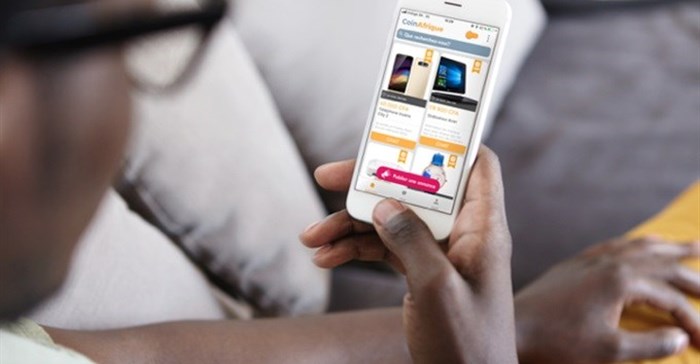

CoinAfrique app makes its mark in francophone Africa

The app is said to have more than 150,000 monthly active members, span across 16 countries. In November, it was the only francophone startup among the 20 selected to participate in the first edition of the World Bank's XL Africa startup acceleration programme.

Its shareholders include Investisseurs & Partenaires (I&P), an impact investment fund dedicated to SMEs in sub-Saharan Africa, and a pool of investors represented by French Partners and Mercure International, a retailer in French-speaking Africa.

The fundraising is part of a generally favourable trend for mobile apps in Africa. According to venture capital fund Partech Ventures, African startups raised $560m in 2017, up from $368.8m in 2016, a 53% year-on-year growth.

There are also more transactions (128 in total), as well as a wider geographical distribution. The classified ads model is one of the most profitable in the online space and in other emerging economies, these apps are growing more popular, such as Carousell, a Singapore based startup that recently raised $70m.

Investisseurs & Partenaires’ president Jean-Michel Severino said: “CoinAfrique offers an innovative classifieds offer, based on the growing use of new technologies and adapted to the consumption habits of young people, a rapidly expanding age group.

“We are happy to support CoinAfrique in this new stage of its development so as to maximise its impact on small urban businesses in the region, be it in terms of sales growth, job creation or formalising and structuring of these businesses.”