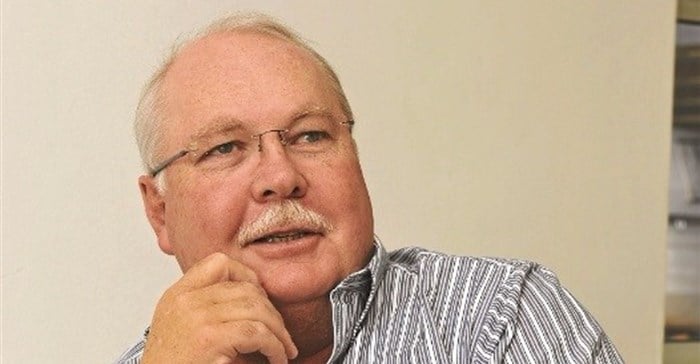

Speaking after the release of results to end-September on Monday, Astral CEO Chris Schutte said there had been about a dozen casualties among medium-sized poultry players in the past three years, including a company that had been operating for 35 years.

"There’s still going to be a lot of contraction in the poultry sector. We support consolidation in the industry," he said.

Given the state of the poultry industry, cutbacks in local broiler production were imminent, said Schutte. "Under these circumstances, Astral will continue to assess consolidation opportunities as they arise. There are not many opportunities, but we do have something we are looking at."

Despite a dismal operating performance, Astral still has a robust balance sheet. Chief financial officer Daan Ferreira said Astral’s net gearing of 10% was still acceptable. The company’s cash flow from operations did fall sharply from R996m in 2015 to R500m.

Astral’s income statement showed revenue up 6% to R12bn, but operating profit down 50% to R549m. Headline earnings were 52% lower at 965c per share, but Astral maintained its two times dividend cover at 490c per share for the full year.

Schutte said the effect of the drought and the imbalance in supply and demand caused by excessive imports placed tremendous pressure on Astral.

Astral’s operating profit margin was slashed from 9.8% in the previous year to a lean 4.6%.

In the core poultry division the average selling price of poultry fell 0.6%, while feed prices rose 17.4% because of the drought. Higher feed costs drove up production costs, said Schutte, and these could not be recovered from selling price increases. It meant profitability in the poultry division fell 91% to R59m (2015: R661m) with the net operating margin at only 0.7% from last year’s 7.6%.

Schutte remained concerned about poultry imports, warning that variations in month-to-month levels made it impossible for local producers to plan for appropriate production levels. "How can we adapt to imports when one month it’s 57,000 tonnes and another month its 37,000 tonnes. These are opportunistic imports..."

There were record levels of total poultry imports during the year, peaking at 57,700 tonnes in March.

In terms of local production, the March import figure was equivalent to about 10.3-million birds a week and represented about 55% of local production.

A considerable increase in bone-in portions originating from the EU had been reported, which affected local jobs, Schutte said.

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za