A new report sponsored by global law firm Baker & McKenzie finds that the funding gap for African infrastructure has narrowed to about $25bn a year, based on a continental need of $90bn worth of infrastructure spend annually. This is good news in the context of the globally squeezed construction sector, and the dismal state that many JSE-listed infrastructure companies find themselves in.

But the survey also shows that in more than seven years of world economic turmoil, the quantum of need has remained static even as the funding gap has narrowed. The World Bank in 2009 estimated that $93bn was needed each year for continental power, transport, ports, water and sanitation projects, but that only about half of that was raised and spent.

The survey, independently researched by the Economist Group, was first released in the UK last month. It assesses 22 African countries. Based on interviews with development finance institutions (DFIs), export credit agencies (ECAs) and commercial banks, it analyses sources of capital inputs for African projects.

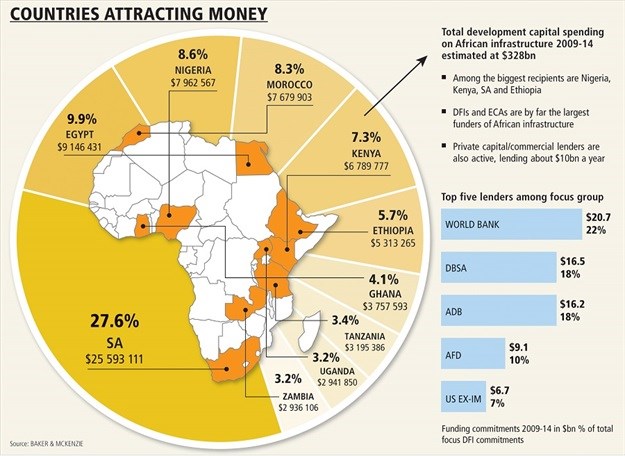

Major findings indicate that development finance institutions and export credit agencies are by far the largest funders. Between 2009 and 2014, an estimated total of $328bn was spent on six main categories of African infrastructure. Private capital and commercial lenders fund only about $10bn of infrastructure each year, partly because of a lack of "bankable" project environments in many African jurisdictions. But private sector capital flows have grown by more than 300% between 2010 and 2013, the report says.

"I have never come across a deal in Africa that is financed purely by commercial banks," says Jen Stolp, partner in the banking and finance practice group of Baker & McKenzie in Johannesburg.

She says China tends to go it alone when it comes to funding, and that three-quarters of this comes from the Export-Import Bank of China. Meanwhile, development finance institutions are not entirely altruistic. The money to close the African funding gap is there, she says, but the "enabling environment is challenging" in the face of local regulation, project risk, corruption, and increasing demands for local skills and enterprise development. China is the largest single funder, while Nigeria, Kenya, SA and Ethiopia are among the largest recipients.

SA received the bulk of development finance institutions and export credit agencies funding in 2009-14 - about 28% of the total, worth $26bn - followed by Nigeria, Egypt, Morocco, Kenya and Ethiopia. But despite some impressive gains, and China's substantial presence in African mining and infrastructure markets, the continent still lacks power, roads, water and irrigation.

The report says 50% or more of the populations of about 24 countries in the sub-Saharan region lack access to electricity grids.

Meanwhile, Chinese growth has slowed considerably, along with that of Brazil, whose giant Odebrecht construction group is a big infrastructure player in Angola and Mozambique. Ghana as well.

China's ministry of commerce says imports from the continent plummeted about 40% last year. Meanwhile, Nigeria and SA have seen their currencies fall to record lows, mainly on the global minerals commodities rout.

Global Credit Ratings, which focuses on emerging markets, has just issued a negative outlook for SA's construction industry. Patricia Zvarayi, senior corporate analyst, says factors such as regulatory uncertainty, low levels of public infrastructure spend and falling global commodity prices have "converged to create turmoil in the sector".

But the Baker & McKenzie report quotes Zhao Changhui, an Export-Import Bank of China chief risk analyst, as saying cumulative Chinese investment in Africa will amount to at least $1tn in the next 10 years.

Last month, Johannesburg was the venue for the sixth China-Africa co-operation summit. China committed $60bn to African development funding in the next three years, including by debt forgiveness, grants and soft loans.

Source: Business Day