For public transport to keep running, operators must find ways to outlast coronavirus

We have already seen the struggles of the aviation industry. The Covid-19 pandemic also has major financial implications for the public transport sector. While it has been declared an essential service, fears about coronavirus, widespread work-from-home directives, cancellations of major events and potential city-wide lockdowns will result in massive drops in patronage.

Railways are a high fixed-cost industry (like airlines) and are particularly vulnerable to demand volatility.

Read more: To limit coronavirus risks on public transport, here's what we can learn from efforts overseas

The Chinese experience has been that people preferred to use private cars and services like taxis and ride hailing rather than public transport. In New York, we have seen a surge in cycling as people seek to avoid the subway crowds.

What are the impacts on revenue?

Developments like these appear inevitable. However, the loss of revenue for transport operators depends very much on the design and specifications of their contracts with government.

Most urban public transport systems in Australia are “gross cost” regimes. This means operators are paid on a per-kilometre basis regardless of the number of passengers carried. These operators are much less susceptible to changes in demand.

Transport operators who work off "net cost" contracts – meaning they keep their fare revenue – are facing huge financial pressures. This, in turn, has implications for the cash flows of their suppliers, including vehicle manufacturers and consultancies.

Hong Kong rail operator MTR (which has businesses in Melbourne and Sydney), already battling almost a year of protests, has been forced into significant service reductions. In Japan, some Shinkansen services are being suspended as patronage plummets. Many Asian operators have diversified revenue streams from property developments, but large falls in patronage also affect the ability to collect rents (such as from retail).

We are also seeing US transit agencies calling for emergency funding as demand drops. Major service cuts are on the horizon – suggestions include running a weekend schedule on weekdays. This is likely to reduce patronage further as the service becomes less useful for the travelling public.

Read more: Who's most affected on public transport in the time of coronavirus?

Any service reduction has major ramifications for public transport workforces. Permanent staff may have their work hours reduced, while casual staff will struggle to get rostered. This will add to the psychological impacts on staff.

The global collapse in oil prices is another factor as the lower cost of fuel makes driving more attractive.

Beyond government-contracted public transport there are many intercity coach operators and small-to-medium-sized charter operators (many family-owned). These operators serve the school, tourist, airport, hotel and special-needs markets. They are all private commercial operators.

Many charter operators have already seen a massive reduction in bookings due to the summer bushfires and travel bans. The loss of international tourism and cancellation of school excursions and extracurricular activities will bring even greater pain to charter operators and their workforces. Chinese tours have been a large part of the charter market.

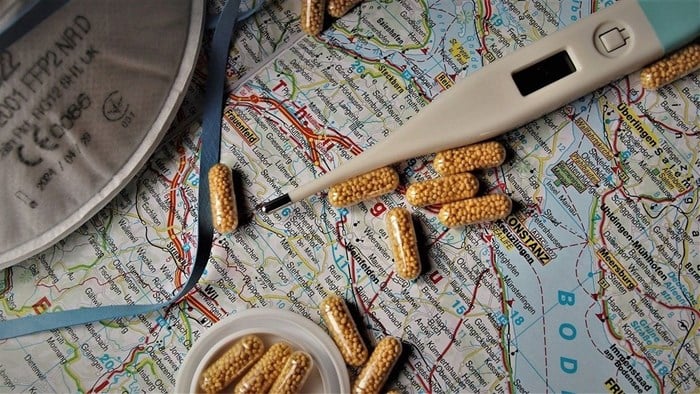

On the other side of the ledger are increased costs arising from enhanced cleaning efforts and changes in operational practices to reduce the risks of COVID-19 infection for as long as the crisis lasts.

A major issue in these circumstances is how to provide incentives for transport operators to go above and beyond what is required as part of their usual remit. Do operators merely “comply” with their contract specifications, or do they see an opportunity to extract value from proactively deploying, for instance, an enhanced disinfection regime? Should the contracted operator bear the extra costs, or should government share these costs?

Reshaping the industry

Covid-19 brings enormous unknowns for the public transport sector. Cost and revenue pressures may lead to transport operators fighting for survival. The result could be market consolidation and less competition in the industry.

In the longer term, how can future contract design for both transport services and transport assets ensure resilience to “black swan” events and encourage a proactive, rather than reactive, response? Too often, a myopic focus on cost reduction has governed these discussions.

Finally, is there a way to protect commercial operators from huge swings in demand?

The coronavirus pandemic demands an urgent operational response by our public transport systems. But it should also encourage a strategic rethinking of our institutional structures and how public services are procured. Let us create an opportunity for longer-term reform out of the crisis.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Source: The Conversation Africa

The Conversation Africa is an independent source of news and views from the academic and research community. Its aim is to promote better understanding of current affairs and complex issues, and allow for a better quality of public discourse and conversation.

Go to: https://theconversation.com/africa