Kate Everett-Allen, head of international residential research at Knight Frank, said: “The UAE’s handling of the pandemic, strong take-up of the vaccine, the delivery of high-end turnkey projects, as well as innovative new visa initiatives and economic reforms, have together boosted Dubai’s profile in the eyes of international buyers. The top end of the market has been particularly active – sales above $10m have historically accounted for 2% of all transactions but in 2021, they equated to 7%.”

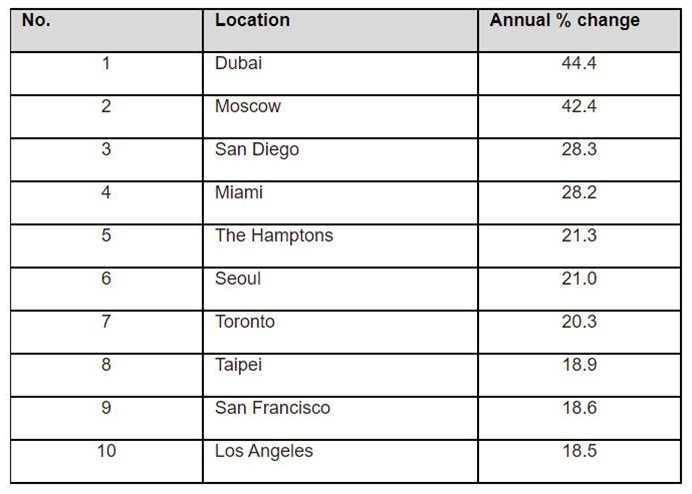

With price growth of 42%, Moscow came in second place, Russia’s mortgage subsidy programme and tight supply fuelled price growth, albeit temporarily. San Diego (+28.3%), Miami (+28.2%) and The Hamptons (+21.3%) make up the rest of the top five.

Highest annual increase since 2008

The value of the Knight Frank Prime International Residential Index increased by 8.4% in 2021, up from just under 2% in 2020 - its highest annual increase since the index launched in 2008. Of the 100 luxury markets tracked, only seven saw prices decline in 2021 and a staggering 35% of locations saw prices increase by 10% or more, underlining the strength of the sellers’ market during the pandemic.

Overall, the Americas were the regional top performer, accounting for six of the top ten rankings and posting average growth of almost 13%. Although, Asia-Pacific (+7.5%) outpaced the EMEA region (+7.2%), this was largely driven by Australasia (+12.3%). Asia alone managed a relatively modest rise of 5.5% growth.

Cities bounced back in 2021

Although sunshine resorts from Miami to the Gold Coast shone bright in 2021, with prices climbing 10.2% on average, it was cities that provided this year’s curveball. Overlooked in 2020 as suburbs and resorts attracted those looking for space to hunker down during the pandemic, the city bounced back in 2021, averaging price growth of 8.4%. Covid-19, it would seem, hasn't triggered the ongoing flight from bustling urban centres that some were predicting. Even ski resorts, which have in recent years posted fairly frosty results, saw average price growth climb to 7.2% in 2021 – Aspen, St Moritz and Verbier were the top performers.

What’s driving demand?

- Low interest rates, the availability of cheap finance,

- A shortage of prime stock,

- Rising wages and accrued savings in lockdowns,

- Strong-performing equity markets and record bonuses,

- A reassessment of housing needs and lifestyles,

- More flexible working patterns,

- Wealth creation – five million new millionaires in 2021 globally,

- Growth of co-primary living, heightened demand for second homes, and

- The appeal of property as an inflation hedge.

Analysing the future of prime price growth in 2022, Liam Bailey, global head of research at Knight Frank, said: “Far from running out of steam, this year we will see the luxury housing boom endure. Dubai, Miami and Zurich lead our 2022 forecast, with prime prices expected to end the year between 10% and 12% higher. Asian cities are expected to trail slightly, but even here, prices will grow. Key themes to watch: Agents will complain about stock shortages, buyers will complain about rising taxes and cooling measures, and city markets will be back in demand.”