Undeterred by Covid-19, private capital continues to invest in commercial real estate

Looking forward, the Knight Frank Attitudes Survey highlights that a quarter of ultra-high-net-worth individuals (UHNWIs) plan to invest in commercial real estate assets in 2021.

Victoria Ormond, capital markets research partner at Knight Frank said: “There are a number of drivers set to shape markets throughout 2021 – the move to safe havens – large, relatively liquid, transparent markets should continue to attract global investment; global travel disruptions also provide opportunity for private investors to leverage understanding and ties to more local markets, which under usual circumstances might face larger competition for assets by institutional investors; ESG – something private investors cannot afford to ignore and the rise of data centres – where there is huge potential for investment opportunities.”

The Wealth Report 2021 also reveals the amount of private capital invested into real estate in 2020 split by sector:

Alex James, partner, head of private client advisory, commercial at Knight Frank said: "Commercial real estate provides investors with a relatively high yielding stable income return, the potential for capital value growth and diversification. These are all key drivers in preserving wealth for future generations and protecting against the impact of the global pandemic.

“While the pandemic has impacted the way we live, work and do business, there is renewed optimism in 2021 that as travel restrictions reduce and the rollout of the vaccination programmes reaches advanced stages, private capital will look to increase its exposure in familiar markets and focus on sectors with strong long-term fundamentals.”

The US ($141.7bn), Germany ($11.1bn) and the UK ($10.6bn) are the top three countries for private capital real estate investments in 2020* with the majority of countries in the top 10 relying on domestic investment over cross-border investment.

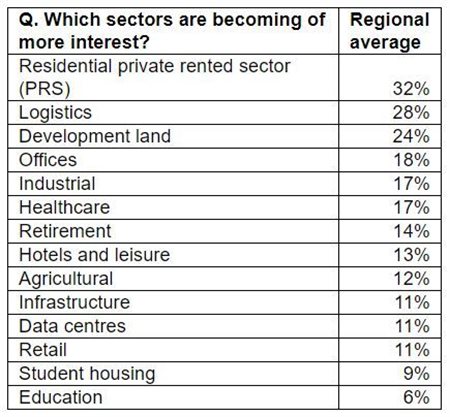

Knight Frank’s Attitudes Survey shows that the average asset allocation in UHNWIs real estate investment portfolio is as follows:

Download the full Knight Frank Wealth Report 2021.