Rhys Dyer, CEO of Ooba Group, says that while, in nominal terms, national house price inflation remains positive (+1.9% in September 2022), the national average purchase price is down among first-time homebuyers.

The price of properties purchased by this demographic registered a third consecutive decline in September 2022 (down 3.5%), reflecting first-time homebuyers’ sensitivity to interest rate increases.

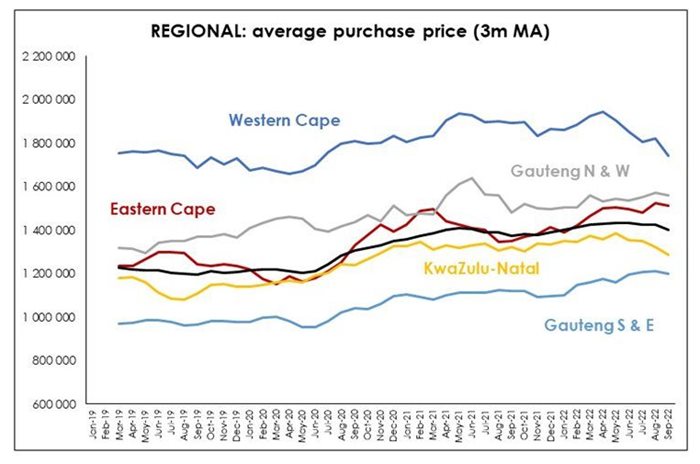

Dyer breaks down regional house price inflation for the year to date as follows:

“Interestingly, properties in Gauteng’s South and East Rand continue to register robust growth in prices, despite this region’s average house purchase price being the lowest at R1,183,032. The Western Cape, on the other hand, has the highest average purchase price in the country but it is the only major region to report house price deflation.”

“After peaking in March 2022 at R2.05m, the average purchase price of properties purchased in the Western Cape eased to R1.66m in September – with purchase prices over the year to date registering a decline of 2.1% compared to the same period last year,” adds Dyer.

“In Gauteng North and West, the average purchase price of properties purchased this year (to date) is currently pinned at R1,551,273, while in the Eastern Cape and KwaZulu-Natal it sits at R1,490,898 and R1,337,229 respectively.”

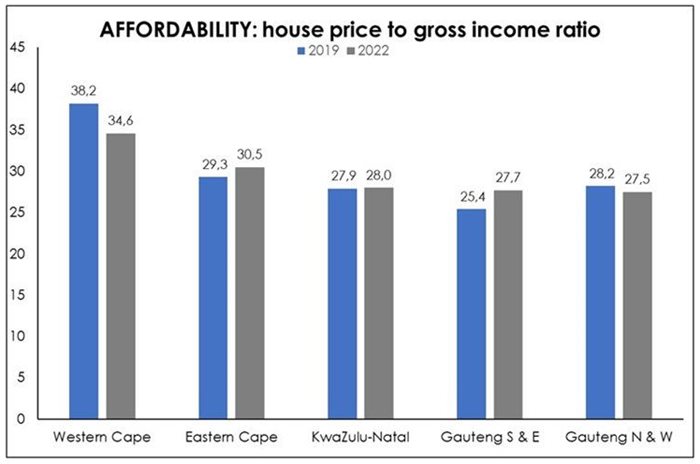

As Dyer notes, examining property prices in isolation reveals one side of the story “because the price of a home is not the same as the relative affordability of a home”.

One way to measure the affordability of homes is to look at the price-to-income ratio. “Here, the nominal house price is divided by the nominal disposable income per head. This means that in a particular region, homes may be more expensive but incomes may also be higher – thus making the homes there more affordable,” says Dyer.

Dyer explains that in the Western Cape, for instance, the average purchase price of properties purchased for January to September 2022, compared to the same period in 2019, shows an increase of 6.1%.

“The average gross income of applicants has, however, increased by 17.5% over the same time period, suggesting that on average, the homes purchased this year are almost 10% more affordable than those purchased during the same period in 2019.”

Affordability has also improved marginally in Gauteng North and West as the average income of home loan applicants increases at a slightly faster pace than that of the average purchase price.

“However, the same cannot be said for homes in the Eastern Cape (where house prices of homes purchased increased by 18.5% during the year to date, compared to the same period in 2019) and, particularly, in Gauteng South & East Rand (tracking a house price increase of 21.7%). In both these regions, this rise in house prices purchased has outpaced growth in average gross incomes, resulting in a relative deterioration in affordability in these housing markets.”

“Gauteng is home to the largest percentage - being 20.3% - of potential first-time homebuyers (namely young adults aged between 30 and 39 years), while the Eastern Cape has the lowest.”

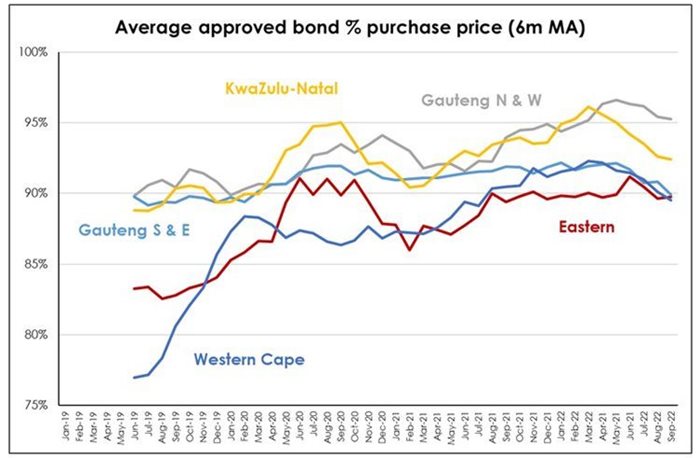

Across the regions, but most notably in the coastal provinces, the average first-time homebuyer’s purchase price has decreased.

“Interestingly, in Gauteng South and East, where first-time buyers make up more than half of applications received, registered the lowest average purchase price year to date and, despite a slight deterioration in affordability, is the second most affordable region for homebuyers.”

Despite varying levels of affordability across the country, the market remains stable and there are still deals to be had for those who want to capitalise on a generous lending environment.

“As interest rates begin to stabilise in 2023, we expect to see activity in the market improve, especially among first-time homebuyers,” Dyer concludes.