Consumer markets under pressure in 2020

As coronavirus (Covid-19) shifts the global economic outlook into deep recession, reflecting the impact of social distancing measures on economic activity, no industry remains untouched.

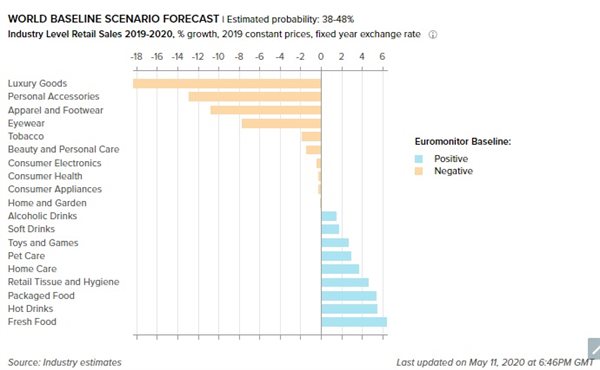

The defining characteristic as to how consumer markets weather Covid-19 is their exposure to discretionary spend. Industries such as luxury goods, apparel and footwear, personal accessories and eyewear will find themselves under more pressure than those like packaged food, fresh food and hot drinks.

Luxury goods hit hard in 2020

Luxury goods and those industries with a high level of luxury spend are set to see the biggest declines in 2020. Luxury goods, which was previously forecast to record 3% constant value growth in 2020, is now expected to decline by 18%. The market is heavily dependent on sales in countries where the impact of Covid-19 has been heaviest.

Luxury sales in China are set to decline by 22% in 2020; this is a huge setback as China accounts for one-third of luxury sales, both on Chinese territory and abroad. The next largest luxury goods market, the US, will see sales fall by 25% in 2020.

On top of this, travel restrictions are a major blow for the sales of luxury goods. The industry is also under pressure from changing consumer attitudes towards conspicuous consumption and the fact that in lockdown the opportunity to wear or show off luxury goods has been eroded.

As a result, luxury goods companies are having to reposition themselves to stay relevant, with many companies taking an early and active role globally in creating personal protective equipment for health carers or offering luxury hotels for health workers to stay in.

Fashion supply chain in chaos

Personal accessories (-13%), apparel and footwear (-11%) and eyewear (-8%) are all expected to sustain big losses in 2020. All of these consumer markets have a high level of exposure to luxury, are discretionary in nature and share many traits in terms of the impact of Covid-19.

The fact that people are limiting their socialising, combined with chaos in the supply chain, means 2020 will be a very difficult year for all three industries. Covid-19 has wrought havoc to both supply and demand across many industries, but it is particularly apparent for apparel and footwear. With unsold stockpiling up as stores remain closed, manufacturers have halted production, causing misery in countries such as Bangladesh.

High-end apparel will take the hardest knock, whilst other categories are faring better. Athletic will outperform other categories, and low-cost, discount and off-price are set to benefit. E-commerce is faring better, but online outlets such as UK-based Next are limiting orders over concerns about maintaining the health of workers.

Tobacco faces longer-term uncertainty

Tobacco is set to decline in 2020 by 2% in comparison to the pre-Covid-19 forecast of 2% growth. In general, tobacco has a higher recessionary floor than other industries, with some evidence that people turn to tobacco more in times of crisis. However, in contrast to other industries, the main impact on tobacco is likely to be felt long term, as consumers become more conscious of their health.

It is likely that Covid-19 will accentuate the long-term existential challenge faced by tobacco as consumers revaluate their nicotine consumption. To add to this, with governments across the world have spent vast sums propping up their economies and industries, they will be looking to claw that back by increasing levies on tobacco.

Lack of social occasions means beauty and personal care takes a hit

Another key consumer market which is taking a hit is beauty and personal care (BPC). Covid-19 is set to knock four percentage points off growth in 2020. In some categories, BPC is weatherproof – as seen in the 2008 Great Recession – especially deodorants and body wash/shower gel, which are mass reliant.

However, the lack of social occasions and a decline in premium products, especially evidenced in the temporary closure of selective stores, means that declines are inevitable in 2020. As the world falls into recession, there will be an upturn in demand for local and masstige products.

Going forward, companies will need to focus on safety, transparency, botanicals, hygiene and a general move towards more thoughtful spending, prioritising quality over quantity, and with lingering uncertainty around physical stores, they will be looking to create online communities.

Watershed moment for companies to revaluate their priorities

No industry will be unaffected as consumers rethink their spending in the context of a global recession and changes to health and social conditions. But with no quick fix in sight for those industries most under pressure, Covid-19 presents a watershed moment for companies to revaluate their priorities and social responsibilities in order to prosper in the new normal.