How will SAA become world class?

Recent statistics published by the Star Alliance, of which SAA has recently become a member (Lufthansa Magazine, 05/2007) have raised some interesting issues regarding South African Airlines' operations in comparison to other member airlines globally.

Synovate recently reviewed these stats to explore the differences and the possible reasons that SAA has failed to retain its position as a dominant and profitable airline. Perhaps the recent announcement by SAA to retrench 1000 workers has been forced by the implications of global numbers such as those below.

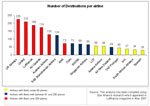

SAA ranks second last in terms of destinations offered across all categories (segmented according to the size of the fleet)

US Airways offer the highest number of destinations (225 using 411 planes). Of those airlines with less than 60 planes in its fleet, SAA offers the lowest number of destinations (34). This might be a result of South Africa's geography - not only are there less internal destinations, but most of SAA's destinations are long haul, meaning that flights take more time. Of those airlines with less than 60 aeroplanes in its fleet, LOT Polish Airlines offers the most destinations to its passengers – 58. European countries, however, do enjoy a closer proximity to more destinations.

When looking at how many planes are available per destination, SAA has 1.7 planes per destination. This is on much of a par with US Airlines and SAS Scandinavian Airlines. TAP Portugal, LOT Polish Airlines and Austrian Airlines operate with a much lower ratio of planes to destinations. This is possibly due to the number of long haul versus short haul destinations. One plane can make more short haul trips than long haul – it is simply a matter of the time each trip takes.

Employees

SAA has a relatively high number of employees. South African Airways has 11 000 employees for 58 planes and 34 destinations. To compare, LOT Polish Airlines has 3 500 employees for 51 planes and 58 destinations. SAA employs 190 people per plane in its fleet - very high compared to the likes of world class airlines such as SAS Scandinavian Airlines, Austrian airlines, bmi, LOT Polish airlines, Spainair and US Airways – all of which employ less than 100 heads per plane.

South Africa appears to be slow to catch up to global standards of technology. Does SAA use sufficient technology? Perhaps SAA needs to hire a person whereas administrative jobs globally are conducted by means of technology?

In some countries, air stewards require a university degree before getting a job at an airline. This may indicate that global airlines employ relatively more educated staff than SAA do. Perhaps by employing more educated ground staff and administrative staff, SAA may be able to decrease the number of staff working at SAA and improve productivity. To supplement this strategy, SAA could also examine the extent to which staff are trained and multi-skilled.

Employees per plane:

In terms of passengers served per employee, SAA's figure is also comparatively low. SAA serves more than 7 million passengers per annum, which is the second highest amount of passengers in its category of airlines with less than 60 aeroplanes.

This year in March, SAA reported a R603 million operating loss. This followed a R485 million profit in the previous year. The loss has been attributed to the rising price of fuel as well as competition from low-cost airlines. Other airlines operating in similar environments will have gone through similar challenges, and SAA's seeming complacency means that perhaps they have been slow to come to terms with these challenges. To this end, it might serve SAA well to examine the recent return to profit of United Airlines following a similar slump in performance – who also pointed at fuel costs as a reason.

While fuel prices and low-cost airlines may very well be the only reasons for SAA's declining performance financially, perhaps after close examination of these numbers some solutions may appear for the local airline. However, it is worth considering whether SAA's performance would have been any better if they had cut back on staff earlier or if they had used up millions of rands making technology investments or offering more destinations. Solutions may appear obvious when examining differences in the operations of world class airlines, but getting SAA to this world class status may require an entire different approach based on the unique landscape in which it operates.

Ipsos is an innovative, entrepreneurial, client-focused organisation, providing research services to clients on a global basis. We set ourselves high standards and aim to work collaboratively in partnership with our teams in order to service our clients most effectively.

- Unlocking the value of creativity in advertising: How to bridge the creativity gap15 Apr 13:47

- 4 habits keeping your brand poor26 Mar 16:08

- Understanding consumer mindsets for growth in 202407 Mar 08:52

- South Africa's unemployment nightmare: The burden on its people09 May 10:05

- Global survey shows shrinking trust in internet29 Nov 10:17