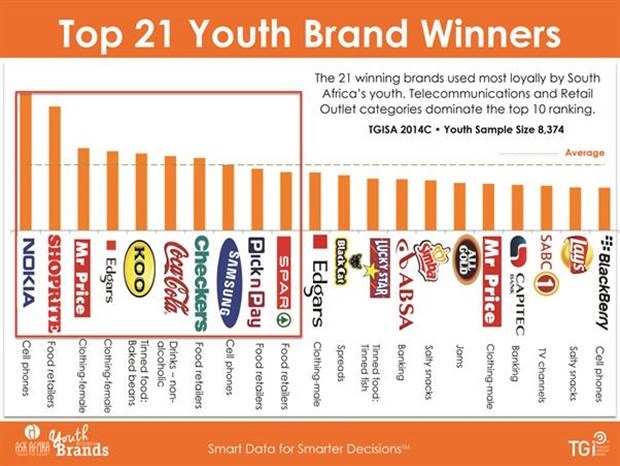

The 21 winning brands are used loyally amongst those aged 15-34, irrespective of background and living standard, with winners across 72 product categories.

Telecommunications and retail outlets dominate the youth market brand usage. The product category importance differs from Ask Afrika's Icon Brands winners, brands that are used loyally across the South African demographic and all age groups, where food and drink product categories dominate. This demonstrates what the youth prioritise in their spending.

Youth brand usage is significant if you consider that 51% of the population in South Africa is less than 34. In line with national Stats South Africa's definition, youth are regarded as persons aged 15-34 years and adults 35-64 years.

"These Youth Brands rise above the clutter and resonate with South Africa's youth. The youth market, however, is not only defined by age; lifestyle, preferences and values are unpacked to help us better understand this market. In the South African market, the changing traditional family structure has elevated the youth's influence in purchasing decisions. Understanding what makes them tick is vital," says Maria Petousis, TGI Director at Ask Afrika.

Appealing to the youth is not as simple as being on social media or having a cool ad or app. A plethora of information is vying for the youth's active yet short attention span. Finding common ground between your brand and the savvy youth market differentiates between "being in, and being out". The purpose of the research is to enable solutions for brands to deliver measurable results in terms of their status across the youth market in South Africa.

"The Ask Afrika Youth Brands benchmark seeks to understand which brands are used loyally by the youth, the nuances which define this market and what is required to cultivate loyal relationships, well into South Africa's future. Our research provides insights for marketers, guiding them in how to engage the youth to ensure relevant and sustainable brands."

The Ask Afrika Youth Brands survey interviewed a sample of 8374 youth consumers and the survey represents the views of 11,952,000 youth living in South Africa. Face-to-face interviews were done. An external company BDO audited the results and sampling expert, Dr Neethling was asked to check all results, weightings and so on. For consistency and credibility, the same calculation was used as in the Ask Afrika Icon Brands and the Ask Afrika Kasi Star Brands.

Two types of reports are currently available, a Youth Brands Life Stage Segmentation Report and a Category Overview Report. Reports can be ordered from Maria Petousis email az.oc.igt@sisuoteP.airaM or call +27(0)12 428 7400.