Top stories

HR & ManagementNike under investigation for allegedly discriminating against White employees

6 Feb 2026

"May was another solid month in terms of demand growth. As had been expected, we saw some moderation, as rising airline costs are reducing the stimulus from lower airfares. In particular, jet fuel prices are expected to be up nearly 26% this year compared to 2017. Nevertheless, the record load factor for the month signifies that demand for air connectivity is strong," said Alexandre de Juniac, IATA’s director general and CEO.

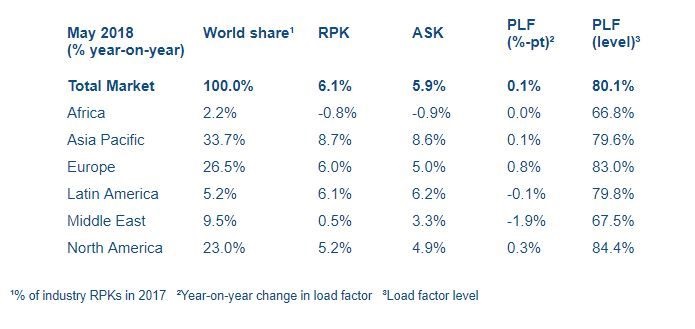

International passenger traffic demand rose 5.8%, which was up from 4.6% growth in April. All regions recorded growth, led by Asia-Pacific airlines. The total capacity climbed by 5.4%, with the load factor rising by 0.3 percentage points to 78.7%.

Asia-Pacific airlines saw their traffic rise by 8.0% in May compared to the 2017 period, slightly down on an 8.1% increase in April. Capacity increased by 7.6%, and the load factor edged up to 0.3 percentages points to 77.9%. Passenger traffic has continued to trend strongly upwards in seasonally-adjusted terms, buoyed by a combination of robust regional economic growth and increases in the number of route options for travellers.

European carriers’ May demand climbed by 6.2% over May 2017, well above the 3.4% year-over-year growth recorded in April. Capacity rose by 5.1% and the load factor was up by 0.8 percentage points to 83.5%, which was the highest among regions. Despite the impact of strikes in the region and mixed signals regarding the economic backdrop, traffic growth is healthy.

Middle East carriers’ May demand growth slowed to 0.8% compared 2017 from 2.9% annual growth recorded in April. The earlier timing of Ramadan this year may have affected the results, but more broadly, the upward trend in traffic has slowed compared to last year. The May capacity reflected an increase of 3.7%, while the load factor fell by 1.9 percentage points to 67.5%.

North American airlines’ traffic rose by 4.9% in May compared to that of May 2017, a strong rebound from 0.9% annual growth in April (which was a 36-month low). Capacity climbed by 3.4% and the load factor increased by 1.2 percentage points to 82.0%. Given the comparatively strong US domestic economy, April’s weak demand performance likely was more reflective of unfavourable year-to-year comparisons with April 2017, when the current upsurge in growth began.

Latin American airlines experienced a 7.5% increase in traffic in May compared to May 2017, which was up from 6.5% growth in April. Capacity climbed by 7.0% and the load factor rose by 0.4 percentage points to 81.6%. Economic disruption in Brazil may be contributing to a slight slowdown in demand growth in recent months, but this is not expected to have a long-term impact on the healthy traffic trend.

African airlines’ traffic rose by 3.8% in May compared to the 2017 period, which was an eight-month low. Capacity rose by 3.2% and the load factor edged up by 0.4 percentage points to 66.4%. The region’s two largest economies, Nigeria and South Africa may be moving in opposite directions again, with higher oil prices bolstering the Nigerian economy, while business confidence in South Africa has weakened again.

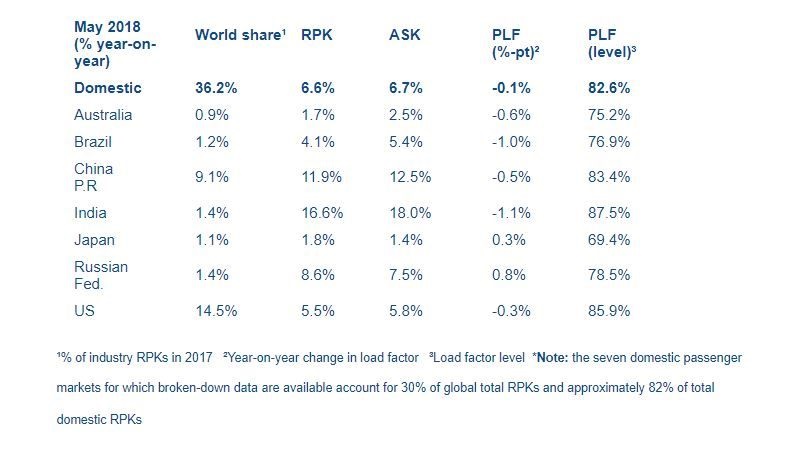

Domestic demand rose by 6.6% in May compared to that of May 2017, led by growth in China and India. This was down from the 8.6% year-on-year growth recorded in April largely owing to moderate growth in both countries, although each continued to post double-digit traffic gains.

India’s domestic traffic rose by 16.6% year-over-year, which was down from 25.7% in April. Passenger volumes in India have fallen back in seasonally-adjusted terms in recent months alongside some mixed signals on the economic front. Notwithstanding this, May was India’s 45th consecutive month of double-digit annual RPK growth. Demand continues to be supported by strong growth in the number of airport connections within the country: some 22% more airport-pairs are scheduled to operate in 2018 compared to last year.

US domestic traffic experienced a mild pick-up in May, with 5.5% year-over-year traffic growth, up from 5.3% in April. This partly offset the moderate growth in China and India. Domestic traffic is trending upward at an annualised rate of around 7%, helped by the comparatively strong US economy.

"Last month, IATA released its mid-year economic report showing expectations of an industry net profit of $33.8bn. This is a solid performance. But our buffer against shocks is just $7.76bn.

"That’s the average profit per passenger that airlines will make this year – a narrow 4.1% net margin. And there are storm clouds on the horizon, including rising cost inputs, growing protectionist sentiment and the risk of trade wars, as well as geopolitical tensions. Aviation is the business of freedom, liberating people to lead better lives. Governments that recognise this will take steps to ensure aviation is economically sustainable. And aviation works best when borders are open to trade and people," said de Juniac.