The result was a steady flow of investment money, much of which found its way into developing projects.

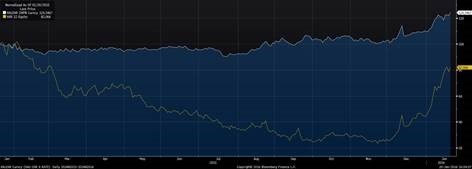

This secular bull market came to an end, and the four years since 2011 have not been a particularly pleasant time for those involved in the mining space. The downturn was not entirely unexpected, as gold, oil and metals would inevitably return to their historical inverse correlation, and the market's response to high Chinese consumption levels had largely failed to take into account basic supply dynamics.

The downturn has hit the sector relatively hard, with many veterans of the industry suggesting that it is the worst they have seen in the past 40 years - made worse by the apparent lack of upside potential evident in today's markets. Despite this, there are still pockets of opportunity in the sector, and it's a worthwhile exercise to take a closer look at a few commodities that still offer fairly good prospects.

The wholesale sell-off in commodity stocks in 2011/12 was precipitated by complaints that gold miners, particularly gold juniors, were not returning cash to shareholders, electing rather to spend it on expansions and acquisitions. This lack of interest eventually spread across commodity stocks.

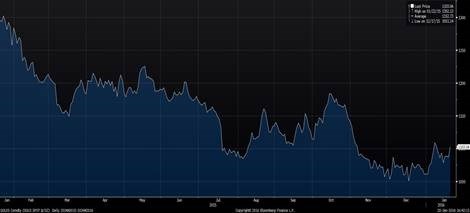

However, as the graph below reveals, recent concerns about global growth have caused gold to show signs of upward movement in 2016.

The $50/oz increase in the gold price caused a rise of over 5% in gold share prices in US and Canadian markets, and Australian gold stocks have also performed well due to a combination of reduced input costs and the devaluation of the Australian dollar.

South African gold stocks reveal a similar picture, with rand gold prices at historical highs, which can be attributed to the devaluation of the local currency. While input costs in this country have risen modestly, these are mostly rand denominated, so the increase in price has offset this.

Investors are once again showing interest in gold shares, particularly given the generally lower mining input costs due to the falling oil price, coupled with rising concerns about a possible absence of yield from other assets due to slower global economic growth.

While there is the potential for zinc and copper production shortfalls, large stocks of these are currently held by producers, consumers, and the London Metal Exchange (LME). In the case of zinc, it is likely that these stockpiles will run out within 12 to 18 months resulting in a rapid increase in price.

It is also projected that there will be a deficit in copper supply in the next year. However, the current amount of copper held in stock is uncertain, as there is speculation that some of the carry trade between Western and Chinese interest rates is collateralised by copper stocks. That said, it may only be a short time before there is a genuine supply shortfall and, if that happens, copper prices will increase in the same way as zinc.

Given the generally positive gold scenario painted earlier, investors would do well to hold on to SA gold producers, particularly those with lower cost operations or those that have the potential to pay down debt. A number of West African gold projects also offer promise, as many are very leveraged to fuel prices.

On the debt front, the willingness of banks to consider mining projects in Africa has dwindled. While the French banks are still open for business to most of Africa, as is Nedbank, the other banks, in South Africa and worldwide, are not. This means that raising debt has become far more difficult.

Public funds also remain hard to attract, and merger and acquisition activity is at historical lows. However, the number of private equity funds active in the resources market remains high, but these are selective about the deals they do and demand real evidence of quality before parting with their funds.

All in all, financing new projects in Africa is going to prove more complex than it was in the boom years and developers will need to work smarter than in the past to ensure they put in place optimum financing structures.

On the whole, there is some reason for optimism for gold miners in the relatively short-term and some base metals in the medium-term. However, caution is advised as the long-term outlook for commodities overall remains poor.

The reality is that the days of easy money from steadily increasing commodity prices are over and caution and a highly selective approach are set to become the new normal.