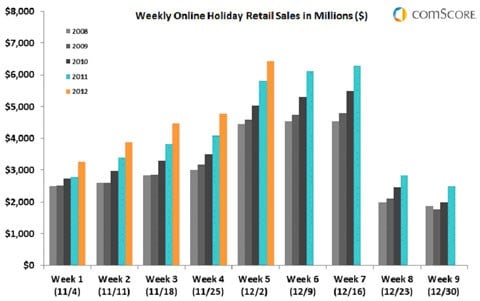

US online holiday spending surpasses US$21bn, up 14% vs last year

The most recent week saw three individual days eclipse US$1bn in spending, led by Cyber Monday, which became the heaviest online spending day on record at US$1.46bn. However, growth rates softened considerably in the wake of Cyber Monday and through the weekend.

| 2012 Holiday Season To Date vs. Corresponding Days* in 2011 Non-Travel (Retail) Spending Excludes Auctions and Large Corporate Purchases Total US - Home & Work Locations (Source: comScore, Inc) | |||

|---|---|---|---|

| Millions (US$) | |||

| 2011 | 2012 | Percent Change | |

| November 1-December 2 | US$18,668 | US$21,350 | 14% |

| Thanksgiving Day (Nov. 22) | US$479 | US$633 | 32% |

| Black Friday (Nov. 23) | US$816 | US$1,042 | 28% |

| Thanksgiving Weekend (Nov. 24-25) | US$1,031 | US$1,187 | 15% |

| Cyber Monday (Nov. 26) | US$1,251 | US$1,465 | 17% |

| Cyber Week (Nov. 26-Nov. 30) | US$4,928 | US$5,462 | 11% |

*Corresponding days based on corresponding shopping days (November 3 thru December 4, 2011)

"While Cyber Monday was a high point for holiday e-commerce spending and Cyber Week saw several strong spending days, there was a clear softening in the growth rate during the back half of the week," said comScore chairman Gian Fulgoni. "It is likely that, to some extent, holiday spending was pulled forward to the Thanksgiving-Black Friday period given the heightened promotional activity around that time. And some of the softening is a natural post-Cyber Monday lull that we often experience, an effect that may be somewhat more pronounced this year given the additional shopping days between Thanksgiving and Christmas. However, as the urgency to finish one's holiday shopping increases we expect to see growth rates pick up again in the next couple of weeks before Christmas."

Holiday season gains driven by growth in number of buyers and spending per buyer

An analysis of holiday spending demonstrates how various components are contributing to the current 14% growth rate. Thus far, in the season, spending growth is being driven both by an increase in the number of buyers (up 9% to 128.7 million) and the average spending per buyer (up 5% to US$165.90). The increase in spending per buyer is coming primarily from an increase in the number of transactions (up 4% to 2.19 per buyer) as opposed to the amount spent per transaction (up only 1% to US$75.90).

| 2012 Holiday Season To Date Spending Breakdown vs. Corresponding Days* in 2011 Non-Travel (Retail) Spending Excludes Auctions and Large Corporate Purchases Total US - Home & Work Locations (Source: comScore, Inc) | |||

|---|---|---|---|

| 2011 | 2012 | % Change | |

| Total Spending (US$ Millions) | US$18,668 | US$21,350 | 14% |

| Buyers (000) | 118,609 | 128,691 | 9% |

| Buyer Penetration | 48% | 50% | 4% |

| Spending per Buyer | US$157.39 | US$165.90 | 5% |

| Transactions (000) | 249,541 | 281,279 | 13% |

| Spending per Transaction | US$74.81 | US$75.90 | 1% |

| Transactions per Buyer | 2.10 | 2.19 | 4% |

*Corresponding days based on corresponding shopping days (November 3 thru December 4, 2011)

"That we are seeing growth come from an increase in both the number of buyers and the average spending per buyers suggests broad-based strength in the e-commerce sector," added Fulgoni. "It reflects not only the health of the e-commerce channel as more people buy online, but also the health of the consumer who has been willing to spend more online this year than last. It's particularly noteworthy that half of the online population has made an e-commerce purchase thus far in the holiday season"

Source: comScore

comScore, Inc. (NASDAQ: SCOR) is a global leader in measuring the digital world and the preferred source of digital marketing intelligence.

Go to: http://www.comscore.com