In its first set of results published on the JSE since listing in April‚ Safari said its portfolio of seven properties - four of which are generating income - was valued at R1.4bn.

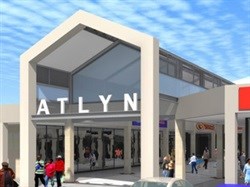

Safari is busy constructing a retail node on Maunde Street in Atteridgeville to strengthen its Attlyn Shopping Centre‚ and is also adding on to its Thabong Shopping Centre in Sebokeng.

Construction of the real estate investment trust's (Reit's) Swakopmund Waterfront in Namibia "will commence soon - as all earth and waterworks are nearly complete"‚ Safari said on Friday. "With these new additions‚ the portfolio is estimated to grow to R2bn in the next financial year and to R3bn in the next three to four years‚" it said.

Safari's four income-generating malls are all in Gauteng.

The vacancy rate of its portfolio was less than 1%‚ Safari said. In its year ended March‚ Safari grew its revenue 17.4% to R119.6m‚ and grew its portfolio value by 28%. Profit for the year jumped to R122.2m from R47.2m‚ assisted by the reversal of capital gains tax due to Safari obtaining Reit status.

After accounting for tax costs of R19.3m in its 2013 financial year‚ Safari recorded a tax gain of R8.9m last year‚ following the reversal of capital gains taxes.

Safari's operating expenses were R7m lower‚ mainly due to the completion of the revamping and extensions at the company's existing properties early in the 2014 financial year. Safari said that since its listing in April‚ its share "is performing well and we anticipate a stable performance period ahead".

Safari's relatively illiquid shares‚ which listed at R7.63 in early April‚ rallied as much as 2.35% to an intraday high of R8.70 on Friday.

With these new additions‚ the portfolio is estimated to grow to R2bn in the next financial year.