This year's Gartner CMO Spend Survey polled over 600 marketing leaders across industries in North America and the UK to help companies benchmark their spend and prioritise activities by better understanding marketing priorities and budget allocations.

The survey shows that innovation is alive and well in marketing. Chief marketing officers (CMOs) indicate that 16% of their budgets are allocated to innovation, and nearly two-thirds expect this number to grow next year. However, marketing leaders rated themselves as relatively low in innovation maturity despite having high ambitions for their ability to innovate. Where CMOs plan to spend their budgets indicates where ambition and ability diverge.

“Marketing leaders must demonstrate the business value of their efforts amid uncertain times,” says Ewan McIntyre, senior director, analyst, Gartner for Marketers and CMO Spend Survey lead author.

Here are eight key findings from the 2018-19 survey to help you set the right course for 2019 and beyond.

1. Marketing budgets remain steady despite uncertain times ahead

Digital business across the enterprise is now a full C-suite team pursuit, so marketing is a priority investment area. CEOs are optimistic about marketing’s future; 57% expect to increase their investment in marketing in the coming year, according to the 2018 Gartner CEO and Senior Business Executive Survey.

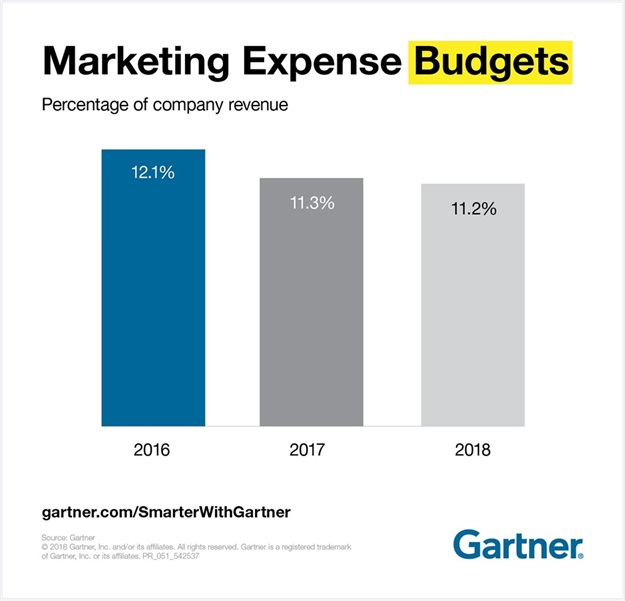

Last year’s CMO Spend Survey saw marketing expense budgets level off from their climb to 12.1% of company revenue in 2016 to 11.3% in 2017. Marketing budgets in 2018-19 are 11.2% of company revenue, nearly unchanged from last year. CMOs are optimistic that future budgets will grow, with nearly two-thirds (63%) expecting their budgets to increase in 2019.

Yet with great power comes great responsibility. CMOs must appease the often-sceptical chief financial officer’s (CFO’s) expectations for return on investment (ROI) to justify future budgetary commitments.

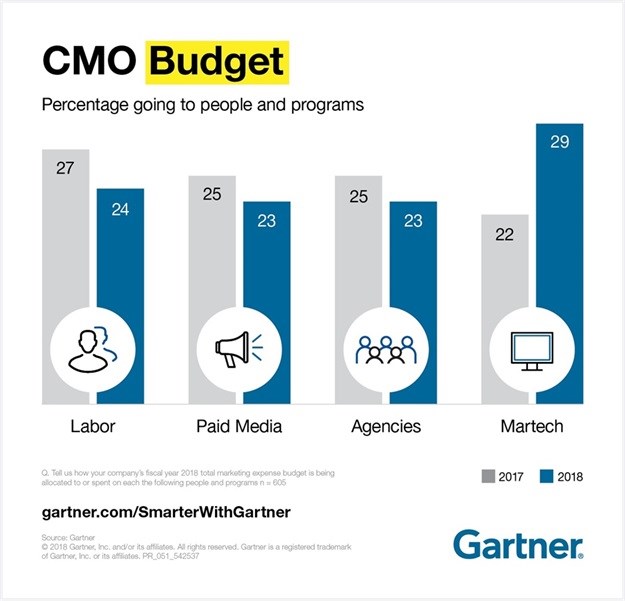

2. Nearly 1/3 of CMO budgets allocated to marketing technology

Marketing technology (martech) budgets continue their march forward with no signs of slowing. Up from 22% of the budget in 2017, technology now accounts for a whopping 29% of the total marketing expense budget, making martech the single largest area of investment when it comes to marketing resources and programs.

Email marketing platforms, web content management and digital marketing analytics platforms top the CMO’s martech shopping list, according to the Gartner 2018 Marketing Technology Survey. Yet buyers beware, says McIntyre. Ensure you have a martech roadmap for integrating applications, marketing and customer data to avoid costly mistakes.

3. Advertising dominates the CMO’s multichannel budget

In this year’s survey, CMOs reported that they spend, on average, over 21% of their marketing budgets on advertising. CMOs also spend more on digital advertising than on offline advertising, with two-thirds of their advertising budgets invested in paid digital channels, including search advertising.

Despite ongoing concerns over trust, transparency and the effectiveness of digital advertising, CMOs are still willing to invest a significant portion of their budget in paid digital media to boost revenue and prove marketing’s worth within the enterprise. CMOs are turning to digital advertising as a means to increase brand awareness and drive new business.

4. Digital workhorses account for 25% of marketing investments

One-quarter of the average marketing expense budget is invested in:

- Paid search

- Organic search

- Website

- Email

Marketers continue to invest in these tactics because they still work. And digital channels are easy to measure during a time when it’s critical to calculate marketing ROI. Additionally, organisations often face little challenge sourcing in-house talent and skills to fuel these marketing initiatives within their organisation.

Marketers face challenges proving the value of newer marketing techniques. For example, it’s difficult to demonstrate the economic impact influencers have on ROI. Contrast this with organic search (SEO), where measurability is cited as the number one reason for channel selection.

5. One in six marketing dollars spent on innovation

Over 9% of CMOs feel that marketing innovation will be vital to the delivery of their company’s marketing strategy over the next 18 months. As marketers adapt to a barrage of changes in consumer behaviours, technologies and environmental conditions, innovation spending plays a key role in many budgets.

63% of CMOs expect their innovation budgets to increase in 2019. While still relying on core channels and tactics to deliver results, marketing leaders embrace new channels, models and methods to remain competitive.

However, marketers’ innovation intent isn’t matched by their innovation capabilities.

On a scale of 1 to 5, marketing leaders surveyed in the Gartner Marketing Maturity Assessment scored themselves an average of 2.2 for their innovation maturity. Yet marketers noted that they wish to achieve a 4.3 maturity rating, indicating a significant innovation capability gap. It’s not surprising that CMOs are spending on innovation to fill this gap.

“Be mindful of the risks in this innovation arms race,” says Anna Maria Virzi, principal analyst and CMO Spend Survey co-author. “You risk syphoning off precious marketing investments for poorly defined projects with a loose scope and looser success criteria.”

6. CMOs prioritise customer experience and customer analytics but risk overlooking acquisition and retention

Customer-related capabilities have been a focal point over the past few years. In the 2017 Gartner CMO Strategy Survey, customer experience (CX), customer loyalty, and customer retention and growth dominated the list of skills CMOs feel are vital to deliver a strong, cohesive marketing strategy.

CMOs continue to focus on CX, which is listed as one of the top three capabilities in this year’s survey, and one they consider to be vital to their marketing strategies in the coming 18 months. They estimate that 18% of their overall marketing budgets are allocated to CX initiatives.

Despite the focus on CX, capabilities around customer retention and growth have lost some ground, falling behind others such as marketing technology, digital business transformation and innovation. And customer acquisition fares even worse cited only by 16% of CMOs as a top three capability.

The long-term output of any CX program is to create business value. Value is gained through acquiring, retaining and growing profitable customers. For CX strategies to be more than rhetoric they must connect CX investments with customer value outcomes to yield results, according to McIntyre.

7. CMOs value awareness more than ROI and market share

CMOs have a shared understanding of the metrics that demonstrate marketing’s value to the enterprise, such as revenue, profitability and market share.

But are they measuring what matters?

The 2018-19 Spend Survey indicates that many CMOs still gravitate toward metrics that have little meaning outside the marketing organisation. When asked to define the most important metrics on their marketing dashboard, CMOs cited “awareness” as the most important, beating ROI and measures of customer value and customer satisfaction (CSAT).

Numerous Gartner surveys, backed by multiple client inquiries, indicate the strategic imperative of CX for CMOs. Yet brand metrics are used twice as often as KPIs than CX metrics. It’s important for marketers to measure what matters for both marketing and the business.

8. Personalisation prevails and its meaning varies widely

This year’s Spend Survey found investments in personalisation to be nearly universal. Personalisation has emerged as a strategically important marketing capability, given the increased focus on customer experience and the fight for customer attention.

Overall, CMOs spend an average of 14.2% of their budget on personalisation efforts, with double-digit percentage averages across all industries and business models. Marketers investing in personalisation should proceed with caution, however, because spend doesn’t guarantee success.

Personalisation requires a deep well of customer data, along with the skills and integrations to leverage that data wisely. Given the larger cultural conversations and trends around privacy and trust, marketers must tread lightly in their personalisation efforts to appease both consumers and regulators.

Overall, heading into a year of significant uncertainty, marketers have dollars and data. But they must deliver on lofty expectations. There may be surprises ahead, but armed with a strategic outlook that takes into account the complexity of today’s markets and consumers, the surprises may be a little less surprising.