FNB Home Loans Quarterly Report June 2013 released

On a regional level, KwaZulu-Natal attracts the highest rate of buy-to-let investment with a figure of 11% of buyers buying for buy-to-let purposes. This is much higher than the 6% and 8% recorded in Gauteng and the Western Cape, specifically where more buyers are buying residential property for primary residential purposes compared to second homes.

The low rate of investment in residential property for buy-to-let purposes is driven by a variety of factors. Assuming that more housing is needed for rental purposes, this lack of growth in supply could start creating a more lucrative opportunity for investors to enter the market in the near future.

Returns on buy-to-let property

Returns on property as an investment can be categorised in two groups. Firstly, capital growth, or price appreciation of the property, encourages buyers to invest for a potential future increase in property prices. This was a great motivating factor driving the high levels of investment prior to 2007 when property price growth contributed a large portion of the total return. The growth rate at the time exceeded the lending rates and allowed amateur investors to make an easy return simply by holding onto it for a while and selling at a higher price.

However, evaluating longer-term performance of the FNB House Price Index, in real terms the index is -19.2% down on last decade's real price peak reached in November 2007, while in nominal terms it is a mere 14.9% higher. This dismal growth rate makes residential investment a lot less attractive from a capital growth point of view.

The lack of capital growth creates a necessity to place more reliance on the rental income stream generated from letting the property out. While it may not attract the same level of investment, rental yields are a much more reliable form of income. Today's buy-to-let buyers are more sophisticated in their approach and focuses on buying an income stream rather than just merely betting on property price appreciation.

However, rental returns are not without their challenges. High debt levels, pressure on income and slow economic growth since the 2008/9 recession not only influenced residential property price growth, but also impacted on the financial wellbeing of tenants. These tenants have, in many cases, not been able to absorb large increases in rental payments.

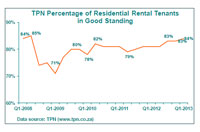

According to Tenant Profile Network's 1st Quarter 2013 estimates, 84% of tenants are in good standing (have not missed a payment). Many landlords prefer to keep performing tenants in a property at a lower rental return than to increase prices too much and having to face the risk of losing good tenants. It also mitigates the risk of vacancy between tenants if the same party is not in a position to afford an increased rental amount.

Increases in rates and taxes, and the maintenance cost of residential property squeezes the return and discourages potential investors from investing in buy-to-let properties. The margin on these investments is quite small. Therefore, eviction issues or damage to property by problematic tenants could wipe out returns very quickly. Our legal system offers a lot of protection to tenants from landlords, making disputes both time consuming and expensive, and, in turn, residential property a lot less attractive investment.

The current low interest rate environment decreases interest expense and increases returns, but eventual upward movements in rates could affect create major fluctuations in yield and scare away potential investors who are not willing to stomach this type of risk. The resulting effect of low capital growth and pressure on the yield both contribute heavily towards the low interest in buy-to-let investment at the moment. However, low supply growth relative to growing demand on the other hand is expected to ultimately start forcing rental upwards.

Financing buy-to-let property with a home loan

In the years following the 2008/9 recession, banks have generally been more conservative in financing buy-to-let properties, compared with the boom years, which may have also contributed to slower buy-to-let buying. However, since there is no co-ordination of bank policies, the competitive nature of the financing industry encourages banks to push the limits of risk taken on with these types of transactions. These types of applications are of a more complex nature compared to applications for primary residential property buying and require some special considerations when considering whether to grant a loan.

Expected future rental income of a property being bought cannot be taken into account to help the applicant qualify for a home loan. Before the property is bought and the rental agreement is in place, the expected rental amount is undetermined. There is no guarantee that the expected amount will be earned, or that there are tenants ready to move in on the day that the property is transferred. Furthermore, the National Credit Act requires banks to determine affordability and to ensure that the applicant can afford the loan at the time of granting the bond. This is not possible if the rental agreement is not in place yet from both a legislative, and a credit risk perspective.

The income stream of a rental property is by nature volatile. Non-performing tenants, eviction issues or even vacancy between one tenant moving out and the next one moving in could severely affect the regularity of the cash flow generated from the property. In the case of holiday rentals, properties tend to attract much higher rentals in peak periods and generate low or even no income out of holiday season. Therefore, it is not possible to merely take an average of the rental amount for the purposes of assessing affordability of the applicant to qualify for a home loan. Depending on the volatility, only a portion of the rental income can be taken into account in the affordability calculation when being assessed for an additional buy-to-let unit.

Expenses relating to the property, such as rates and taxes, levies and home owner's association fees (where applicable) have to be taken into account in the assessment to determine the customer's full commitments and ability to repay the loan on the property. Regardless if the property is occupied or not, the owner is still responsible for these expenses. The full cost of ownership could also include general maintenance and insurance on the structure.

If the investor conducts his primary transactional account with the bank where he applies for the loan, it is much easier to assess the full extent of the income and the expenses related to the investment property. The clarity of information allows the bank to make a much more informed decision on future credit applications. Furthermore, if the bond account of investment properties is held with the same bank, the strength of the relationship could result in a much better chance to qualify for further lending and increase one's investment property portfolio.

A deposit can further reduce the risk and, in turn, the interest rate of a new home loan account. An upfront payment proves the investor's commitment and reduces the potential loss on an account, allowing the bank to afford the investor a better interest rate based on the reduced level of risk. This interest rate has a large effect on the profitability of the property and can improve the total return significantly. Potential buy-to-let investors are encouraged to use the opportunity to benefit from paying a larger deposit.

Risk of increasing repo rate by the reserve bank could threaten the profitability of the buy-to-let investment and introduces an additional form of risk. Fixed rates are offered on most home loans, and are typically a little more expensive than the variable rate available at the time (price dependant on market conditions), but could offer a level of certainty of the monthly payments.

A useful alternative is to fix your instalment at a higher level than the current minimum repayment. This would allow you to repay the loan quicker, creating interest savings, and help to buffer possible future increases in interest rate. A home loan is still arguably one of the most useful investment vehicles, offering a risk-free, and tax-free saving. Fixing the instalment at a higher level offers this interest saving and provides a certain level of consistency in the repayment amount.

Conclusion and outlook

The prolonged lack of capital growth in the residential property market has made investment in residential real estate fairly unattractive compared to the earlier part of the last decade when house price growth was at much higher levels. Yields are also driven down by financially strained tenants and rising costs of maintenance, further stacking up an argument against investing in residential property.

However, as more young South Africans require housing, there is a constant growth of demand for rental stock. Ownership is not always possible or feasible and for some there will always be strong arguments in favour of renting instead of buying. This is fuelled further by challenges that banks face in granting credit. These individuals often have no other choice but to enter the rental market.

Should the Reserve Bank's repo rate and, in turn, the bank lending rates rise, the argument quickly tips in favour of renting rather than buying and is expected to further increase the demand for rental properties in the short term.

This rising demand for rental properties and slow growth in supply is expected to ultimately drive up yields to a point where buy-to-let property becomes a much more attractive investment. Once this excess demand pushes prices upward, investors will start earning higher returns. High returns will, in turn, attract more investors to participate in the rental market, buying up a larger portion of stock.

Risks of financing buy-to-let properties are not expected to change, but banks will continue to support this market with responsible lending to enable a much larger buy-to-let market to support the growing demand for housing in South Africa.

About Ewald Kellerman

- FNB Home Loans Quarterly Report June 2013 released - 3 Jul 2013

View my profile and articles...