Uber yet to make car ownership obsolete

For millennials living in major cities, Uber is a day-to-day feature. As such, there is a tendency to extrapolate that experience to other demographics and markets. This is according to Katherine Davidson, portfolio manager, global and international equities at Schroders who, as a millennial herself, says she often overestimates the pace and scale of disruption being wrought by Uber and other car-sharing/ride-hailing platforms.

The journey so far

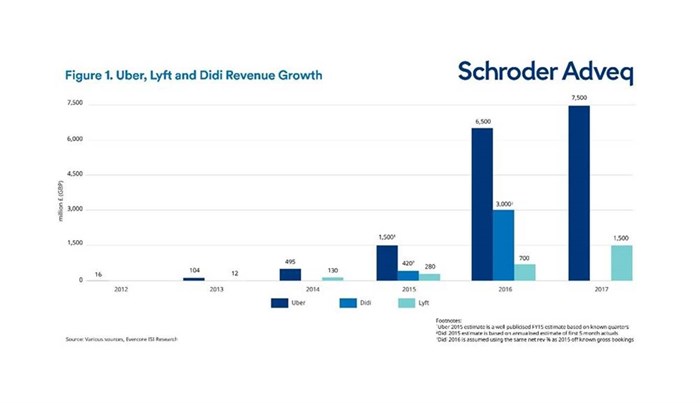

Since 2013, Uber and Lyft combined have increased revenues by almost 80 times. Uber is now present in over 600 cities, has 75 million passengers, and completed over four billion trips in 2017. For Lyft the figures are 65 cities, 23 million riders and 375 million trips. Various surveys have found that around one-fifth of US consumers used ride-hailing services in 2016, and Davidson says that this figure has only risen since.

Usage is reportedly relatively concentrated in urban areas. “New York City and San Francisco alone account for 15% of Uber’s drivers in the US, while these cities represent less than 3% of the US population. Survey data shows that ride-hailing usage, even within urban areas, skews heavily towards younger, more educated and affluent consumers”.

The impact on car ownership

Even with these caveats, Davidson says that it may be surprising to learn that ride-sharing, in total, still accounts for less than 1% of miles travelled in the US.

She says that consumers have not stopped buying cars. “US car sales have been stagnant for the last couple of years, but remain at a very high level of over 17 million per year; at or above pre-crisis highs. After peaking in 2011-12 – around the time that ride-hailing services really took off – the number of households with no car or only one car per family has declined, while the numbers of households with two or more cars have accelerated”.

Who is feeling the pain?

The impact on public transport usage and walking is less visible, she says, and she makes reference to subway ridership in New York, which fell in 2016 and 2017 after strong growth since 2009, and bus ridership which has been falling since 2013. Similarly, Davidson says that journeys on London buses have been falling since 2014 despite robust growth in the city’s population and expansion of the bus network.

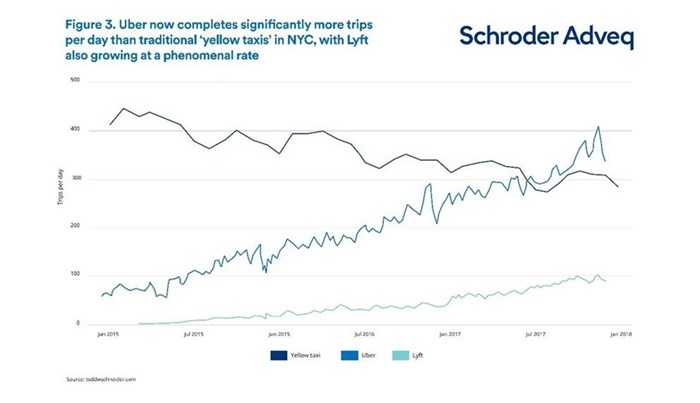

Davidson explains that in New York, taxi rides have fallen 30% in the last three years and the price of prized yellow taxi medallions has plummeted from a peak of $1m in 2013 to less than $200,000 in recent auctions.

Miles travelled

Interestingly, respondents reported that over 20% of the journeys made using Uber or Lyft would otherwise not have been made at all. According to Davidson, this has interesting implications for total vehicle miles travelled (VMT) as ride-hailing usage increases.

Davidson says that this has mixed implications for auto companies and suppliers. On the other hand, she says that if a significant proportion of those sales were essential to ‘fleet’ buyers, these could be lower-value sales due to lower uptake of expensive options, potential bulk discounts.