US consumers likely to go elsewhere for greater choice

Consumer packaged goods (CPG) retailers take note: more than half of US consumers tell The Nielsen Company they are likely to shop elsewhere if they notice a reduced product selection, while nearly half of retailers indicate continued plans to decrease assortment. New insights on the topic that's become the buzz of the CPG industry were announced today at Nielsen's Consumer 360 Conference, the global intersection of what consumers watch and what they buy.

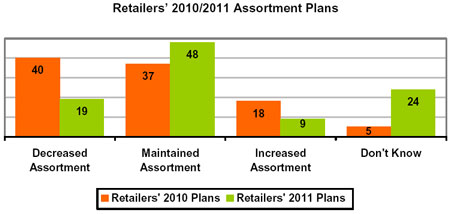

So far, most consumers haven't observed assortment changes with only 7% reporting a noticeable reduction in product variety. And although 42% of retailers decreased assortment in 2009 amid considerable industry hype, assortments overall shrunk by only 1%. Looking ahead to the second half of 2010 and 2011 however, retailers' strategies call for continued downsizing, then maintaining reduced assortments moving forward. 40% of retailers indicate they'll continue to downsize, with stated targets to cut up to 10% of SKUs on the shelf.

"Reduced assortments are definitely here to stay, and the message to retailers is to choose carefully when it comes to deciding which products to trim," said Stuart Taylor, vice president, Custom Analytics, The Nielsen Company. "In many cases, strategically reducing assortment can result in an improved customer experience and greater profitability. Cut the wrong product, however, and the potential customer backlash could be costly."

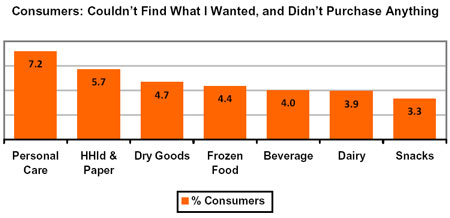

How costly? 7% of personal care product shoppers say that when faced with a shelf that does not contain the item they want, they'll leave the store without buying the category at all. Often, this translates into the consumer taking their entire shopping basket purchase elsewhere. While 7% may seem like a small number, consider that just a one half of 1% decrease in shopper closure across the grocery channel could cost as much as $1.5 billion in sales.

Making more with less

Driven in part by the recession, CPG retailers are making assortment changes for several reasons. According to Nielsen, 75% of retailers are downsizing their product assortment to improve merchandising opportunities, while 71% cite a desire for greater control over inventory. 60% state the moves are made to alleviate shopper confusion, while 52% are reducing selection to cut costs and improve profitability. Nearly half (48%) of retailers are making more room for store brand products.

So what's a retailer to do? According to Nielsen, the key lies in reducing assortment strategically, while balancing the interests of the retailer, manufacturer and consumers. Nielsen recommends adopting an ongoing, objective process around assortment and applying intelligent analytics to help retailers identify the products that provide the greatest incremental sales benefit.

"Success in today's competitive retail market is no longer about having the most products - - it's about finding the right mix of products," said Taylor. "Retailers should be focused on offering the products their customers want most and making it as easy as possible for their customers to find and purchase those products.

Nielsen's Assortment Research

Nielsen surveyed nearly 50 retailers across US CPG channels and consumers in more than 21 000 US households conducting nearly 55 000 shopping trips. The surveys were conducted online in March and April 2010. The company also conducted an industry assortment benchmark analysis, spanning more than 30 grocery categories.

Source: The Nielsen Company

The Nielsen Company is a global information and media company with leading market positions in marketing and consumer information, television and other media measurement, online intelligence, mobile measurement, trade shows and business publications. For more information, go to www.nielsen.com.

Go to: http://www.nielsen.com