New study discovers link between social media popularity, stock prices

Furthermore, this correlation was also found when a 10, and a 30-day lag were introduced into the study, suggesting that social media popularity may be a lead indicator of stock price performance.

The study...

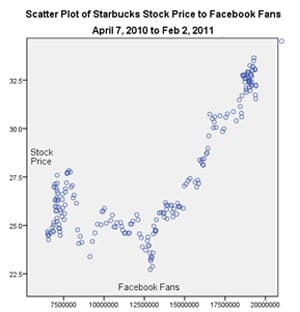

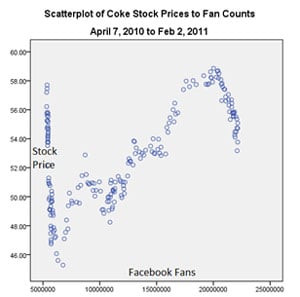

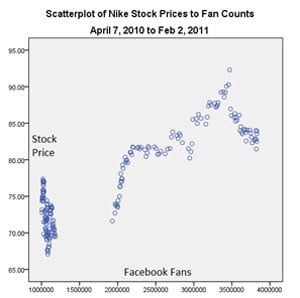

- The academic study focused on Starbucks, Coca-Cola and Nike social media performance.

- Statistically significant correlation were found between social media popularity and stock prices across sample data.

- Data suggests social media popularity may be a lead indicator of stock performance.

The pilot study, undertaken by Arthur O'Connor, a doctoral student at Pace University, using data provided by Famecount.com, the social media analytics service, analysed data over a ten-month period from 7 April 2010 to 2 February 2011. It focused on three of the most popular brands on social networks, Starbucks, Coca Cola and Nike. The study looked at the daily movements in popularity for each company's major social network accounts at three of the most popular services: Facebook, Twitter and YouTube. Specifically, the study used Facebook Like, Twitter Follower and YouTube View data. This data was tracked against daily stock price movements for each of these companies, relative to an index of consumer stocks.

ANOVA and linear regression analysis was conducted on the data set. Statistical significance was found for all three regressions (f value less than .05) and for each independent variable (t value less than .05). In all three studies, statistical significance was also found when social media popularity was lagged 10-days and 30-days - to precede common stock prices, suggesting the data may have significance as a lead indicator of stock price.

Predicting daily stock prices using social network popularity data

O'Connor said: "By using social network popularity data on three major consumer brands, we were able to predict their respective daily stock prices reliably over a 10-month period - during which the stocks of the companies experienced radically different returns, with Starbucks climbing 29%, Nike appreciating by 14%, and yet Coke declining by nearly 6% - even when the social media data was lagged by as much as 30 days."

If the correlation holds, potential stocks to watch include Walmart (NYSE: WMT), Viacom (NYSE:VIA.B) and Sony (NYSE:SNE), each of which have seen major recent growth in key social media profiles.

Samples of the data plotted in scatter charts:

About the study

The Pace University study represents a pilot of a broader project, looking at relationships between social media data and real world business indicators. Subsequent research at the University will test whether the stock price correlations identified in the pilot hold across a broader sample of consumer brands, and whether relationships and causality can be identified with other financial and business data.

Arthur J. O'Connor, the study's author, is an IT management consultant working in the financial services industry enrolled in the executive doctoral program in business at Pace University in New York City. He is veteran of Wall Street and frequently speaks at industry conferences

The full study is available on request from famecount.com/contact.

Source: Famecount.com

Famecount is an independent company that tracks and ranks social media fame. It operates famecount.com, a free service covering Facebook, Twitter and YouTube statistics and trends. It also provides groovecount.com, tracking music statistics across multiple social networks and digital services. A forthcoming professional version of the site, Famecount Pro, provides enhanced data and analytics for brands and professional users of social networks. The research study sourced its social media data from Famecount Pro.

Go to: http://www.famecount.com