Transformation of print and digital media in South Africa

Section 1: Introduction and background

1. The MDDA welcomes this opportunity to make additional submission to the Print and Digital Media Transformation Task Team (PDMTTT), which was launched in September 2012 in Johannesburg by the print and digital media industry to look into and recommend ways of ensuring transformation of the industry. Interested persons were invited to make representations to the Task Team by the 14th December 2012. MDDA then submitted the "Trends of Ownership and Control Report" by Z-coms, 2009.

2. The Task Team is mandated "to assist the industry to develop a common vision and strategy for transformation in mainstream, small private and community media businesses. It will also recommend areas of transformation, methodology of implementing transformation, targets and mechanism to monitor and enforce transformation. The team is looking at both quantitative and qualitative indicators such as: Ownership, Management, control and employment equity; Skills development; Preferential procurement and enterprise development; Socio-economic development; The low levels of black ownership within many large media groups; The extent to which concentration and market power results in anti-competitive behavior that blocks new entrants; The need to develop new media products for regions and communities as well as the languages of those publications, and Diversity of voices."

3. On the 22nd and 23rd September 2011, a Print Media Indaba was convened and held in Parliament. The Indaba, themed 'Transformation and Diversity of Print Media", was attended by industry associations, lobby groups, small commercial and community media representatives, and organs of state (MDDA, ICASA, MICTSETA, Competition Commission, FP&M SETA and GCIS). The Parliamentary Portfolio Committee on Communications ('the Committee') saw the Indaba as the beginning of a process aimed at addressing collectively, the challenges in respect of transformation and diversity in print media, and sought to provide solutions for urgent implementation. The Committee committed to further engagement and consultation on this matter and to a subsequent Indaba on Media Transformation and Diversity the following year.

4. The Committee called on the GCIS and the MDDA to conduct research providing (i) updated data on trends of ownership and control, (ii) the state of print media transformation and (iii) diversity, indicators and measurement tools for media diversity, and (iv) a socio-economic impact study on the MDDA since inception.

5. The Committee further called on the Competition Commission to prioritise a probe into possible anti-competitive behaviour in the print media business processes and the entire value chain.

6. The Committee noted the transformational changes that have taken place since 1994 as presented by the PMSA. The Committee noted with regret that the average black ownership of SA media as at 2011 is 14% and women participation (at Board and management levels) is 4.44% (as presented by PMSA presentation).

7. The Committee noted the commitment by PMSA to develop a transformational strategy and called on the GCIS and MDDA to initiate a consultation process exploring the need for setting up transformation targets aimed at giving meaning and effect to the framework provided by the BBBEE Act and Code of Good Conduct, including the possibility of the Media Charter, having regard to the PMSA commitments and adoption of the Code as a measurement tool for goal-setting as a basis.

8. The GCIS and MDDA were mandated to urgently engage with the National Treasury on the possibility of - through amending either the MDDA Act or a Money Bill - providing for obligated contributions to the MDDA by the mainstream print media in order to enhance the existing partnership for media development and diversity.

9. The 2011 Print Media Indaba discussions looked at media diversity and ways to measure this; challenges in the value chain from (amongst others) writing, publishing, printing, distribution & advertising; barriers to entry (mainly printing and distribution costs, market structure, etc.); possible anti-competitive behaviour in the business process value chain (from predatory pricing, inducement ,abuse of dominance, fixing trading conditions, etc.); ownership & control; diversity with respect to language; gender; content, and underfunding of the MDDA in respect of its print media mandate.

10. A further Parliamentary Print Media Transformation Indaba was held on Monday, 18 June 2012 at ICASA premises in Johannesburg. Having regard to some of the challenges that still plague the industry, the Portfolio Committee on Communications noted that print media transformation needed to be fast-tracked to ensure the print media industry was a mirror of the present democratic dispensation. The aforementioned challenges faced by the community and small commercial print sectors range from barriers to entry to a lack of diversity with respect to ownership and control, language, race, gender, content, sources of news, employment equity etc.

11. The launch of the Print and Digital Media Transformation Task team (PDMTT) initiated by the Print and Digital Media SA (PDMSA) follows the 2012 Parliamentary Print Media Transformation Indaba. The Portfolio Committee on Communications at this Indaba called upon GCIS and MDDA to work with the industry on the roadmap towards the establishment of the Print Media Charter. This economic empowerment print media charter is to promote BBBEE in the sector.

12. The Committee suggested that among others, the Print Media Charter should address the availability of print media in languages all South Africans speak. The Charter should set clear targets and deadlines in fulfillment of the transformation objectives committed to by industry into a diverse and transformed print media in the entire value chain (newsroom, publishing, news sources, printing, distribution and advertising). These include areas of ownership and control, language, race, gender, employment equity, conditions of employment, skills development, contributions to promoting media diversity (through MDDA), accord on access to printing & distribution, etc.

13. The Press Freedom Commission (PFC) in its April 2012 report, in relation to the agenda of this Task Team, recommended considerations for content diversification, skills development and training, a media charter and support for community media.

Section 2: What is the MDDA

14. The Constitution Act No. 108 of 1996 of South Africa provides for freedom of expression and access to information, in Sections 16 and 32 respectively. The Media Development and Diversity Agency was established by legislation (the MDDA Act No 13 of 2002) to create an enabling environment for media development and diversity in South Africa (including radio, television, newspapers, magazines and new media). According to the MDDA Act, the MDDA is mandated, amongst other things, to:

- Create an enabling environment for media development and diversity that is conducive to public discourse and which reflects the needs and aspirations of all South Africans.

- Redress exclusion and marginalisation of disadvantaged communities and persons from access to the media and the media industry.

- Promote media development and diversity by providing support primarily to community and small commercial media projects.

(Preamble, MDDA Act, 2002)

15. The objective of the Agency is to promote development and diversity in the South African media throughout the country, consistent with the right to freedom of expression as entrenched in section 16 (1) of the Constitution, in particular -

(a) freedom of the press and other media; and

(b) freedom to receive and impart information or ideas.

16. For this purpose, the Agency is established to:

- Encourage ownership and control of, and access to, media by HDC as well as by historically diminished indigenous language and cultural groups,

- Encourage the development of human resources and training, and capacity building, within the media industry, especially amongst HDGs,

- Encourage the channelling of resources to the community media and small commercial media sectors,

- Raise public awareness with regard to media development and diversity issues,

- Support initiatives which promote literacy and a culture of reading,

- Encourage research regarding media development and diversity, and

- Liaise with other statutory bodies, such as ICASA and USAASA.

Section 3: Legislative framework and context

17. As the fourth estate (in addition to the legislature, judiciary and the executive), the media is an important communication channel. It informs, educates, entertains and provides a platform for dialogue necessary for democratic discourse. The freedom of the media must be protected by the legislative framework, in particular the Constitution and by implication be protected by an independent judiciary. An independent judiciary is vital and critical for any constitutional democracy. A democratic state has a responsibility to support and promote a free and diverse media, as this is in the interest of its citizenry and sustainability of democracy. Diverse views and opinions and diverse sources of information empower and enrich citizens to participate in a people driven democracy.

18. Accordingly, in South Africa, regard have to be taken to the following laws:

- The Constitution Act 108 of 1996;

- MDDA Act 14 of 2002;

- Competition Act 89 of 1998;

- Companies Act 71 of 2008;

- Labour Relations Act 66 of 1995;

- Basic Conditions of Employment Act 75 of 1997;

- Skills Development Act 97 of 1998;

- Employment Equity Act 55 of 1998;

- Broad Based Black Economic Empowerment Act 53 of 2003;

- Broad Based Black Economic Empowerment Strategy of 2003;

- Codes of Good Practice of 2007;

- Access to Information Act of 2000; etc.

19. The Constitution Act of 1996 protects and provides for freedom of the media, freedom of expression and access to information. The Windhoek Declaration was endorsed by the United Nations Educational, Scientific and Cultural Organization (UNESCO) promoting press freedom, independent and pluralistic media. In 2003, the International Telecommunications Union (ITU) also adopted the World Summit on Information Society (WSIS) Declaration towards building an information society. There is a number of international protocols which South Africa is signatory to which protects media freedom for all, freedom of expression and the public interest. These include the 'African Charter on Human and Peoples' Rights Declaration of Principles on Freedom of Expression in Africa' is an international human rights instrument that is intended to promote and protect human rights and basic freedoms in the African continent.

20. South Africa post 1994 has developed and embraced a culture of human rights, including the right of access to information. This is also a key priorities of the National Information Society Plan, developed by the South African Presidential National Commission on Information Society and Development, which sets out South Africa's plan for the realization of the millennium goals agreed to at WSIS.

Section 4: History

21. South Africa has a dynamic media industry and is one of Africa's major media players. Government censorship during the apartheid era (i.e. pre 1994 democratic elections) severely hampered the media industry; ensuring that it "towed the line" in terms of the apartheid government's policies. Newspapers had to apply for registration if they published more than 11 times a year. An arbitrary amount was also required before registration was approved. The government also enforced regulations controlling what newspapers could publish, especially with regard to articles and comment on activities deemed to be against the apartheid system.

22. Post 1994 saw the enactment of a new constitution with a Bill of Rights guaranteeing that every citizen has the right to freedom of expression. The Bill of Right includes freedom of the press. As a result in the post 1994 era, freedom of the media was given a lot of focus and is regarded as one of the supporting pillars of democracy. Transformation of the media was and remains a challenge in South Africa.

23. The print media landscape in the post 1994 South Africa has not transformed much in terms of ownership and control and is still majority owned and controlled by the white shareholders. In spite of various interventions by the state through promotion of transformation processes and BEE, the majority of print media in South Africa is still owned / dominated by a few companies and individuals.

24. The South African print media industry has experienced good growth in terms of revenue and number of titles despite growth in broadcasting and new media which are in direct competition for adspend. The industry is dominated by a few large companies who own and control a large number of newspapers and magazines across the country.

25. The four large publishing groups are: Avusa Publishing (now The Times Media Ltd); Naspers; Independent News, Media24 and Caxton / CTP. Most of these companies have their head offices in Gauteng Provinces with the exception of Naspers which has its headquarters in the Western Cape Province. There are several independently-owned newspapers, but these are small commercial newspapers and community newspapers.

26. Ownership and control

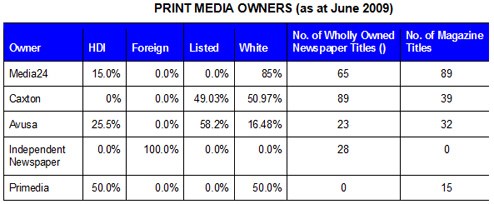

27. A number of changes have taken place since the publication of the MDDA Report "Trends of Ownership and Control Report" by Z-coms, 2009, most notably within the AVUSA (now The Times Media Ltd) and Independent Newspapers. MDDA is currently updating this information and its report will be published before the end of the financial year.

Section 5: Definition of community media

28. The MDDA and the Print Media South Africa (PMSA, which includes, Media 24 LTD, CTP Limited, Independent Newspapers LTD and Avusa LTD) agreed to use the MDDA Act of 2002 as a basis to define community media:

- Community Media - in terms of the MDDA Act means any media project that is owned and controlled by a community where any financial surplus generated is reinvested in the media project; and "community" means a geographically founded community or any group of persons or sector of the public having a specific ascertainable common interest;

- Small Commercial Media (SMME) - in terms of the MDDA Act means independent media enterprises or initiatives that are run for personal gain as micro, very small or small businesses as classified in the National Small Business Act, 1996 (Act No. 102 of 1996). This category will be considered as "emerging"- community print projects owned by small community enterprises / individuals and have been in existence for 2 years.

The definition is also aligned to the Electronic Communications Act of 2005.

29. The above definitions exclude commercially owned local newspapers and magazines, which are the traditional 'knock 'n drops' owned and distributed by corporate media owners like CAXTON, Media 24, etc.

30. The above agreement is a milestone in the pursuit of developing and promoting media diversity. It will also assist in ensuring that adspend in community media is appropriately reflected and reported.

Section 6: Printing

31. Most printing companies are owned by the big media companies. Media24 and Caxton provide much of their own printing needs and those of others media entities in both newspapers and magazines. In 2006, Caxton / CTP became the largest publisher and printer of books, magazines, newspapers and commercial print in South Africa. Printing companies are located in cities such as Johannesburg, Durban and Cape Town, so many newspaper and magazine owners have to go to these large cities for their printing.

32. Details of the ownership and control of printing in SA is provided in the MDDA Report: Trends of Ownership and Control of Media in SA, Z-coms, pages 100 - 103, June 2009. The printing of newspapers for the independent publishers, community and for small commercial newspapers is mainly done by the major media owners, as printing plant ownership is out of reach for the small media owners in terms of onerous capital outlay.

33. In the financial year 2005/6, the MDDA, commissioned Editorial Assignment to conduct research on Distribution (including sales) and Printing Costs affecting the Small Commercial and Community Print Media Sector in South Africa. The report concluded that the "resources of the sector can be aggregated with the MDDA playing the role of energiser" and that this could and should lead to printing cooperatives for instance. The report proposed a General Agency for Publishing Services (GAPS) to act as a "clearing house for printing procurements; exercising the collective muscle of the sector to gain economies of scale in buying paper and inks; obtaining better prices and terms of credit; forming printing press hubs; empowering emergent printers; and bolstering the position of individual publishers when dealing with printing houses". (Editorial Assignment, 2006)

Section 7: Distribution

34. Newspaper and Magazine distribution is done mainly by the big media players such as Caxton's RNA and Media24's NND24 and NLD24. Many small to medium sized companies outsource distribution services to (amongst others) RNA and NND. These are the organisations that are most often quoted by various newspapers and magazines when asked how they distribute. Others quote the Post Office or CNA. Most magazines and newspapers can be obtained from CNA, Exclusive Books, supermarkets and convenience stores.

35. Most newspaper companies distribute for themselves or outsource it to some other small companies like 'Mr Pamphlet', Promail or Colour Press. Some of these distributors like Colour Press and Intraprint also double up as printers. Those media companies that distribute for themselves either send out their free newspapers door-to-door or drop them off at petrol stations and supermarkets / convenient stores.

36. The ownership and control of newspaper and magazine distributors, as in other sections of media, is dominated by the big media owners. The independent distributors are mostly white. In the MDDA 2009 research, we have not found one distributor wholly owned by a HDI.

37. The 2005/6, MDDA commissioned report, on Distribution (including sales) and Printing Costs affecting the Small Commercial and Community Print Media Sector in South Africa" further noted:

On DISTRIBUTION: Exploiting distribution channels that already exist and may be shared; exploring possibilities for logistical and transport co-operatives in regions or local areas; setting up points of sale on agreed rotational basis and conducting research around them; and merchandising the grassroots press as a brand to gain visibility for the whole sector.

On CIRCULATION: Agreeing on principles for circulation audits including print orders and returns; conducting distribution research and reader surveys; maintaining a national database of circulation and reader statistics on iPop; calling for a Circulation Ombudsman to hear complaints about data and check the claims of all print sectors.

(Editorial Assignment, 2006)

Section 8: Advertising

38. According to SAARF data published by AMPS June 2012, total national readership of both magazines and newspapers is 22.9 million people, reaching 65.6% of adult population (34.934m, aged 15+). Extensive research into the advertising industry has been conducted in the past. Public dialogues and public hearings into the transformation challenges of the industry have been held and all these research reports and public debates have confirmed that the extent of challenges in the sector require a renewed sense of purpose and commitment to the transformational agenda.

39. The 2009 MDDA Trends of Ownership and Control of Media in South Africa states that "four large media companies dominate the space with Caxton CTP leading the pack with 130 identified titles (89 wholly owned and 41 co-owned) representing 28.3% of newspaper titles in the country. Naspers through its print media subsidiary, Media24 follows with more than 65 titles (i.e., 68 titles including subsidiary Mooivaal Media's titles); the foreign owned Independent Newspapers group owns 28 titles and then Avusa (formerly known as Times Media Limited and then Johnnic Communications) with 23 titles". These newspaper titles consist of both commercial and local free newspapers. The local newspaper titles which are mainly knock and drop carry a fair amount of advertisement and some local community news in varying degrees.

40. In some cases, advertising revenue in these local newspapers (or community rags) surpass revenue made from sales of commercial newspapers. However, these local newspapers are not the community newspapers as defined by the MDDA Act, they are owned by the conglomerates (i.e. CAXTON, Media 24, etc) and not by the communities which they serve.

41. In 2004 the MDDA funded the Social Integration and Cohesion Program report which concluded that:

"a range of sustainability strategies including research into national advertising procurement agency, a new system for circulation verification, a new arrangement for printing procurement, the securing of the discounted rate for connectivity and the establishment of the sectoral investment institution.

"A marketing procurement agency should be established to facilitate access by small media to government communications contracts". (HRSC/Mediaworx, 2004)

42. The 2005/6, MDDA commissioned report, "Editorial Assignment to conduct research on Distribution (including sales) and Printing Costs affecting the Small Commercial and Community Print Media Sector in South Africa" further noted as its outcomes:

On MARKETING: Gaining recognition and representation of the sector at media industry level, with agencies, the government, and external donors; networking across the sector to unite perceptions and bring about interactions; supporting the iPop system and especially syndications of national and regional advertising and news copy sales".

43. In 2009 the MDDA supported the Transformation, Gender and the Media Dialogue in partnership with The South African Human Rights Commission (SAHRC), The Commission for Gender Equality (CGE), The Independent Communications Authority of South Africa (ICASA), and the South African Broadcasting Corporation (SABC). The dialogue articulated the following set of recommendations;

- Promoting gender equality and eliminating gender discrimination in the media

- The media should portray more diverse and positive range of images and realistic gender roles and not perpetuate stereotypes

- There is a need to address challenges relating to research, ownership, language and culture

- Programming should accommodate people in rural areas because most of it is currently urban focused

- There is a need to build capacity for children?s editorial, children should be part of editorial decision making processes and children?s content needs to be re-examined as most of it is currently frivolous.

- Government departments should take a lead in communicating their programmes such as the Integrated Development Planning processes

- We must ensure that there is promotion and preservation of indigenous languages

- The Independent Communications Authority of South Africa (ICASA), the banking sector, the Media Development and Diversity Agency (MDDA), Department of Trade and Industry and the Department of Communication should come on board to ensure that there is review on content creation

- The Media Development and Diversity Agency (MDDA) and other media organisations need to help educate and intensify programmes that teach community groups on how to access the media -in short on how to promote accessibility of the media.

44. In March 2011, the Parliamentary Portfolio on Communications Committee requested the MDDA to assist in facilitating the oversight visits to the projects supported by the MDDA in the Eastern Cape and Kwa-Zulu Natal. These were followed by the second round of oversight visits to the Northern Cape and the Free State. The Committee noted with concern during these oversight visits that there are still challenges facing the advertising industry. Community Media projects lamented the lack of advertising support for community radio stations, small commercial media and community print media projects. This lack of support is as a result of lack of understanding by the advertising industry of the Community Media sector.

45. Following these oversight visits, the Portfolio committee conducted public hearings into the transformation of the Advertising industry on the 15th June 2011 where in the advertising stakeholders briefed the committee on the progress of transformation within industry.

46. After hearing and considering presentations made before the Committee from MDDA, the Association for Communication & Advertising (ACA), Advertising Standard Authority of South Africa (ASA) and National Consumer Commission (NCC) the Committee made the following recommendations:

- MDDA and ACA must meet, discuss, consider and take all issues raised by the Community and small commercial media at the oversight visits forward and report back to the committee.

- The Marketing, Advertising and Communications (MAC) Sector Charter Council should have review mechanisms that include experiences encouraging media development & diversity. These may comprise industry business practices, like a percentage commitment of ad spent to community media as defined in the MDDA Act.

- The Committee will engage the Department of Trade Industry regarding "promulgating" the MAC charter to the next step, Section 9 as suggested by ACA.

- Government Communication and Information Systems (GCIS) to commit and implement a percentage adspend to community media as defined by MDDA Act and small commercial media.

- GCIS must support the MDDA proposed online advertising booking management system for community and small commercial media.

- GCIS must support the MDDA proposal for establishing a community radio software management tool to enhance professionalism, accountability, record keeping, reporting and good community radio management.

- Committee will review progress in all this regard at the end of the financial year.

- Government organs and state owned entities are encouraged to also use community and small commercial media as defined in the MDDA Act in respect of their advertising spent. This will not only ensure their messages reach the targeted communities but will also support the ideal of sustaining a diverse media society, viable community media and enhance democracy.

- The Committee urges that the NCC urgently speed up the accreditation and conclusion of Memorandum of Understanding (MOU's) with the sectoral and self regulatory bodies.

Section 9: Industry bodies in perspective

47. Capro (Pty) Ltd

CAPRO is an independent representative body of media owners that specifically represents community newspapers in Southern Africa (South Africa, Namibia, Botswana, Swaziland and Zimbabwe) to advertisers and advertising agencies in South Africa. Since its inception in 1950 it has played an important role in the development of the community newspaper market. Capro has grown its "community newspaper" representation to over 110 titles in the last year. It offers a unique advertising procurement service - newspaper and website, specific to the close community markets.

48. Audit Of Bureau of Circulation (ABC)

The ABC is a non-profit organisation registered in terms of Section 21 of the Companies' Act, based on a bi-partite agreement between advertisers, advertising agencies and media owners. ABC primary function is the certification and provision of accurate and comparable circulation figures, to assist the bi-partite groupings (advertisers/marketers and publishers) in the buying and selling of advertising and promotional material. This is achieved through agreement or auditing standards, on the certificates and on the reports submitted. Its Board of Directors consists of 4 PDMSA representatives, 1 AMF, 1 ACA and 2 MA (SA) . It is clearly dominated by PDMSA representatives.

ABC has designed ABC Grassroots Certificate to audit smaller rural, township and neighbourhood publications that cannot afford the costs associated with full ABC membership. The certificate confirms print orders, methods of distribution, and frequency of publication, but not actual circulation. "Grassroots newspapers" that apply for certification are required to provide the ABC with invoices from their printers confirming the exact print run and frequency of each of their publications over the preceding six-month period. They also file details of whether their publications are sold or free, and how they are distributed. The resulting certificate is valid for six (6) months. Only publications that abide by both Press Ombudsman and Advertising Standards Authority (ASA) codes are eligible for the new certificate. This new certificate is intended to give smaller publishers the tools to compete for that advertising on a more even footing.

The challenge of defining what constitutes grassroots newspapers and magazines persists. The tendency is for this definition to conflate conglomerate-owned grassroots newspapers and magazine with those owned by individual/s and those owned by communities. The Agency follows the definitions as in the MDDA Act which then excludes the conglomerate-owned newspapers and magazines, even if they are published at grassroots level. It is hoped that in future the ABC would be able to provide such circulation information data as it relates community newspapers and small commercial newspapers and magazines as defined in terms of the MDDA Act.

49. South African Advertising Research Foundation (SAARF)

SAARF® is the name by which the South African Advertising Research Foundation is familiarly known. SAARF's main objective is to direct and publish media audience and product/brand research for the benefit of its stake-holders, thereby providing data for target marketing and a common currency for the buying and selling of media space and time. SAARF has thus the responsibility to measure the audiences of all traditional media such as newspapers, magazines, radio, television, cinema and out of home media. The proposed formation of SAARF was announced on 24 October 1973. SAARF was formally established on 4 December 1974 and commenced operations in January 1975. The first research report was SAARF All Media and Products Survey, (AMPS) 1975, a joint venture with the National Readership Survey.

Section 10: Competition issues

50. The 2006 MDDA research on Print, Distribution, Circulation and marketing of grass roots press in South Africa, found that, because of the predominance of the bigger media companies, they are able to manage market conditions to some extent to suit their needs and may actively or by default limit the access of smaller players to the market. This exclusion can be seen in the way distribution is commanded by a handful of operations owned by the mainstream press; and in the way that media buyers fail to see opportunities in the lower end of the marketplace as it is below their radar.

51. The Competition Commission has presided over a number of competition complaints in the recent years. With respect to the proposed merger between Media 24, Paarl Coldset and Natal Witness the Commisison's recommendations sought to safeguard the position of small newspapers, especially those publishing in African languages. The Commission therefore recommended to the Competition Tribunal that this transaction be approved on condition that Media24 divest a portion of its shareholding in African Web and implement a pricing remedy to ensure that African Web remains an affordable and effective option for small independent publishers in the region.

52. The Parliamentary Portfolio Committee on Communications has also called on the Competition Commission to prioritise a probe into a possible anti-competitive behaviour into the print media business processes and the entire value chain.

Section 11: Existence of Sector Codes in general and Media Charter / Sector Code in particular

53. At the outset, we would like to point out that the MDDA is opposed to the interpretation of the BBBEE Act that creates an incorrect understanding that Sector Codes are a creation of the Act.

54. Contrary to popular belief, the BBBEE Act does not in fact provide for Sector Codes. There has been a generous and questionable interpretation of section 9(1) of the principal Act that provides for the Minister, by notice in the government gazette, to issue codes of good practice on BEE to also mean Sector Codes. This is simply incorrect and not supported by any clause in the law.

55. Prior to the gazetting of the Codes of Good Practice (CoGP) and notwithstanding the MDDA view about the legalility of the Sector Codes in the first instance, government had issued a circular advising all the stakeholders that those that wished to have their Sector Codes gazetted should do so by a particular deadline, which was before the gazetting of the Codes of Good Practice.

56. All those that have missed the 31st August 2008 (Notice 218 of 2008) are infact acting outside the provisions of the regulations. The TRANSITIONAL PERIOD was since never extended.

57. The CoGP, as envisaged in terms of section 9(1) of the BBBEE Act of 2003, have already been issued through notice 112 of 2007 and thus the law has been complied with.

58. The primary purpose of the CoGP was to harmonise the implementation BBBEE so that a common baseline could be used to avoid comparing apples to pears during the assessment of compliance.

59. The Sector codes are analogous to a "gentlemen's agreement" with Ministerial endorsement. As such, they should at the very least meet the standards set in the generic CoGP, and at the best they should exceed the minimum requirements of such CoGP. Both conditions militate against the extra effort to initiate the Sector Code

60. The Transformational Charters are by contrast specifically referred to in section 12 of the BEE Act. These were the initial Government initiatives to get industry buy in and to get some learnings on the eventual template of BBBEE.

61. By their very nature, the Sector Codes are reformational and amount to window-dressing in that they seek to legitimize current untransformed practices by simply providing new "BEE" labels to such practices.

62. Notice 1106 of 2010 issued by the Department of Trade and Industry and inviting comments from the public on Phase 1 of the Draft Code refers to Section 9(5) of the BBBEE Act as the legal basis upon which the "draft code" was issued. We submit that there is no reference to "Sector Code (s)" in section 9(5), so the reference by various experts and sometimes by gvt officials is infact incorrect.

63. Section 9(5) of the BBBEE Act ONLY empowers the minister to enable the issuing, replacing or amending a CoGP in terms of section 9(1) i.e. the generic CoGp.

64. The MDDA would thus argue very strongly that the non-reference to "Sector Codes" in section 9(5) reduces the foundation of the Sector Codes to the spirit rather than the letter of the law and therefore at all times "Sector Codes" (where such exist) must equal or exceed all the minimum requirements of the generic CoGP.

65. A mechanism such as Media Charter/ Code, may be perceived as designed to evade compliance with CoGP.

66. Notwithstanding the moderate targets set in the 2007 Generic CoGP, various base line research studies have been consistent in indicating poor levels of compliance. To now bring another instrument with more conservative targets would make mockery of transformation and thus such moves should be avoided.

67. The Media Charter / Code as a case in point is not proposing to surpass the generic CoGP and rather under-perform them. It is thus undesirable, the Agency is now arguing for compliance with CoGP and that Government through its tools like National Treasury Regulations and Practice Notes should enforce the requirement for doing business with transformed companies.

Section 12: Major Objections to the Sector Charters/Codes

68. The mere existence of the Sector Charters/Codes undermines a fundamental principle enshrined in the CoGP which states that "Substance supercedes the form". The motivation for the Sector Codes/Charters rely on the differences in the various industry sectors and thus on the argument that one size fits all as alleged about the CoGP is not desirable. The truth though is that this allegation is without basis because the correct application of the "Substance supercedes form" principle actually makes the CoGP universal. On the contrary the Sector Charters/Codes are actually rigid and force companies to perform at industry level norms which companies are not always geared for resulting in the poor compliance to BBBEE.

69. Sector Charters/Codes seem to promote collusion, in that the industry discussion requires competitors to agree on a whole range of variables which sometimes create barriers for entry by new players.

70. Sector Charters/Codes stifle innovation in that companies cannot play to their individual strengths but have to succumb to industry norms.

71. Sector Charters/Codes lower standards in that for an industry standard to be agreed it becomes natural to opt for the lowest common denominatior.

72. Sector Charters/Codes increase the costs of doing business in that the Supply Chain Management must be geared to accommodate the numerous different standards of the various Sector Charter/Codes because each supplier brings a different standard to be measured by.

73. Sector Charters/Codes creates unneccessarry uncertainties in that stakeholders are forced to await the final outcome of often protracted negotiations which are still subject to DTI approval.

74. Finally, the purpose of introducing harmonising CoGP is eventually completely undermined.

Section 13: Options

75. All Sector Charters/ Codes in the gazzetting pipeline should be scrapped with immediate effect.

The Law must be amended to outlaw further drafting of the sector codes especially because the translation period that was provided for sector code has long expired.

76. The principle of 'substance supercedes the form' must be workshoped extensively by the DTI.

77. Companies should seek direct compliance with the CoGP, play to their strengths and seek company specific concessions from the DTI.

78. The MDDA will recommend to Parliament that the print media charter process be abandoned with immediate effect, in favour of full compliance with CoGP and enforcement of compliance by Government.

Section 14: Conclusion

79. Free, independent and pluralistic media can only be achieved through not only many media products but by diversity of ownership and control of media. Free and diverse media supports, promotes and strengthens democracy, nation building, social cohesion and good governance. Lack of transformation does not auger well for sustaining our democracy and the industry itself. The MDDA hopes that the PDMTT will engage with the Agency and GCIS after it concludes its report, in order to assess whether its report responds well to the mandate of the Agency in terms of the MDDA Act and the transformational issues raised by Parliament and on how its recommendations could be implemented.

80. References

1. African National Congress. Media in a democratic South Africa. Umrabulo Number 16. August 2002. http://www.anc.org/ancdocs/pubs/umrabulo/umrabulo16/media.html (accessed 10 October 2010).

2. "Community Media 2000" conference, Cape Town, 1995

3. Reconstruction and Development Programme (RDP), 1995

4. David Niddrie, Political Economy of South African Media, speech at the NUMSA workshop, 10 April 2010.

5. MDDA Report: "Trends of Ownership and Control of Media in SA", Z-coms, June 2009

6. MDDA Act

7. SAHRC, Report : Inquiry into racism in media in SA, August 2000

8. MDDA Report: Media Monitoring Africa (MMA) research on "Race and Migration in the Community Media: Local stories, common stereotypes", 2008/9.

9. MDDA Report: People's Voice: "The development and current state of small media sector", HSRC & MediaWorks, 2004.

- Deadline looms for MDDA-Sanlam Local Media Awards entries for 2014 23 Jan 2015

- MDDA-Sanlam Local Media Awards entries for 2014 now open 26 Nov 2014

- Entries open for MDDA-Sanlam Local Media Awards 25 Nov 2014

- Mandla Langa acknowledges 20 years of media freedom and diversity 28 May 2014

- MDDA-Sanlam Local Media Awards winners announced 27 May 2014

Media Development and Diversity AgencyThe Media Development and Diversity Agency (MDDA) is a statutory development agency for promoting and ensuring media development and diversity. |