China is placed in 8th position in the NPS index ranking among the 10 countries where the study is carried out (global NPS= +10.6). Regarding media agencies, the average NPS index in China is -14.5 (in eighth position among nine countries analysed). The global NPS average for media agencies is +9.7.

Scopen’s Agency Scope Study in China, in collaboration with R3, a global marketing consultancy in China, is the ninth edition of the study in the country, which is also conducted in 11 other markets, enabling it to include global benchmarks in key criteria.

In this edition, Scopen interviewed 396 professionals from 208 leading companies that operate in the Chinese market with 670 client-agency relationships analysed. The fieldwork took place between August and December 2021.

China is the most demanding market in terms of clients' satisfaction with its agencies. Even though the NPS index has increased in the last two years, the number of detractors is still higher than that of its promoters.

The complexity and higher competition of the market mean those agencies need to offer more added value (new services, specialities alliances with other partners, etc.) to achieve higher levels of client satisfaction.

The level of satisfaction with the service provided by the IMC agencies in China has also increased in the last two years (2020 Very satisfied or satisfied: 63.4% vs. 2022: Very satisfied or satisfied: 66.2%), while the international satisfaction benchmark stands at 77.1%.

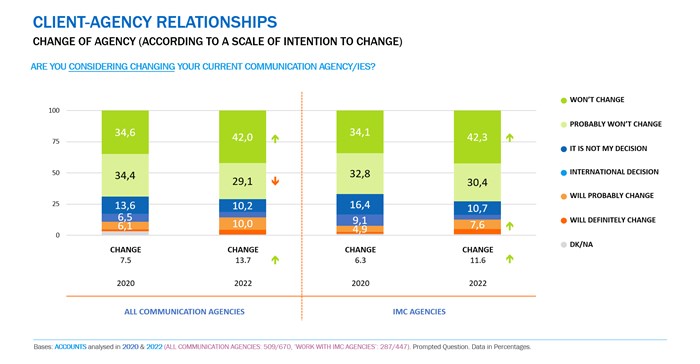

72.7% of interviewees have no intention to change their current IMC agencies (66.9% in 2020) but in the last two years, the intention to change agencies has increased (Definitely will change or Probably will change) and is similar to the global average (11.6% of Chinese marketers are thinking of changing their IMC agencies in 2022 (6.3% in 2020, and the global benchmark is 13.9%).

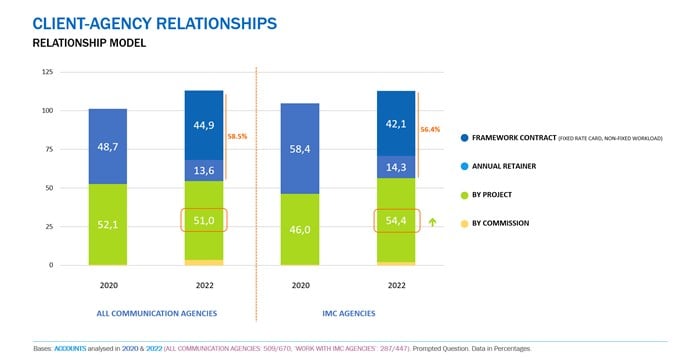

The marketers’ remuneration model with creative agencies in China is different from the global sample. China is above the global average in the number of Project-based relationships (China: 51.1%, Global: 36.4%) as it also occurs in Argentina, Spain, the UK, and India.

On the other hand, we find that Brazil, Chile, India, and South Africa are markets with a higher percentage of client-agencies remuneration based on a Framework contract / Annual Retainer model.

For marketing professionals, the most mentioned challenges are:

As a global trend, Understanding consumers is key in brand strategy as they are better informed and have developed new habits. ROI and efficiency are also listed amongst the top challenges for marketers, which can be attributed to a review of budgets, especially in these uncertain times caused by Covid-19.

Data Protection Laws are also of greater concern. When compared to the previous edition, four concepts have increased dramatically:

Meanwhile, two ideas have been included as new: Better understanding of Digital Transformation and Achieving good relationships with more and different partners.

The desire to differentiate from competitors through creative and innovative campaigns is also a global trend in 2022.

Asked to identify the main challenges for their agency partners, marketers mention:

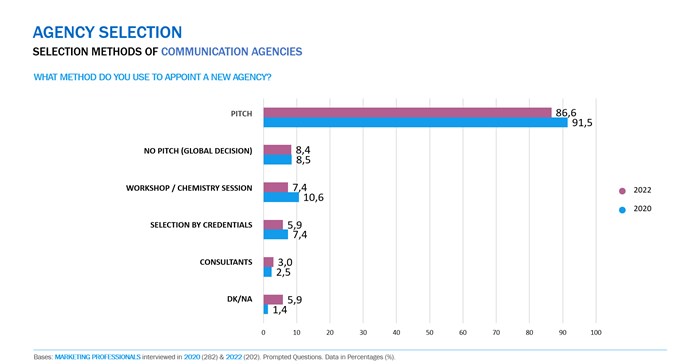

The study found that in China, Pitching is the most frequently used method to select a new agency/partner (87% - a decrease of more than five percentage points when compared to 2020) and has a higher importance than in any other country where this study is carried out. In other countries, such as India or Spain, International decisions are higher than the global average when selecting a new agency.

No Pitch (global decision) is in second position (8.4%), followed by Workshop / Chemistry Session (7.4%). Selection by credentials (5.9%) and, Help of external consultants (3.0%) are less mentioned.

When marketing professionals identify decisive criteria used to select a communications agency, the three most mentioned attributes are:

Less decisive factors when selecting an agency, are Agency rankings, Awards won by the Agency and Multiple locations of the Agency in China.

More than half of marketers have a relationship model with their current communication agencies based on:

If we make a comparison with the last edition, there are more marketers that work with agencies based on Project-based relationships (46.0% in 2020).

The study provides a unique tool for agencies to improve and supply new services as it covers the main findings and trends in the communication and marketing sector in China, more specifically, the perception and image of a company in comparison to all other agencies and communication partners that Chinese marketing professionals work with.