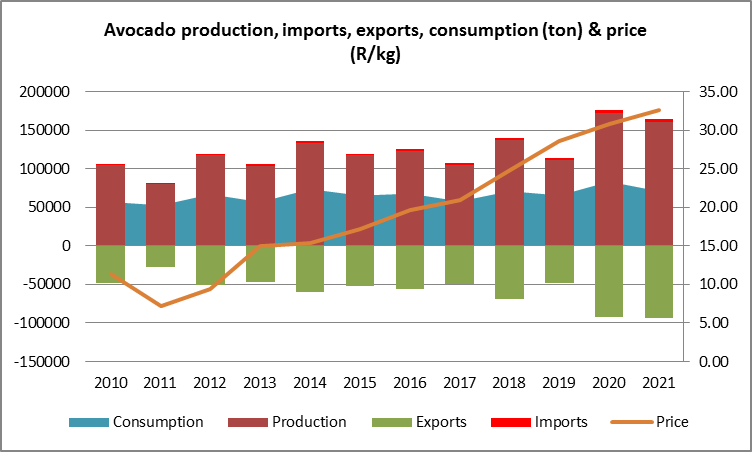

There are about 17,500ha planted to avocado in South Africa. However, the 2015/2016 drought negatively affected avocado yields in 2017, which resulted in lower-than-average production levels. Moreover, as 2017 was an off-season, which usually tends to deliver lower yields, production declined even further. The estimated total avocado production for 2017 is currently at 117,000 tons. However, there is certainly room for expansion, with an average of an additional 1,000ha planted to avocado every year.

Avocado is currently grown in Limpopo, Mpumalanga, and KwaZulu-Natal. There is also growing interest to expand production to the Eastern and Western Cape.

In 2016, 45% of South Africa’s avocado harvest was exported, while 18% was sold on the fresh produce markets. 12% went to the processing sector, while 16% was sold on the informal market and 8% was sold directly to retailers.

Price increases have been driven by higher demand, as well as avocado increasingly being used in the manufacturing and production of beauty products.

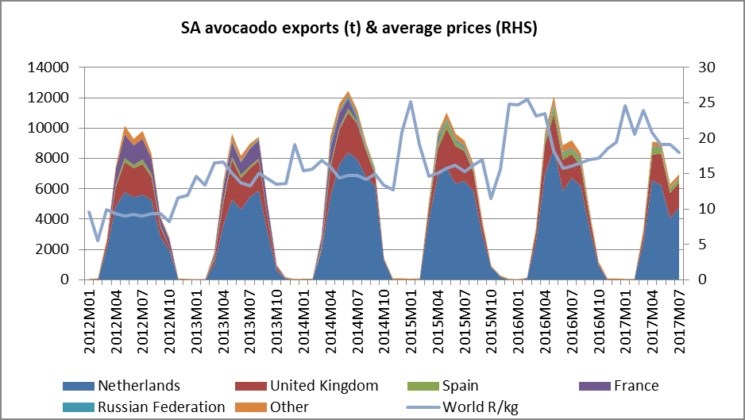

Lower production and yield have resulted in lower exportable volumes. Exports of the 2017 crop, primarily to the Netherlands are expected to amount to 52,000 tonnes, which is 7% lower than that of 2016. Despite lower yield in 2017, there may be more export opportunities for South African producers in the future, as industry role-players work on accessing new markets such as the US, Japan, China and India. The avocado industry remains profitable, as local prices have increased annually for the past six years. During this period, prices increased 173% because of strong demand. This may also explain the increased rate at which additional trees have been planted.

Demand is increasing more rapidly than the current rate of production. This trend will most likely be supported by a growing market, which may encourage producers to invest in expanding production.

AgriOrbit is a product of Centurion-based agricultural magazine publisher Plaas Media. Plaas Media is an independent agricultural media house. It is the only South African agricultural media house to offer a true 360-degree media offering to role-players in agriculture. Its entire portfolio is based on sound content of a scientific and semi-scientific nature.

Go to: http://agriorbit.com/