Increased affluence in traditional markets such as China and a growing demand for natural fibres in athleisure wear coupled with an abundant supply have created a "perfect storm" for wool. New demand from the market for active outdoor sportswear (Adidas, Nike, Puma, etc.), which is primarily produced from finer wools, is largely driving this demand for wool. More consumers are preferring natural fibres over synthetic ones.

China imported 53% of the global production in the 2016/17 season, which made it the biggest wool consumer globally. The Asian country’s strong economic growth of 6.8%, well above the global growth of 3.7%, is expected to carry into 2018 and 2019. Strong growth in wool consumption is expected to be fueled by growth in the demand for luxury woollen textiles due to China’s expanding middle-class.

Globally, wool production is under pressure due to declining flock numbers, and a 1% decrease is expected in the 2017/18 season due to a number of farmers switching to other enterprises or even exiting farming operations altogether, because of factors such as risk of predators, diseases, previous low wool price and high competition from other enterprises.

South Africa, a country globally known to produce high-quality wool, contributed 1% to global wool production in the 2016/17 season with 52.46 million kilograms of wool. Of this, 51.63 million kilograms (98%) has been sold and of that, we exported 92% (47.5 million kilograms). Major export destinations were China (71%), the Czech Republic (16%) and Italy (7%).

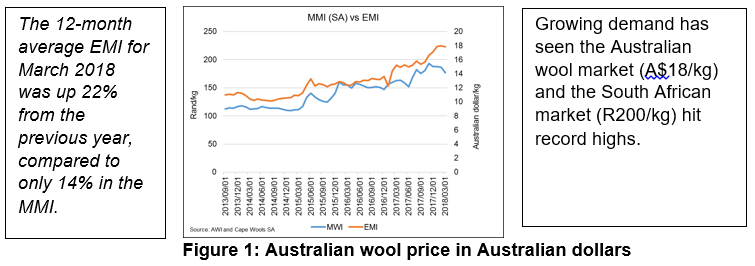

The industry is directly and significantly influenced by macro trends and development in the global textile industry, from consumer level back through the textile-processing chain. These factors are normally reflected in the wool price. Australia is the world’s biggest producer of wool with a figure of 25%. Therefore, the international price of wool is determined by the Australian market with the Australian Eastern Market Indicator (EMI) indicative of the market performance.

The long-term trend of the South African Merino Market Indicator (MMI) follows the EMI fairly closely. However, since November 2017, the MMI has been trending negatively compared to a positive trend in the EMI. This is explained by the difference between the performance of the Australian dollar against the US dollar, and the performance of the rand against the US dollar. In the coinciding period, the rand strengthened by 15.4% against the US dollar, while the Australian dollar’s performance remained flat.

Outlook

The positive sentiment for wool is forecast to remain for as long as growth in global demand continues to exceed growth in supply. Strong demand, particularly from China, India and the Czech Republic, coupled with an abundant world supply of Merino wool, is likely to contribute to higher wool prices.

The Australian Eastern Market Indicator (EMI) is forecast to rise by 15% in the 2017/18 season. This higher EMI is expected to be supported by higher prices for fine and superfine wools, reflecting the strong growth in global demand relative to the supply of fine wool used in manufacturing.

Although the rand exchange rate has strengthened and put a brake on the increase in the market price, local wool producers are still expected to benefit a great deal from the positive wool market on the back of improved global prices due to high demand. The South African Merino Market Indicator (MMI) is expected to grow by 8% during the 2017/18 season.

Given the above analysis, now is the right time to increase sheep flocks and it is the ideal agri-market for investors, as the country has a worldwide reputation for producing high-quality, environmentally sound products that meet the needs of the global textile industry.