Top stories

More news

ESG & Sustainability

Redisa calls on govt to fix South Africa’s “broken” waste management system

The JSE's all-share index first rose and then dropped, to end only 1.85% higher than last year.

But the valuation of the overall market, reflected in the index's price-to-earnings ratio (p:e) of about 19 times, looked stretched against a long-term average of 12.5 times.

Traditionally, analysts cite the deviation from the longterm average as an indicator of whether the market will rise or fall in coming months.

PSG Asset Management portfolio manager Shaun le Roux said various factors were distorting the all-share index's at present.

"Firstly, the index is currently dominated by three shares that account for more than 30% of the index and are on very high p:e ratios: Naspers, SABMiller and Richemont," Le Roux said.

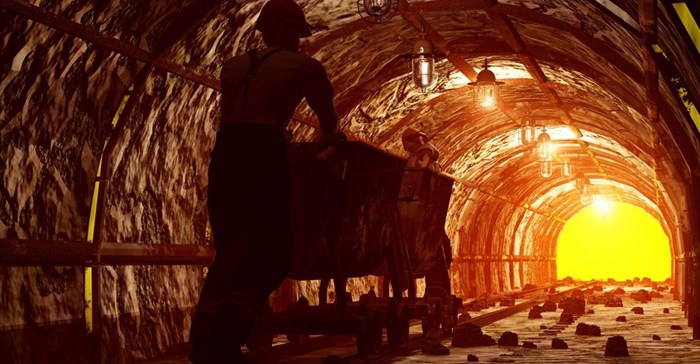

"Also, some companies in cyclical industries like mining, where the earnings have been very weak recently, are actually on very high p:e ratios. Because the mining companies are making next to no money at the moment, the p:e ratio is not a good measure of whether they are cheap or not.

"That said, there are a number of shares that are exposed to the local economy that have become very cheap relative to history on a p:e measurement. These would include banking stocks and other businesses that are typically sensitive to higher interest rates or are exposed to sectors in the economy that are experiencing recessionary conditions. The p:e ratio at an all-share index level does not capture this dynamic."

Measured on a total return basis, which adds dividends to share price growth, the JSE's best performer for the year was Labat Africa, which has risen tenfold, from 15c to 150c, largely on the back of the acquisition of the cash-generative Reinhardt Transport Group. It was Labat's best deal for many years.

Second most rewarding investment for the year was another small-capitalisation share, RBA Holdings, which specialises in affordable housing. It was recapitalised in late 2014 by Old Mutual's housing fund, enabling it to improve its project pipeline and construction capacity. The shares have risen 654.55% to 83c in the past year. While most investors in commodities shares are licking their wounds, those who put money into Jubilee Platinum a year ago would have been delighted with a 132.35% return to 79c.

Jubilee's winning move was to sell its Middelburg smelting and power business for R110m to focus on making cash from platinum and chrome tailings.

The best large-cap share for the year was investment fund Brait, which made two canny acquisitions in the past year: 78% of the Virgin Active fitness chain and 89% of UK clothing chain New Look. At R166.94, the shares have more than doubled and are trading at a premium to the last published net asset value of R123.50 a share.

Lonmin, the world's third biggest platinum producer, was the JSE's worst performer, with a 99.4% loss to R18.30, adjusted for the group's 100 for one consolidation.

Lonmin was battered not only by difficult operating conditions for all deep-level platinum miners, but by an urgent need to restructure debt. Late in the year, it held a deeply discounted $400m rights issue that was supported by only 71% of shareholders.

Steel maker ArcelorMittal SA, another company forced by ongoing weakness in its sector to hold a rights issue, fell 82.57% to 450c last year, making it the JSE's fourth-worst performer.

After announcing a R4.5bn rights issue in November, ArcelorMittal 's shares took another hammering when its CEO, Paul O'Flaherty, resigned in December. Mr O'Flaherty had been in the job for only 18 months.

Other resources shares among the JSE's worst performers were Impala Platinum, down 66.55% to R25.04, and Kumba Iron Ore, which shed 80.19% to R41.20. Kumba's decline reflected the plunge in iron ore prices below 40/tonne.

Anglo American, Kumba's parent, was the 12th biggest loser on the JSE, sliding 62.93% to R68.99, after announcing a drastic restructuring that will cut the group to a fraction of its former size.

Three junior coal producers, Keaton Energy, Wescoal Holdings and Resource Generation, also ranked among the JSE's biggest losers. Each company faced both specific operating issues as well as weak export prices and changing Eskom contract requirements.

Source: Business Day

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za