For the past few weeks we have seen an increasing number of reports on the US government shutdown, budget impasses, defaults, democrats, republicans and the like. While these issues are played out on a foreign continent, they have far reaching implications and could possibly represent significant changes in the global economic environment.

As South African investors we should be considering how these events may affect our lives and our future investment returns.

The South African economy has developed significantly over the past two decades and has opened meaningful trading avenues for foreigners over this period. From a global perspective, we are broadly categorised as a small open economy. As a result we have shown a high level of sensitivity to economic events and sentiment from abroad, as have many emerging economies. We should not underestimate the impact that foreign flows into our markets have played in driving up our equity market and forcing down bond yields to lows last seen decades ago.

The United States is the world's largest economy and has generally been seen as the major driver of global economic cycles and sentiment. Before delving into the latest occurrences in the US and how they affect us, it is important to firstly understand the structure and complexities within the US government.

US government structures and the government shutdown

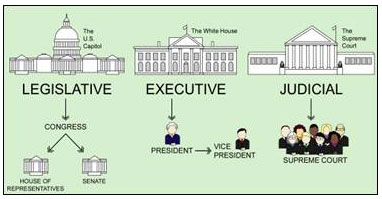

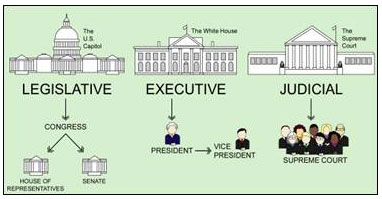

The Three Branches of the US Federal Government

The US federal government is divided into three independent branches, each fulfilling a specific function. Simply put, the legislative branch makes and modifies federal laws, the executive branch enforces those laws and the judicial branch interprets laws and determines if laws are constitutional.

The legislative arm of the government (commonly known as the US Congress) is divided into the House of Representatives (House) and the Senate, each containing members from all political parties, but largely comprised of members from the Democrats and Republicans. In order for a bill (or in this case the budget) to be forwarded to the president for final approval, both the House and Senate must be in agreement. The case of the budget is slightly different from other bills in that the president prepares the Budget Proposal which outlines the White House's vision of fiscal policy for the upcoming year (beginning on 1 October each year).

There had been a stalemate between the Republican dominated House and Democrat dominated Senate regarding the proposed budget spending put forward by President Obama on the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act (together commonly known as Obamacare). Effectively, until a resolution was reached where the House and Senate could agree on a budget, a partial "shutdown" of the US federal government had been enforced as congressional funding was unavailable to continue operations from October 1. A US government shutdown was previously seen in December 1995 lasting 21 days into January 1996, although there have been 17 previous shutdowns through history.

Why is it important?

Now to understand how the budget negotiations could impact South Africa, the role of the US government debt ceiling in the budget negotiations is vital. The debt ceiling or debt limit was created in 1917 to set out the maximum amount of money the US can legally borrow. One of the roles that congress plays is passing bills which allow for increasing the debt limit when they deem it necessary or appropriate.

The major concern stemming from the on-going budget impasse was that the Republican members of Congress had been unwilling to agree to raise the debt ceiling without concessions on the Obamacare spending, while the Democrats had been unwilling to budge on the Obamacare spending. The debt ceiling was therefore used as a bargaining tool in the on-going tussle of budget negotiations.

The debt limit heading into the negotiations was set at just under US$16.7 trillion ($16,699,421,095,673.60 according to the US Treasury) and was approved by congress in May this year. As of 10 October the total debt subject to the limit fell just US$25 million short of reaching the limit. Once the debt limit is reached (as it was expected to on 17 October), the US Treasury would be unable to issue new Treasury securities to cover any upcoming obligations. The Treasury would then have to rely on cash on hand and incoming revenues to settle its obligations. The cash on hand and incoming revenue was estimated to cover mandatory payments until 1 November when a US$29 billion interest payment would be due.

On Wednesday, 16 October, after 16 days of deadlocked negotiations, the House and Senate finally passed a bill to end the shutdown and raise the debt limit with many Republicans ultimately backing down from their ardent stance. This ultimately means the US will now avoid a default on their sovereign debt. One import caveat on the bill is that the deals put in place are temporary ones which see government agencies funded only until 15 January 2014 while the debt ceiling increase will expire on 7 February 2014. As the days wind down towards January 2014, the world will again watch on as US lawmakers attempt to find common ground.

Although most economists and political analysts expected a resolution to ultimately avoid a default, the uncertainty surrounding the events of the past two weeks was highly disturbing. Needless to say, these negotiations created a dangerous and potentially crippling situation where the US might have been unable to fulfil its obligations on what is commonly regarded as the "most-risk-free" debt globally. Credit rating agencies however have seen weakness in the US government with Standard and Poor's downgrading the debt from AAA to AA+ in 2011. More recently, Fitch has this week announced that it has put the AAA rating of US credit on a negative watch.

The Devil's Advocate - what if the US defaulted?

While the US government shutdown itself isn't a major concern for global markets, the potential damage of a US default may be catastrophic.

The precise outcomes are very difficult to forecast but would no doubt throw global markets into chaos with vast and far reaching consequences. Both US and foreign holders of US debt would suffer significant losses on their Treasury holdings as coupon payments and possibly future principal payments are delayed. The resultant spike in yields would result in capital losses. Companies relying on coupon or principal inflows to match their liabilities could be among the most affected. A number of banking and collateralised operations would suffer severely as US treasuries are often offered as collateral underpinning operations and deals. The US Dollar could lose its place as the world's benchmark currency with nations around the world losing confidence in a currency that has been the reserve currency since the collapse of the Gold Standard. The very notion of a risk-free return would forever be challenged.

It is impossible to predict the potential outcome of a US default, but should it ever come to pass, I do not think it's implausible for one to expect a global financial crisis much greater than the US$517-billion Lehman Brothers episode of 2008.

The risks for South Africa

South Africans held an estimated $14 billion of US debt at the end of July 2013 according to the US Treasury. The potential capital losses on these holdings would not be the only consequence of a US default for South Africa. A default would no doubt trigger a significant risk-off global economic environment where global bonds yields may rise substantially and equity markets could come under pressure as investors look to sell off risky assets. Given that a large portion of South African assets are owned by foreigners, the outflows we might experience could be significant. According to Arno Lawrenz of Atlantic Asset Management, foreign ownership of South African bonds is in excess of 35%. A Merrill Lynch study highlighted in the SIM Sanlam Intelligence Magazine Q3 showed that 52% of JSE industrial shares excluding dual-listed issues were foreign-owned.

Looking at the foreign outflows from our local markets seen in 2008 and more recently in May and June this year (R14,328-billion from the local bond market - iNet), when Federal Reserve Chairman Ben Bernanke announced that quantitative easing may be tapered; we can see just how closely the performance of our economy is tied to major events in the US. In recent times, our bond yields have in many ways followed suit from yields in the US.

US and SA 10 Year Government Bond Yields (Source: I-Net)

click to enlarge

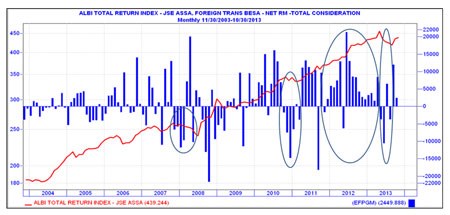

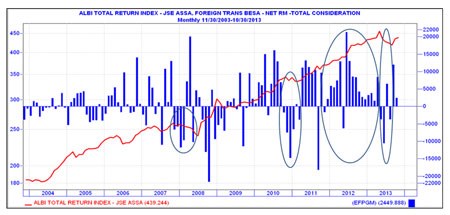

ALBI and Foreign Net Bond Flows (Source: I-Net)

click to enlarge

JSE (J203) and Foreign Net Flows (R’000) (v)

click to enlargeThe above graphs not only highlight the impact of sell offs but also show that foreign inflows have boosted our economy over the last decade by driving yields down and equities up. Should a US default ever occur, we could expect a bond and equity sell off similar to that seen during the 2008 crisis. As liquidity dries up in a global recession, asset prices would be forced down with sellers unable to find buyers unless prices are cut. Investors, both individual and institutional, could experience significant drawdowns and major capital losses across risky asset classes during this period of major uncertainty.

However, the effects on the South African economy could be magnified beyond a possible JSE decline and yield hikes. The spinoff of the resulting sell offs could see our currency depreciate against the remaining major currencies of the world as our twin deficits come under more scrutiny. Inflationary pressures could tick up beyond what we could control in a recessionary environment as the dual roles (controlling inflation and promoting growth) of the South African Reserve Bank would be even more strained. Another potential negative result as we slid deeper into a recession could be a worsening of the structural unemployment issues we face.

Conclusion

The mere fact political pressures around raising the US debt limit led to a situation where the possibility of a default on US debt should lead one to seriously question whether in fact risk-free investing is still a valid concept. As South Africans the default would have a serious and direct impact on our lives and society. The investment losses, social and emotional issues that could result, while not uncommon through history in recessionary times, would perhaps be graver than we as a young democratic nation have witnessed. For now, we should be thankful that a potential US default remains a "what if" discussion.

![By PMO - Ethiopia - [1], Public Domain,](https://biz-file.com/c/2509/787241-300x156.jpg?5)