There is a shortage of sorghum crop in South Africa, as farmers shift to other profitable crops. The market is also losing volume to other beverage markets. The total volume produced is expected to decline further in the future, as the local crop declines.

Labour unrest in the mining sector also put the category under pressure in 2013, as sales in this sector were low.

Wet-based offerings are competing with craft beer sold in townships and other ready-to-drink beverages. The wet-based 20-litre bucket was reintroduced into the market in 2013. This pack size is expected to grow and regain its volume share in the future.

The value of the market increased in 2013, with dry-based increasing the most. The shortage in local supply forced the industry to import more sorghum, at a time when the rand was weak and this contributed to price increases.

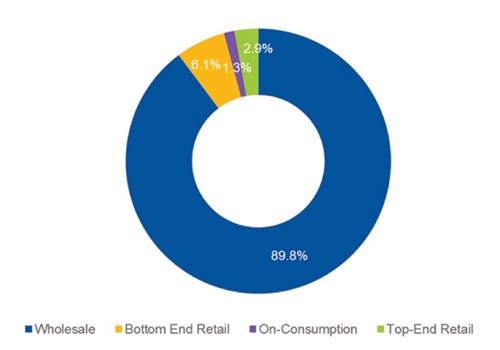

Wholesale remains the biggest channel used for product distribution - 89.8% of the total sorghum volume is sold through wholesalers. Bottom-end and top-end retail also showed growth in 2013. Bottom end retail is the second largest consumer for the category, selling 6.1% of total products. There is very limited consumption by alternative channels. Players revised their channel distribution in this year's submission.

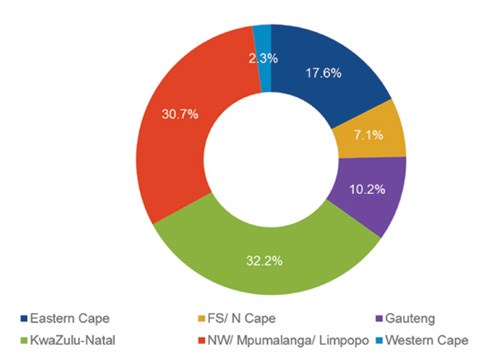

KwaZulu-Natal has the highest market share followed by NW/MP/Limpopo region. Only small volumes reach the Western Cape.

BMi Research specialises in consumer and industrial research in various sectors, including the retail market. For more information, go to www.bmi.co.za.