Last year we forecast the weakest Christmas sales (November and December) outcome in years, with nominal and real retail sales of 11% and -2% respectively. Unfortunately, an anaemic outcome of 11.5% and -1% (nominal and real resp.) did happen and retail sales have performed dismally in the year to date.

Despite prime falling a cumulative 5% since the first cut in December last year, nominal and real retail sales in the first eight months of 2009 have recorded growth of 6.2% and -4.8% respectively.

Notwithstanding the interest rate relief, the rapid run-up in household debt in 2006 and 2007, which then levelled out in 2008 at 76.6% of disposable income, has seen scant reduction in such levels so far in 2009. Debt servicing costs (as a % of disposable income) rose from 6.7% in 2005 to 7.9%, 10.1% and 11.6% in 2006 through 2008 before dropping back to an estimated 9% this year. This latter figure should fall further to below 8% next year but in 2009, the effect has been dampened by the severe effects of the recession, including the dwindling numbers of the employed.

253 000 jobs were shed in the first six months, compared to levels in December 2008 and, while the pace of job shedding should slow in 2H'09, the negative impact on gross national disposable income exceeds R7 billion. This then is felt via declining domestic demand with Gross Domestic Expenditure exhibiting a 2.8% real decline in 1H'09.

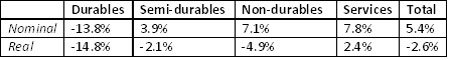

As is evident in the table below, household expenditure on furniture, appliances and electronic goods (durables) plunged in 1H'09 by almost 14% in nominal terms, with clothing, footwear, household textiles, tyres and vehicles parts (semi-durables) experiencing a meagre 4% advance over the same period. Food and petroleum (non-durables) held up in nominal terms but saw an almost 5% contraction in real terms with only services managing a positive performance in real terms.

Final consumption expenditure by households: 1h'09 vs 1H'08

Source: SA Reserve Bank Quarterly Bulletin

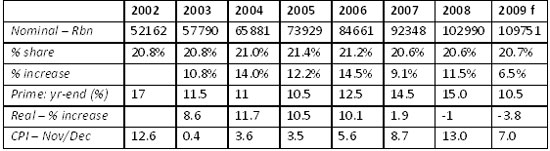

The peak contribution of 21.4% of Christmas to annual retail sales was attained in 2005, before declining to reach 20.6% over both 2007 and 2008 - on par with that experienced at the end of the last decade. Although annual nominal retail sales have doubled from R250.5 billion in 2002 to R500.2 billion last year, the poor real Christmas sales outcome of 1.9% and -1% over the last two years was caused by rising interest rates and inflation. Despite relief on both these fronts, the dire financial position of consumers implies that this year will be by far the worst performance in over a decade.

One issue that would potentially boost the situation relates to restocking, given that inventory levels have been ruthlessly rundown in tandem with plunging sales. Industrial and commercial inventories to GDP fell from 15.1% in 2005 to 12.8% last year and further to 11.4% and 10.8% in Q1'09 and Q2'09 (seasonally adjusted annualised rate). However, wholesale sales provide little evidence of any restocking having occurred so far in Q3'09. Nominal and real wholesale sales in the first eight months of 2009 recorded declines of 10.1% and 10.8% resp., with nominal falls of in excess of 15% in July and August. Even if one excludes the 32% fall in fuel and related product sales (20.7% weight in total sales), June-August 2009 nominal wholesale sales fell 11.8% y-o-y (vs the total fall of 16%) with food, beverages and tobacco (16.8% weight) providing a buffer with a small 1% rise.

Table - Retail sales analysis

Source: Stats SA; CGIC analysis and forecast

There remains an outside chance that poor economic conditions and a marginally better inflation outcome may induce the MPC to cut rates by 0.5% at their 22 October meeting. Further, the over-recovery of 24c/l and 14c/l for petrol and diesel resp. (as at 16 October) may also provide a boost to empty pockets. However, we can find no additional justification to expect anything more than a 6.5% rise in nominal Christmas sales and a contraction of some 4% in real terms given retail inflation.

This will certainly represent an improvement from the depths experienced of late but consumers have been battered and appear wary of opening the spending taps just yet. Pursuit of a portion of this additional R6.8 billion spend (compared to 2008) will have to be hard fought for; certainly this trading period is going to require that a very fine line be tread as stocks are matched against demand. Our advice to manufacturers and wholesalers at present would be to insist on very short terms and to be wary of abnormally large orders. We suspect the gathering of due payments in February and March 2010 may prove to be very difficult and turn out to be true ‘hangover months'.