African Rainbow Minerals (ARM) and its mining partner, Brazil's Vale, have extricated themselves from an expensive investment in the Lubambe copper mine in Zambia, fulfilling a commitment chairman Patrice Motsepe made in 2016.

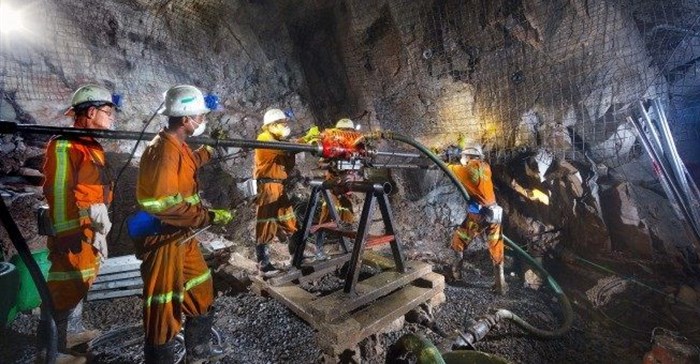

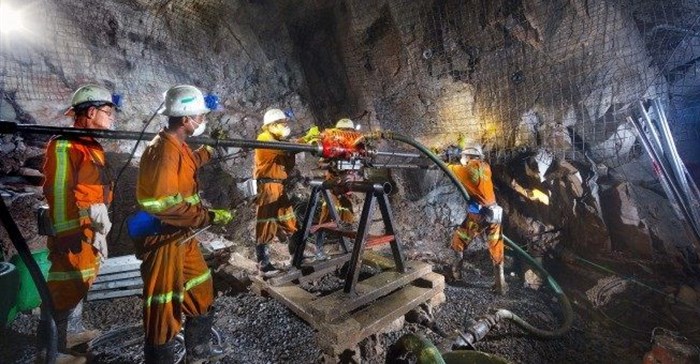

Lubambe mine, Zambia. Photo: Murray & Roberts

The Lubambe mine, one of the key factors behind JSE-listed ARM's fall into a full-year loss of R757m, was identified as an asset for sale by Motsepe during a results presentation.

ARM said the mine would be sold to EMR Capital, a private-equity group, for $97.1m cash, marking the end of a venture that absorbed at least $400m and in 2016 produced 21,000 tonnes of copper.

ARM's copper division holds a 50% stake in the joint venture, which holds 80% of Lubambe, giving each partner 40% of the mine. Lubambe's costs were the highest in a suite of ARM's assets and efforts to rein them in proved difficult. State-owned Zambian Consolidated Copper Mines Investment Holdings holds 20% of Lubambe.

ARM impaired its investment in Lubambe by R1.4bn during 2016 and the partners considered ways to cut costs, including lowering production to lower cash funding requirements.

The conditional sale of Lubambe will be welcomed by shareholders and marks the end of their exposure to the unprofitable asset, where the headline loss deepened to R555m in 2016, from R430m the year before. ARM and Vale will continue providing funding to Lubambe until the transaction is finalised.

Motsepe said in September ARM was looking for other copper projects to remain exposed to the metal, but gave no details. Motsepe and CEO Mike Schmidt were clear that if assets could not be made profitable within three years, they would have no place in ARM. Lubambe fell squarely into this definition.

Lubambe struggled to ramp up production, running into geological problems such as a sand zone that needed specialised support at a time when copper prices fell, stopping work in the South Limb of the mine.

Among the cost-saving plans were for the partners to operate the mine and phase out contractors. This led to a small reduction in costs.

The mine had been planned to generate 45,000 tonnes of copper a year from 2019, but a host of difficulties meant the target remained out of reach.