Scopen has just finished presenting its 4th edition of Agency Scope in Mexico. More than 40 agencies subscribed to the report and were able to learn and understand the state of the industry in a turbulent period.

Fieldwork was completed during the first five months of 2017, probably the worst economic time in recent years of Mexican history. After Trump won the US elections along with all of his rhetoric against Mexico, his plans to build the wall, the drop of the Peso, it was not a good moment for the Mexican economy and therefore a complex occasion for the advertising industry.

Because marketers recognised that they didn’t have a clear budget for 2017, they were working with a one month or two-month budget and trying to prepare campaigns with small resources. Agencies were preoccupied, while their costs had increased (office space, research, are paid in dollars) their clients had no clear view of their long-term budgets nor for the campaigns they would be running. On top of that situation, it is important to bear in mind that Mexico is a country where in many sectors there is just a duopoly and just two huge companies control more than 80% of that sector.

Increased investment in digital

Therefore, there are no challengers and new, young companies are trying to win market share with new product offerings, special discounts or aggressive campaigns. This has resulted, for many years, in very conservative communications and dull campaigns from the leading brands in the country. Mexico is one of the four countries among the Mist (Mexico, Indonesia, South Africa and Turkey) economies. Therefore, it is interesting to analyse trends in Mexico and see how they compare to those in South Africa.

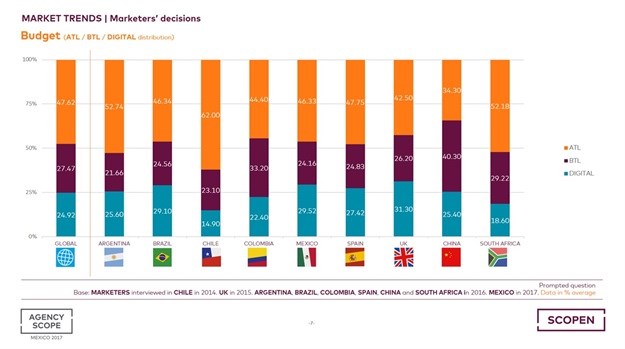

Marketers have increased their investment in digital, and it now represents 30% of their total communications-marketing budget. This is an increase of nearly eight percentage points since 2015 and we can now see that Mexico is more in line with other emerging markets in terms of digital investment.

The increase in digital budgets has come together with a decrease in the investment in traditional conventional media, mainly television. A major complaint of agencies is that the money taken from television budgets is not being re-invested in other media. Because of this digital shift, marketers are saving money and reducing their overall budget in communications.

One of the biggest concerns for agencies and media owners is the weak investment by Mexican brands in advertising communications: for every 100 pesos of turnover, they only invest 0.5%. If we compare this with the UK, the ratio goes up to 2.5%, 1.9% in China, 3.4% in Brazil and 2.7% in South Africa.

Integrated industries is a global trend

All new hires in marketers are digital professionals. This shift in hiring is another problem within the industry. Years ago, the agencies were the only ones trying to hire the best digital talent, then Facebook, Google and similar others came along, also trying to hire that same talent, and now it is the brands. And there is a big lack of this talent, mainly because there are no universities or colleges to train these new roles. Marketers in Mexico are nowadays working with specialist agencies and they use them to solve their communication needs in different disciplines (advertising, activation, sales promotions, digital, PR, media).

When we ask CMOs what type of agency they would like to work with in the future, 56% respond they will look for integrated agencies (trying to solve all their communications need under one roof). This is a global trend in emerging markets that we also saw in 2015 in South Africa. Mexican clients define an integrated agency as that one that solves advertising needs (98%), digital (95%), BTL (87%), media (72%), events (62%) and PR (59%). So being perceived as an integrated agency is becoming more and more complex, because more and more clients demand more disciplines to be solved. The number of clients that want media services to be integrated in the offering is dramatically higher than other countries (72% in Mexico against 56% in South Africa).

When Mexican CMOs define their ‘ideal’ creative agency they mention an agency that provides the best creativity and innovation, profound knowledge of the market/category/brand and powerful strategic planning. When thinking of media agencies, their ‘ideal’ is one that provides knowledge of the market/media/category/brand, good account service and strong negotiation power with media owners. On top of those qualities, not easy to find as a combination, they search for good value for money, mainly influenced by procurement directors getting involved in the negotiation process with agencies. More and more, procurement directors are getting involved in the negotiation process with agencies. In Mexico, nowadays in 47% of the cases (below South Africa’s 52% and much lower than the UK at 80%, world’s highest).

More innovative and effective creativity

One of the biggest problems in Mexico, as well as in other emerging markets, is the number of agencies being involved in pitches. We frequently see 8-10 agencies participating in the final presentations to clients for small accounts that sometimes are even small projects. And only 17% of marketers declare that they pay participating agencies in the pitch. The duration of the relationship between clients and their agencies has dramatically dropped in the last two years. From over seven years to slightly over five years! Why? The answer is in the proliferation of independent agencies.

Due to the economic crisis, talented professionals are leaving the holding groups and creating their own agencies which has resulted in a new breed of smaller, independent agencies and clients are trying to work with them. Changing agencies is no longer related to the lack of good service but the search for more innovative and effective creativity. The search for new ideas is top of mind for all marketers.

Most importantly, because of the difficult economic times, marketers agree in Mexico that agencies contribute by 28% to growth their businesses (slightly lower than 31% in South Africa). This figure has increased from 20% in 2015 and agencies are satisfied when they see that marketers perceive all the effort they are making in attracting talent, reinforcing their offering and providing better service to their clients.

Challenges for the future in Mexico are very similar to those that we see in other markets. The biggest concern for Mexican marketers is to better understand the consumer and all the touch points. Digital, new media and new platforms make it much more difficult to get to the consumer and they need their agencies to help them. They also need their agencies to help them understand digital and all new media. They understand that if they want to approach people they won’t be sitting in front of the TV set as they used to in the past. And this is happening in Mexico much later than in other markets.