The people of Britain have voted to leave the European Union and attention will increasingly focus on the direct impact on business, and the practicalities surrounding exit negotiations.

Looking at specific categories with the UK consumer goods sector, according to our Industry Forecast Model:

- In forecast volume growth terms, in a Brexit scenario, confectionery, ready meals and sweet and savoury snacks are expected to be the most affected packaged food sectors in the UK. Within this, volume sales of chilled lunch kits, gum and chocolate are most influenced;

- Brexit should have a muted impact on the sale of beauty and personal care products. In total value terms, by 2020 the UK market would be $205 million smaller (in 2015 prices) in a Brexit scenario, than it otherwise would be;

- The impact of Brexit will be stronger on soft drinks than either beauty and personal care, or packaged foods. Overall, the sector should see cumulative growth of 1.4 percentage points less in a Brexit scenario between 2015 and 2020. This corresponds with 'lost' sales of 475 million litres over this period;

- The impact of Brexit on the hot drink sector is likely to be broad based, but not deep. In volume terms in a Brexit scenario we expect period growth of the sector to be 9.8% to 2020, compared to 10.5% without Brexit;

- In home care, the impact of Brexit is expected to be limited. Real value growth in home care between 2015 and 2020 will be 1.0 percentage point lower in a Brexit scenario, coming in at 9.5%; and

- The impact of Brexit on tissue and hygiene is broadly in line with the impact on home care. Between 2015 and 2020 growth in real value terms will be 1.0 percentage point lower in a Brexit scenario, coming in at 2.8%. This translates as $148 million in lost sales to 2020 (in 2015 prices) or 2.6% of the total market in 2020.

Sarah Boumphrey

Sarah Boumphrey, global lead, economies and consumers of Euromonitor, commented: “One keyword will continue to overshadow the UK economy: uncertainty. The uncertainty will also flow on to the EU itself - the UK plays a significant role in the EU, both economically and demographically. Economists were almost overwhelmingly united in their opinions about a vote to leave the EU – it would damage the UK economy. The extent of the damage has been harder to agree on. Despite heightened fears of recession in the immediate aftermath, our macro model shows a 2.0% fall in GDP growth over five years stemming from a Brexit, with the biggest impact being felt in 2017.”

The impact on the EU and the wider world

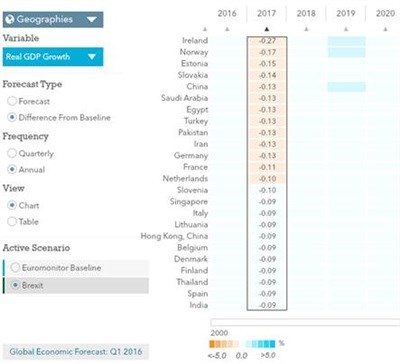

Difference from our Baseline Forecasts in a Brexit Scenario: 2016-2020

The answer, in economic terms, is that it would affect a broad range of countries, but the direct impact would not be economically significant:

- Due to its close trade linkages, Ireland is likely to see the largest negative impact from a Brexit;

- Several non-EU countries are also likely to feel pain, with China, Saudi Arabia and Egypt all expected to see a similar level of impact to Germany in 2017. This is also due to trade linkages.

Although the negative impact will be broad based but not substantial in any one particular country, it is also clear that it would not benefit any other country. In 2017, none of the 57 countries in our macro model will see an uptick in growth in a Brexit scenario.