The forecast is an annual fixture on the South African motoring calendar, and forms part of the annual SAGMJ WesBank Car Of The Year banquet dinner. WesBank CEO Chris de Kock cited many of the current macroeconomic headwinds as reasons for the expected decline in sales this year.

WesBank’s forecast is based on the anticipation of a low GDP growth rate, changes in the interest rate, inflation, a downgrade of South Africa’s credit rating and the deterioration of the rand.

Over the next three years the interest rate is likely to be hiked 125 basis points, keeping inflation within target bands. However, WesBank does expect that South Africa’s sovereign credit rating will be downgraded to 'non-investment grade', or 'junk' status. Finally, the rand will continue to decline against the US dollar, with WesBank forecasting that in 2019 the American currency will sit at R17.20.

“The movement of the rand will be key for the new vehicle sales performance in South Africa. A deteriorating currency will force manufacturers to increase prices more aggressively. This will push new vehicle price inflation well outside that of headline CPI, thus sending more buyers to the used car market,” said de Kock. “Interest rates will also play an important role in affordability and the demand for credit, as has historically been the case.”

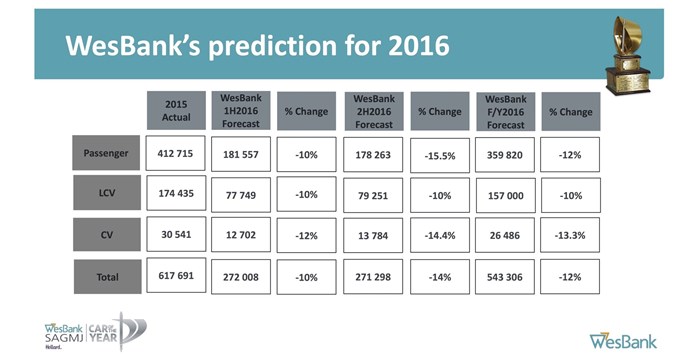

In line with seasonal trends in the market WesBank has staggered its forecast for 2016’s vehicle sales performance. WesBank predicts that in the first half of 2016 industry sales will be down 10%, year-on-year, with passenger car and light commercial vehicle (LCV) sales declining 10% and the remainder of the commercial vehicle segment falling 12%.

The second half of 2016 will be tougher, mainly as a result of accelerated price increases for new cars as well as higher interest rates. Passenger car sales will likely decline 15.5%, year-on-year, with LCVs only down 10% for the same period. Sales of larger commercial vehicles will slide 14.4%, year-on-year, as businesses opt to not to replace existing assets with new models. Combined, the full year will see passenger car sales end down 12%; LCVs 10% lower than last year’s performance; and commercial vehicles down 13.3%.

After the address by de Kock the event concluded with the crowning of the 2016 Car Of The Year – the Volvo XC90. The Ford Fusion and Mazda 2 were first and second runners-up, respectively. The winner was chosen in a thorough testing and evaluation process conducted by the South African Guild of Motoring Journalists, in January. Car Of The Year is an industry award that recognises excellence in motoring, and WesBank has been the proud sponsor of the competition for 31 years.