The number of dairy farmers has reduced from 3899 in 2007 to only 2600 in 2011 and the remaining farmers are faced with an imbalanced market. Of the 360 buyers in the country, the top five buyers purchase 65% of locally produced milk, leaving the remaining 35% to be distributed amongst the other buyers. Major supermarket groups dominate the industry to such an extent that they have total control of the industry.

The result is that a number of dairy farmers will not be able to survive the current low producer prices. Several farmers have sold their herds and other farm sales may follow. Cost increases include veterinary costs, up between 10% and 15%, the proposed electricity increase of 16% and a minimum wage increase of 52%.

Dairy farmers receive lower milk prices compared to other regions in South Africa because of a non-market related price cut in June last year. This decrease in the price of milk will have a negative effect on farmers for some time to come. Producer prices would have to increase significantly to avert a disaster and to guarantee the sustainability of milk production.

Success in the dairy industry depends on two factors: the quality of the products and the support of milk processors. Successful advertising, exports and the development of new products are also important. Huge sums have been invested in the 'Proudly South African' food campaign, designed to encourage consumers to purchase domestically grown and produced goods. Many of the large producers now produce and market their own dairy products, reflecting the increasing maturity of the sector.

The poor state of the country's infrastructure makes it costly for farmers to transport their products, both for the domestic markets and for export. The low profitability of milk production is the major barrier to entry for emerging farmers. The volatility of the market and the effect of imports in depressing producer prices make it difficult for emerging farmers to enter the industry. The dynamics of pricing in the dairy industry as well as the shelf life of products is such that farmers are squeezed to accept whatever price producers/processors offer.

The high demand for value-added products such as sour milk, yoghurt and cheese is a market to be explored. However, this route would require high investment, market knowledge and training. In addition, over the past few decades, there has been a rising demand for free-range products.

Farmers and producers lack the expertise and equipment to pasteurise milk. Transport and quantity are major deterrents for small farmers to sell their products to large processors. Buyers find it not worth the effort to access these farmers due to the road infrastructure and small volumes of milk produced. To the emerging farmer's benefit, smaller processors tend to pay higher raw milk prices than the larger processors during periods of seasonal milk shortages because they lack the bargaining power of the larger processors.

During periods of surplus, large producers dump their products in the retail sector at low prices, making it difficult for the small processors to compete. Four major processors dominate the market, making it difficult for emerging farmers to make inroads. Rising production costs decrease their ability to make profits resulting in many farmers closing down.

Internationally, the main milk producing regions are the European Union 31%, New Zealand 30%, Australia 12%, US 5% and the remaining 22% are the cumulative total of the other regions in the world. Milk production in South Africa makes a small contribution to the world production but in terms of the values of agricultural production in South Africa, it is the fifth largest agricultural industry in the country.

Milk production in New Zealand and in other parts of the world is cheaper in comparison to South Africa and imported milk from the EU and US is cheaper than in South Africa because of subsidies in these countries. Dairy companies in these countries are paid a guaranteed floor price for designated quantities of dairy products. Dairy companies in both countries are given a subsidy to bridge the gap between the supported domestic price and world market price. In the EU, dairy farmers are paid subsidies for the use of certain inputs.

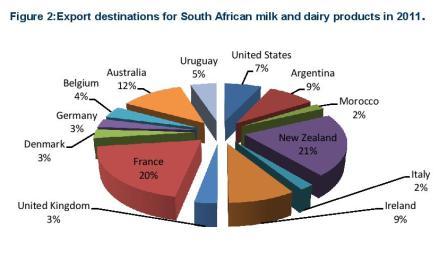

The SA dairy industry is also an important earner of foreign exchange. In 2011, exports of dairy products amounted to 288-million kilograms valued at over R3-billion. There was an increase of 57% of milk and dairy products exported to the world and a drastic increase of 109% in 2011 compared to 2001 volumes.

Figure 2 above shows that during 2011 New Zealand held the biggest market share for South African milk and dairy products exports accounting for 21% followed by France and Australia with 20% and 12% respectively. The smallest shares were Italy and Morocco with a 2% market share each.

South Africa is an importer of dairy products. The average import value over the past ten years amounted to over R468 million and the quantity amounted to over 28 million kilograms.

Figure 3 above shows that the main supplier of milk and dairy products to South Africa in 2011 was Argentina, which had an import market share of 30% followed by France which exported 18% of milk and dairy products to South Africa. Australia and New Zealand had an equal share of 14% of milk and dairy products exported to South Africa.