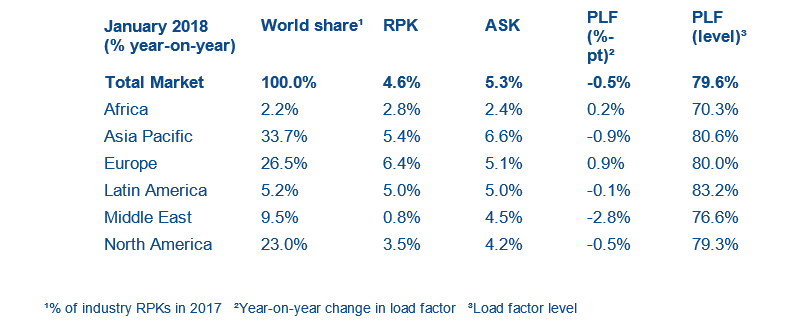

The International Air Transport Association's (IATA) global passenger traffic results for January 2018 show that traffic - revenue passenger kilometres (RPKs) - rose by 4.6% compared to that of January 2017. These results indicate the slowest year-over-year increase in nearly four years, however, results were affected by the timing of the later Lunar New Year in 2018, as well as less favourable comparisons with the strong upward trend in traffic seen in late 2016-early 2017.

Photo by Gerrie van der Walt on Unsplash

IATA estimates the impact of the later Lunar New Year-related travel period holiday represented around two-fifths of the slowdown in year-over-year growth for the month. January capacity – available seat kilometres (ASKs) – rose by 5.3%, and load factor slipped half a percentage point to 79.6%.

"Despite the slower start, economic momentum is supporting rising passenger demand in 2018. That said, concerns over a possible trade war involving the US could have a serious dampening effect on global market confidence, spilling over into demand for air travel," said Alexandre de Juniac, IATA’s director general and CEO.

International passenger markets

International passenger demand growth slowed to 4.4% in January, from 6.1% in December, with all regions recording growth, led by Latin America and Europe. Capacity rose by 5.3%, while the load factor dipped by 0.7 percentage points to 79.6%.

• Asia-Pacific carriers recorded a demand increase of 4.6% compared to January 2017, which was a 46-month low. This was largely due to the impact of the later Lunar New Year, which fell in mid-February. Capacity rose by 6.1%, while the load factor dropped by 1.2 percentage points to 80.4%.

• European carriers’ international traffic climbed by 6.0% in January compared to the year-ago period, which was up from 5.8% growth in December 2017. The region was the only one to see an acceleration in traffic compared to the month before – this is supported by the buoyant economic conditions in the region. Capacity rose by 5.0% and the load factor was up by 0.7 percentage points to 80.8%.

• Middle East carriers had the weakest growth, with demand up by just 0.5% compared to January 2017, the slowest pace since September 2008. The market to and from North America has been especially hard hit owing to factors including the temporary ban on large portable electronic devices, as well as the proposed travel bans to the US from some countries in the region. Capacity climbed by 4.6%, while the load factor fell by 3.1 percentage points to 76.8%.

• North American airlines experienced a 3.5% rise in traffic over a year ago, but capacity rose by 4.3%, while the load factor dipped by 0.7 percentage points compared to a year ago, to 79.6%. The relatively healthy economic backdrop in the region is helping support outbound demand, but this is being partly offset by a negative impact on inbound traffic to the US.

• Latin American airlines’ traffic climbed by 7.3% in January compared to January 2017, the strongest among the regions. Capacity rose by 8.2%, however, while the load factor slipped by 0.7 percentage points to 82.6%, which was still the highest among the regions. Stronger economic conditions in Europe are helping support rising demand on the market between Europe and South America in particular.

• African airlines saw January traffic rise by 4.9% against a mixed backdrop for the region’s largest economies. In Nigeria, business confidence has risen sharply while in South Africa, political uncertainty continues to inflict an economic toll. The region’s capacity rose by 4.2%, while the load factor edged up by 0.5 percentage points to 70.3%.

Domestic passenger markets

Domestic traffic climbed by 5.1% in January year-on-year, down from 7% growth recorded in December. The slowdown is entirely attributable to the later Lunar New Year holiday period in 2018. All markets showed growth, led by India, which experienced its 41st consecutive month of double-digit traffic increases. Domestic capacity increased by 5.3%, while the load factor slid by 0.2 percentage points to 79.8%.

• China’s domestic traffic rose by 6.6% in January, which was a slowdown compared to 14.1% year-over-year growth in December. With the Lunar New Year falling in February, that month is expected to see a big jump in annual traffic growth.

• Russian domestic traffic grew by 7.9% compared to January 2017. Traffic is being supported by strong economic conditions, helped by higher oil prices.

The bottom line

"Aviation is the business of freedom. It liberates us from the constraints of geography, distance and time, enabling us to lead better lives; and it makes the world a better place. For the business of freedom to grow the benefits it generates, we need borders that are open to trade and travel, and infrastructure to support the demand for connectivity.

“Governments have the main role to play in these areas by preserving the benefits of global commerce and ensuring adequate airport and airspace capacity to cope with an expected doubling of demand by 2036," said de Juniac.

View January passenger traffic results.