World's biggest wearable tech adopters

According to Ipsos, early adopters of new technology, the world's affluent are at the forefront of purchasing wearable tech, ownership reaching over 30% in Spain, Turkey, and the USA.

The Ipsos Affluent Survey shows that increased adoption of fitness trackers and smartwatches is greatest in Western markets. Rapidly developing countries such as China (28,1%) and Russia (23,8%) offer opportunities for wearables producers and app developers.

Globally, the USA ranks first in terms of wearable tech penetration, 35,5% of affluent Americans have a fitness tracker in their household, such as the Garmin Vivofit or the Fitbit. Another 15,5% of affluent Americans own a smartwatch like the Samsung Gear or Apple Watch.

The Spanish affluent rank second worldwide, a fitness tracker is the most popular wearable tech device: 19.5% personally owns one or more.

In Turkey, which has the third highest penetration, affluent are most likely to own a smartwatch.

Wearable tech owners: not who you might expect

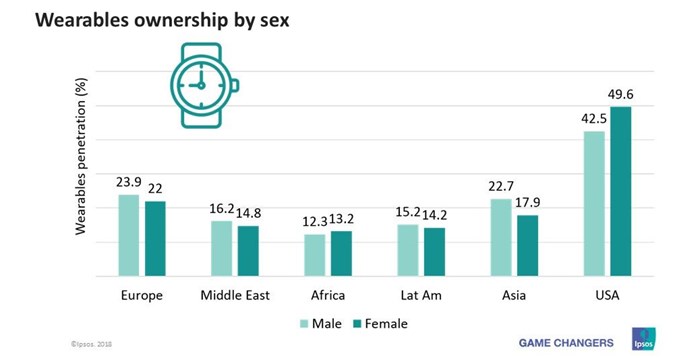

While the gender gap in most countries is relatively small; men are more likely to own smartwatches and fitness trackers are more popular amongst women.

In Europe, the USA, Asia, and Latin America, adoption and ownership of smartwatches and fitness trackers is biased towards affluent millennials.

In the Middle East and Africa penetration is higher among consumers aged 35 and over.

Why the time is ripe for wearables in the enterprise

According to Ronald Ravel, director B2B South Africa, Toshiba South Africa, the idea of integrating wearable technology into enterprise IT infrastructure is one which, while being mooted for several years now, has yet to take-off in earnest. This is visible in figure 1.

The reasons behind previous false dawns vary. However, what is evident is that – regardless of whether wearables to date have lacked the mobility or security capabilities to fully support the ways in which we now work – organisations remain keen and willing to unlock the potential such devices have, says Ravel.

Ripening conditions for wearable growth

This projected increase demonstrates a confidence amongst CIOs which perhaps betrays the lack of success in the market to date, but at the same time reflects a ripening of conditions which could make 2018 the year in which wearables finally take off in the enterprise.

"A maturing IoT market, advances in the development of augmented reality (AR), and the impending arrival of 5G – which is estimated to have a subscription base of half a billion by 2022 – are contributing factors which will drive the capabilities of wearable devices.

"Perhaps the most significant catalyst behind wearables is the rise of edge computing. As the IoT market continues to thrive, so too must IT managers be able to securely and efficiently address the vast amounts of data generated by it. Edge computing helps organisations to resolve this challenge, while at the same time enabling new methods of gathering, analysing, and redistributing data and derived intelligence," says Ravel.

Ravel is of the opinion that as more and more wearable devices and applications are developed with business efficiency and enablement in mind, edge computing’s role will become increasingly valuable – helping organisations to achieve $2 trillion in extra benefits over the next five years, according to Equinix and IDC research.

Where will wearables have an impact?

At the same time as these technological developments are aiding the rise of wearables, so too are CIOs across various sectors recognising how they can best use these devices to enhance mobile productivity within their organisation – another factor which is helping to solidify the market.

In particular, it is industries with a heavy reliance on frontline and field workers – such as logistics, manufacturing, warehousing and healthcare – which are adopting solutions like AR smart glasses.

With enterprise IT infrastructure now in the position to embrace such technologies, it is this ability to deliver bespoke functionality to mobile workers which will be the catalyst for continued uptake throughout 2018 and beyond.

Source: Who are the world’s biggest wearable tech buyers? via Ipsos.