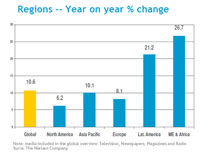

Global advertising rebounded 10.6% in 2010

Strong performance in Asia Pacific, surging growth from emerging consumer regions of Middle East/Africa and Latin America, hefty rebounds from the automotive and financial sectors, and World Cup spending propelled the advertising industry back into positive territory.

"2010 was the year of recovery for the advertising industry," said Randall Beard, global head of Advertiser Solutions for The Nielsen Company. "All global regions and every traditional medium (television, radio, newspapers and magazines) recorded a positive turnaround with highest percentage ad spend increases coming from Middle East/Africa and Latin America, which rose 26.7% and 21.2% respectively. Overall 23 out of 37 global markets posted double-digit ad growth last year in a clear indication that advertisers regained confidence to spend again after a weak 2009 where every region except for Asia Pacific posted declines."

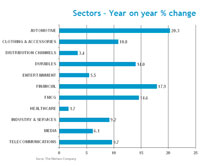

Two of the hardest hit sectors during the global downturn, automotive and finance, returned from their recession hiatus and increased ad spend by 20.3% and 17.9% respectively. Six automotive companies were among the top 20 global advertisers in 2010.

Ad spend for fast moving consumer goods (FMCG) increased 14.6% in 2010 and the sector's share of ad spend also increased from 23.9% to 24.9%. FMCG spend in Middle East/Africa increased by 34.3%, Latin America (+23.9%) and Asia Pacific (+16%).

"Fast moving consumer goods and emerging markets will continue to lead global advertising trends," said Beard. "One in every four ad dollars spent last year was on fast moving consumer goods (FMCG) and the focus remains firmly on key developing regions."

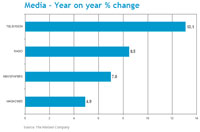

All traditional advertising media types showed increases in 2010, particularly television which rebounded 13.1% and increased to 62% of all ad spend share - the highest on record and up from 60.6% the previous year. Radio advertising rose 8.5%, followed by newspapers (+7%). Magazines recorded the slowest growth of all media types at 4.9% globally, and only posted double-digit growth of 14.9% in Latin America.

Emerging markets with their younger populations, increasing disposable incomes and hungry consumption appetites attracted advertisers to new booming markets in Egypt (+40.8%), Pan-Arab (+43%) and Argentina (+38.9%), which recorded the highest percentage advertising increases.

US back into positive territory

The USA, the world's largest advertising market, had one of the slowest growth rates of 5.6% year-on-year, but is back in positive territory after advertising expenditure dropped 9% in 2009. The only market to experience a decline in advertising in 2010 was the United Arab Emirates (-4.4%) while advertising remained flat in economically battered markets of Japan (+1.3%) and Spain (+0.4%).

In Asia Pacific, nine out of 13 markets enjoyed double-digit growth compared with the previous year, with strongest rebounds from India (+28.1%) and Taiwan (+19.1%). China, the world's second largest ad market, which accounts for half of Asia Pacific's total ad spend, gained more of the region's total ad expenditure in 2010 at 51.4%, up from 51% in 2009, complementing a 10.9% increase in ad expenditure for the market.

Latin America, in addition to posting the second highest regional ad spend increase (+21.2%) in 2010, spearheaded by Argentina, also benefited from the highest ad increases across the Financial (+37.2%), Entertainment (+17.8%), Clothing/Accessories (+22%) and Media (23.8%) sectors.

In Europe, where most markets cautiously emerged from recession last year, Belgium, France, Sweden, Switzerland and UK posted approximately 10% increases. Advertising spend during 2010 peaked during the second quarter with the World Cup driving the highest year-on-year increases of almost 13%.

"The 2010 FIFA World Cup brought the attention of hundreds of millions of soccer fans, and not surprisingly, advertisers followed with significant spending," said Beard. "It presented an excellent opportunity for advertisers to jump back into the market, revitalising ad spend in multiple countries. Advertisers are already thinking about how they'll capitalise on next year's Olympic Games in London, which could prove to be as much an advertising event, as it is a sporting event."

**Methodology

The external data sources for the other countries included in the report are:

Argentina: IBOPE

Brazil: IBOPE

Egypt: PARC (Pan Arab Research Centre)

France: Yacast

Hong Kong: admanGo

Japan: Nihon Daily Tsushinsha

Kuwait: PARC (Pan Arab Research Centre)

Lebanon: PARC (Pan Arab Research Centre)

Mexico: IBOPE

Pan-Arab Media: PARC (Pan Arab Research Centre)

Saudi Arabia: PARC (Pan Arab Research Centre)

Spain: Arce Media

UAE: PARC (Pan Arab Research Centre)

*Exchange rate at time of publishing: US$1=R6.64

Source: The Nielsen Company

The Nielsen Company is a global information and media company with leading market positions in marketing and consumer information, television and other media measurement, online intelligence, mobile measurement, trade shows and business publications. For more information, go to www.nielsen.com.

Go to: http://www.nielsen.com