2022 Christmas spend: What to expect from consumers

The recent KLA survey (data reported below) found that financial stress is a reality for many South Africans, a fact confirmed in the Momentum Unisa Consumer Financial Vulnerability Index Q3 report. The latter found that the overall state of South African consumer finances improved slightly in Q3 2022, but people remain under pressure.

This is further supported by a recent McKinsey Report (March 2022) that unpacks the tangible financial pressures with 87% of South African consumers describing their personal financial situation as ‘stretched’; 70% reporting substituting branded products with cheaper alternatives; and 42% saying that cheaper alternatives are good enough for everyday use.

It is within this context that the findings from KLA’s recent research into how South Africans are thinking about and planning for their Christmas spend are read.

Mindful gifting will bridge the desire to give and will enable consumer to stay within the reality of their budgets.

‘The thought that counts’ mantra will hold more truth this year than ever. Christmas gifting remains important with the majority (72%) saying they will be buying gifts, but 18% have decided to forgo gifts entirely despite having bought gifts in previous years.

Spending will be curbed for some. Relative to last year, the indicated spread of spend is:

- 42% plan to spend more

- 32% will spend similar amounts

- 22% will spend less

- 5% don’t celebrate Christmas

There are clear reasons why spend will be carefully considered and three main reasons are not surprising:

- 63%: inflation (rising cost of living)

- 51%: pressure on disposable income (money left once expenses are paid)

- 51%: transportation

In addition, monthly expenses are demanding – 31% indicate restraint as a result of too much debt, 29% cite housing costs, 27% say school fees, and the cost of healthcare is a challenge for 22% of respondents. Only 7% of respondents have no financial concerns and have no need for restraint.

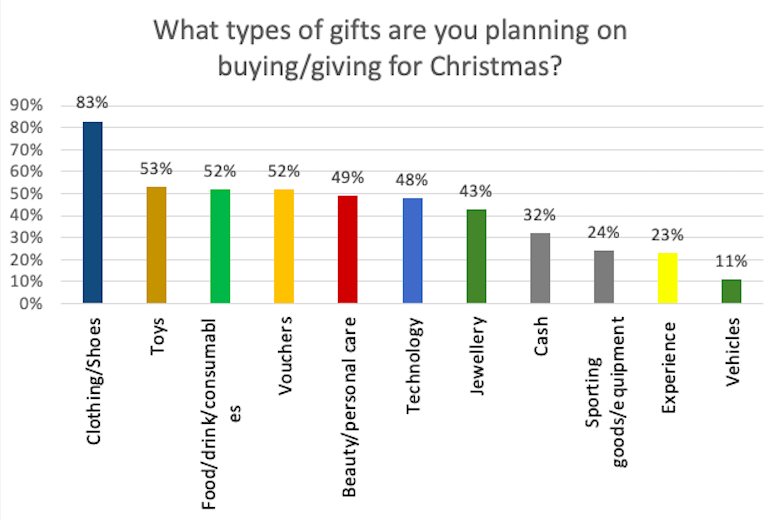

When it comes to the choice of gift this year, consumers are mainly opting for clothing and shoes (83%), toys (53%), food/drinks/consumables (52%), vouchers (52%) and beauty or personal care products (49%).

The survey results indicate the following gifting categories:

In the context of financial and gift-giving caution, consumers are set to apply equal care when it comes to paying for gifts.

Survey results suggest reticence to endure more debt during this time and consumers are looking for the comfort and control that comes with paying with cash; 74% plan to pay cash, while 59% plan to use a debit card, which equates to cash.

Efforts to accumulate points and rewards are realised for 41% of respondents who will use these to pay for gifts and 39% will use gift cards/vouchers. However, credit will be used by some: 25% will use a credit card and 11% will use a Buy Now, Pay Later platform.

Retailers should connect with consumers to create anticipation and build the excitement of Christmas.

Consumers want festive cheer and fun after a rough and complex year, so this is the perfect opportunity for retailers to create experiences that do just that – bring cheer and build a sense of celebration.

Given that discretionary income is limited, retailers could leverage festive feelings and support consumers through this time. Consumers seek Christmas sparkle as they wander through stores, be they physical or digital. Create experiences that deliver the cheer and draws on all our senses building feelings of joy and celebration.

Consumers will be in stores and online, ready for festive experiences – 34% of respondents are likely to shop in-store, 46% will combine online and in-store shopping and 20% will shop online only.

Creativity in gifting and celebrating Christmas might just be the most important ingredients for consumers and retailers to have the most magical time this year. For more information, www.kla.co.za.

- The rise of alternative schooling options in South Africa 22 Oct 2024

- Understanding Gen Z’s perception of fin-fluencers 26 Sep 2024

- Fitness apps are transforming health and wellness in South Africa 10 Sep 2024

- Consumer insights agency, KLA, reveals the quarterly buzz results for Q2 2024 21 Aug 2024

- Babalwa Donkrag appointed managing director at KLA 13 Aug 2024

KLAWe're a full-service market research agency know for taking on client's challenges and working alongside them to find solutions. So, when your business needs intelligence that moves the needle, at KLA, we get it! |