I was particularly reminded of this when reading September’s Harvard Business Review cover article, "Building an Insights Engine – How Unilever got to know its customers". The article is written by Kantar Vermeer’s Frank van den Driest, Unilever’s Stan Sthanunathan and Keith Weed. It highlights the 10 key characteristics required to create customer-centricity and drive business growth. In the article the authors state: “At Unilever, CMI's [Consumer and Market Insights’] prominently communicated mission is 'to inspire and provoke to enable transformational action.' Note that the word 'insight' is missing — intentionally. That’s because insights merely provide a means to the desired end: action that drives business growth.”

It is this concept of transformation that really separates a true insight from merely a finding or an observation. An insight transforms your actions while a finding merely guides them. It is not an insight to realise that men increasingly use cosmetics. In contrast, the knowledge that the men that do use cosmetics feel uncomfortable navigating a physical store to find the men’s section could be a great insight, provided action is taken to alleviate that discomfort in a way that encourages sales.

Some of the most powerful insights often surprise us, and transform the way we understand the world. How Africa Tweets is a report published annually with Twitter trends, hashtags and online habits of the continent. Unsurprisingly, the report found that South Africa’s second-most popular hashtag in 2015 was #FeesMustFall, the student-led movement across the country in response to the rising prices of higher education in South Africa. The unexpected insight the report uncovered was that in absolute terms, Egypt actually had more tweets with the #FeesMustFall than South Africa. In Egypt the data showed the hashtag had 700,000 geolocated mentions, in comparison to South Africa where it gained around 160,000. This suggests a pan-African collective interest in social issues and indicates the unanticipated capacity of African nations to unite on some of the most important social issues impacting the continent.

Today every company has access to data. Research that previously took months of costly work can now be done in days and at a fraction of the cost and as Van den Driest, Sthanunathan and Weed note, “What matters now is not so much the quantity of data a firm can amass but its ability to connect the dots and extract value from the information.”

Even the simplest of insights can unlock powerful business decisions. Omo washing powder was struggling with sales in the African rural markets until they discovered that spaza shops1 do not display products as traditionally intended but are instead stacked on top of one another to maximise space. Competitor, Ariel had their logo placed on the side of the product so it was still visible when stacked, making the brand visible to shoppers. This was a powerful insight which provided package designers with the knowledge that product branding should be recognisable regardless of how the product is displayed to ensure the product can always be identified.

The article goes on to review many of the different ways that Unilever’s CMI team are using technology to close the gap between data and insights but, ultimately, that gap is closed by someone recognising what might be done differently, more productively, more profitably as a result of looking at data. Technology can help in that process but it takes an understanding of the business and brand at large to recognise the real opportunities for change and turning a finding into an insight, into action.

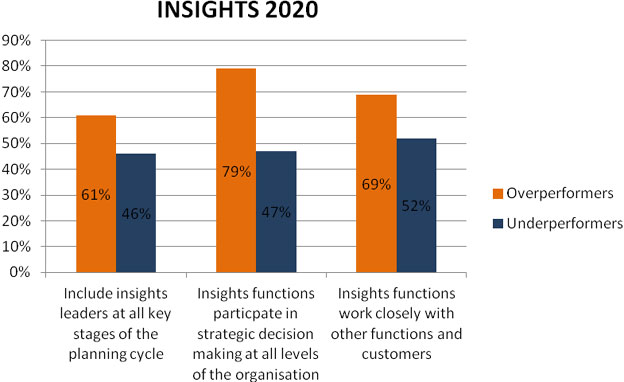

With that in mind, it should come as no surprise that Insights2020, a study led by Kantar Vermeer which interviewed over 350 CEOs, CMOs and I&A leaders across 60 countries and became the foundational research on which the Harvard Business Review article is based, found that 79 percent of insights functions at overperforming companies participated in strategic decision-making at all levels of the organisation, compared with just 47 percent at underperforming companies. You have to be involved in the conversation if you are going to influence the outcome.

And it’s valuable to realise that anyone can be a part of the conversation. Across the firm, insights can come from anyone at any time. Unilever’s CMI team encourages every employee, from factory workers all the way up to the CEO, to engage with customers and gain actionable insights about their needs and the role Unilever plays for them. One of the ways this is actioned is through an "always-on" platform where employees can have virtual meetings with consumers anywhere in the world. An employee can request a meeting with a soup lover from Kenya next week at 4pm and will automatically receive a meeting invite to a live video chat. Then to track their insights, employees use an in-house app to record their observations from these consumer interactions. These insights are then used to detect behavioural patterns across geographical regions. More than just allowing Unilever to really get to grips with consumers’ needs, the initiatives emphasise the idea that anyone can uncover insights - a task that motives and engages employees at every level.

But how effective is this level of collaboration? According to Insights2020, integration of business functions is indispensable. The research showed that 69% of respondents from overperforming firms said their insights functions worked closely with other company functions and customers, compared with 52% of those in underperforming companies. Of course, the most powerful insights are those that when uncovered lead to actionable strategies and ultimately produce tangible business results. For this reason, the quality and frequency of insights coming from all spheres of the business can benefit from the recruitment and training of "action-orientated" employees. Unilever’s CMI has invested in this through programmes intended to develop employees' capabilities beyond the expected functional skills, like research and analysis, to “action skills” such as facilitating, persuading and communicating. Trainings like these, across all levels of the business, help employees improve their ability to turn insights into results.

A considerable amount of what insights engines at any firm do is gather and analyse data and this role is critical. In fact, it was the most important driver of customer-centric growth identified by the Insights2020 study. But in today’s ever-changing, fast-paced business landscape that is no longer enough to ensure success in customer-centricity. It requires input from leadership to guarantee that every function of the business, from factory workers to R&D, assert a singular focus towards interpreting and meeting consumers' fundamental needs. Ultimately, you have to ensure that every employee in the business has the ability to turn those observations about the world around them into powerful actionable business insights if you are really going to separate yourself from the competition and set your business on the trajectory to success.

1An informal convenience shop typically selling small everyday household items, found in rural African areas.