Top stories

LifestyleWhen to stop Googling and call the vet: Expert advice on pet allergies from dotsure.co.za

dotsure.co.za 3 days

AutomotiveHilux Custom Builds offers purpose-built solutions for your business

Toyota South Africa Motors 3 days

Uber is different. Every naira is electronically recorded and accounted for. And because all drivers using Uber must be registered with the tax authorities, the potential to transform the informal sector into an important contributor to the country’s finances is significant.

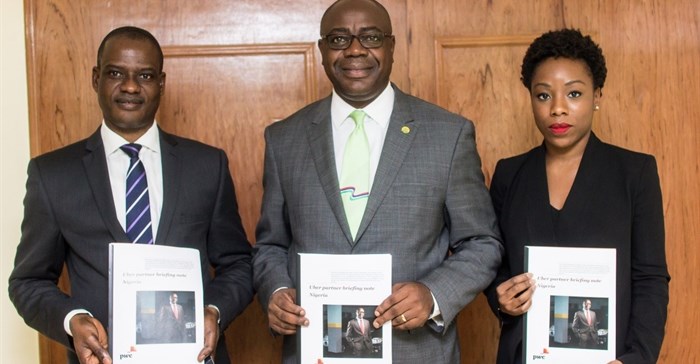

As Uber becomes more popular, more people want to earn by using the app. But many of these new driver-partners are figuring out how to pay taxes for the first time. And it can be complicated. That’s why Uber has partnered with PricewaterhouseCoopers (PwC) Nigeria.

Together with the Federal Inland Revenue Service (FIRS) and the Lagos State Internal Revenue Service (LIRS), guidance has been developed to help demystify tax for potential drivers. Every person that chooses to partner with Uber and qualifies to drive using the app will receive this information so they can easily understand what they have to do and how. All driver-partners are still advised to seek their own tax advice.

Taiwo Oyedele, a partner in PwC’s tax practice, says; “For many driver, this is the first time they are registering for tax and paying taxes, so having clear guidance on what to do is important. Further, as individuals succeed and begin to grow their own business, their tax obligations change, and this is where we find a lot of challenges.”

“Being able to bring some of the informal sector into the tax net will help government realise part of the potential NGN 4 trillion tax revenue that could be generated from the sector assuming the same level of tax contribution as the formal sector,” Oyedele adds.

Ebi Atawodi, general manager for Uber in Nigeria, says; “The drivers using Uber know how important it is to pay the right amount of tax. We are proud to say all driver-partners are required to sign up for Uber with their Tax Identification Number (TIN), showing they have registered with the authorities. With the recent passing of the resolution on ridesharing by the Federal House of Representatives, Uber’s new partnerships will help all Nigerians embrace a sharing economy that can be a valuable contributor to the country.”

Both Uber and PwC are also discussing ways of simplifying the reporting and paying of tax in the transport sector.

APO is the sole press release wire in Africa, and the global leader in media relations related to Africa. With headquarters in Dakar, Senegal, APO owns a media database of over 150,000 contacts and the main Africa-related news online community.

Go to: www.bizcommunity.com/PressOffice.aspx?cn=apogroup